Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

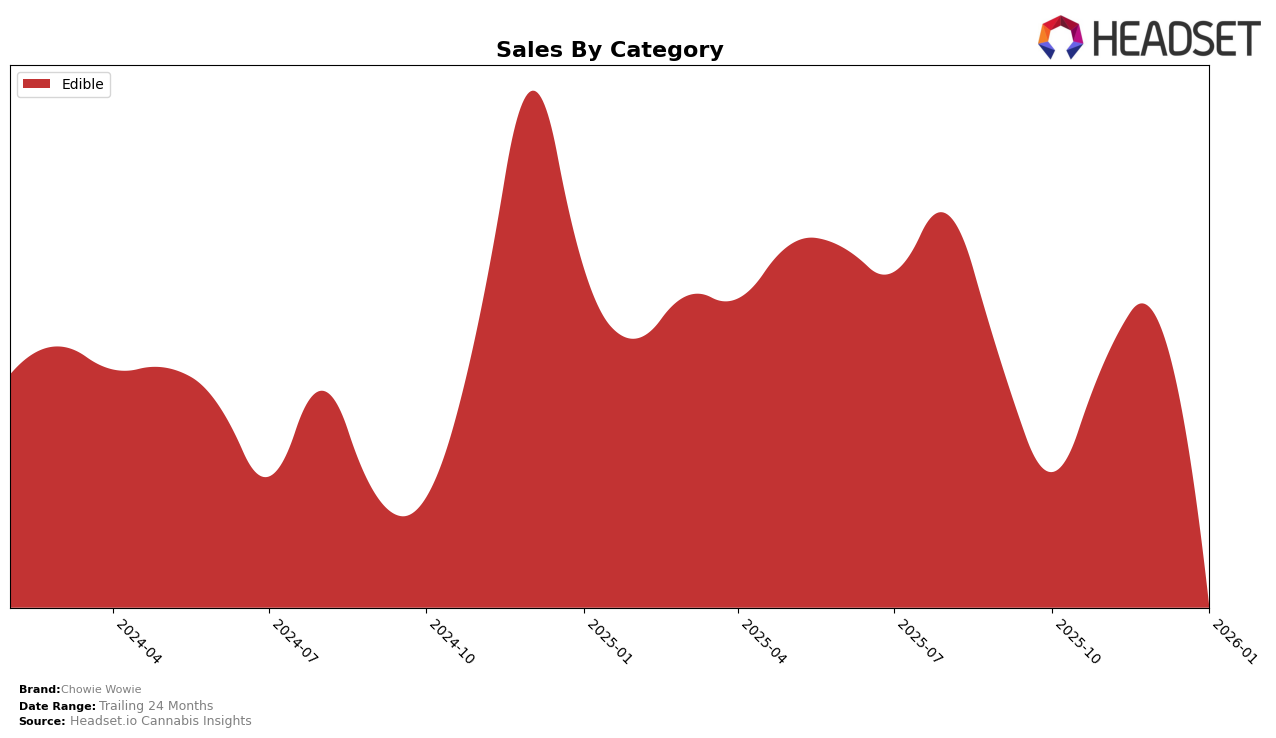

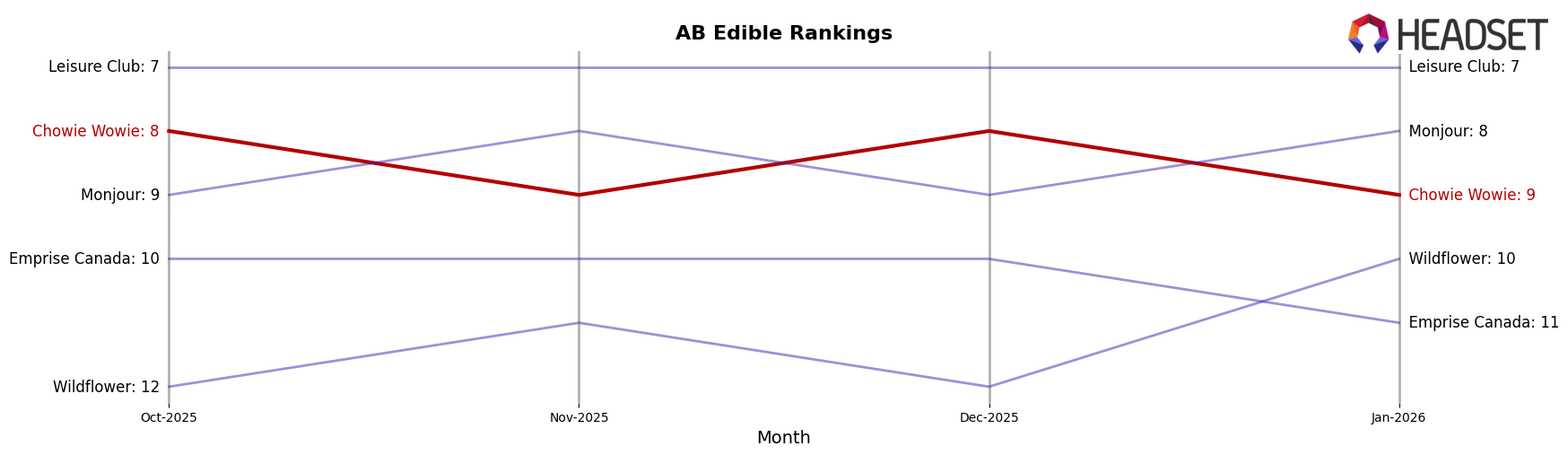

Chowie Wowie's performance in the Edible category across Canadian provinces has shown some intriguing trends over the months from October 2025 to January 2026. In Alberta, the brand maintained a consistent presence in the top 10, fluctuating slightly between the 8th and 9th positions. Despite these minor rank changes, their sales experienced a notable dip in January 2026 compared to October 2025. Meanwhile, in British Columbia, the brand held steady at the 12th position for the latter months, with a significant sales increase from October to November 2025, followed by a gradual decline. This stability in ranking suggests a consistent demand, even as sales figures adjusted month-to-month.

In Ontario, Chowie Wowie experienced a slight downward trend in rankings, moving from 9th in October and November 2025 to 13th by January 2026. This decline in rank coincided with a decrease in sales, indicating potential challenges in maintaining market share in the province. Conversely, in Saskatchewan, the brand showed resilience by bouncing back to the 8th position in January 2026 after a dip to 9th in December 2025. This recovery in rank, despite a decrease in sales, suggests that Chowie Wowie is maintaining a competitive edge in Saskatchewan's edible market. These movements across provinces highlight the dynamic nature of the cannabis market and the importance of adapting strategies to local consumer preferences.

Competitive Landscape

