Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