In the Alberta edible cannabis market, Chowie Wowie has maintained a stable position, consistently ranking 8th or 9th from October 2025 to January 2026. Despite a dip in sales in January 2026, Chowie Wowie's performance remains competitive, especially when compared to brands like Wildflower and Emprise Canada, which have fluctuated in their rankings and sales. Notably, Monjour has shown a strong upward trend, overtaking Chowie Wowie in January 2026. Meanwhile, Leisure Club consistently holds a higher rank, indicating a strong market presence. These dynamics suggest that while Chowie Wowie is a solid contender, there is room for strategic growth to improve its standing against competitors like Monjour and Leisure Club, especially in terms of sales volume and market share.

Notable Products

In January 2026, the top-performing product from Chowie Wowie was the CBD/THC 1:1 Solid Milk Chocolate Bar 2-Pack (10mg CBD, 10mg THC), maintaining its first-place ranking with sales of 22,072 units. The THC Solid Milk Chocolate Bar (10mg) held steady in second place, while the CBD/THC1:1 Soft Caramel Milk Chocolate (10mg CBD, 10mg THC) continued to rank third. The CBD/THC 1:1 Peanut Butter Balanced Milk Chocolate (10mg CBD, 10mg THC) and the CBD/THC 1:1 Peanut Butter Chocolate 2-Pack (10mg CBD, 10mg THC) also retained their fourth and fifth positions, respectively. Notably, all products maintained consistent rankings from October 2025 through January 2026, indicating stable consumer preferences for these edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.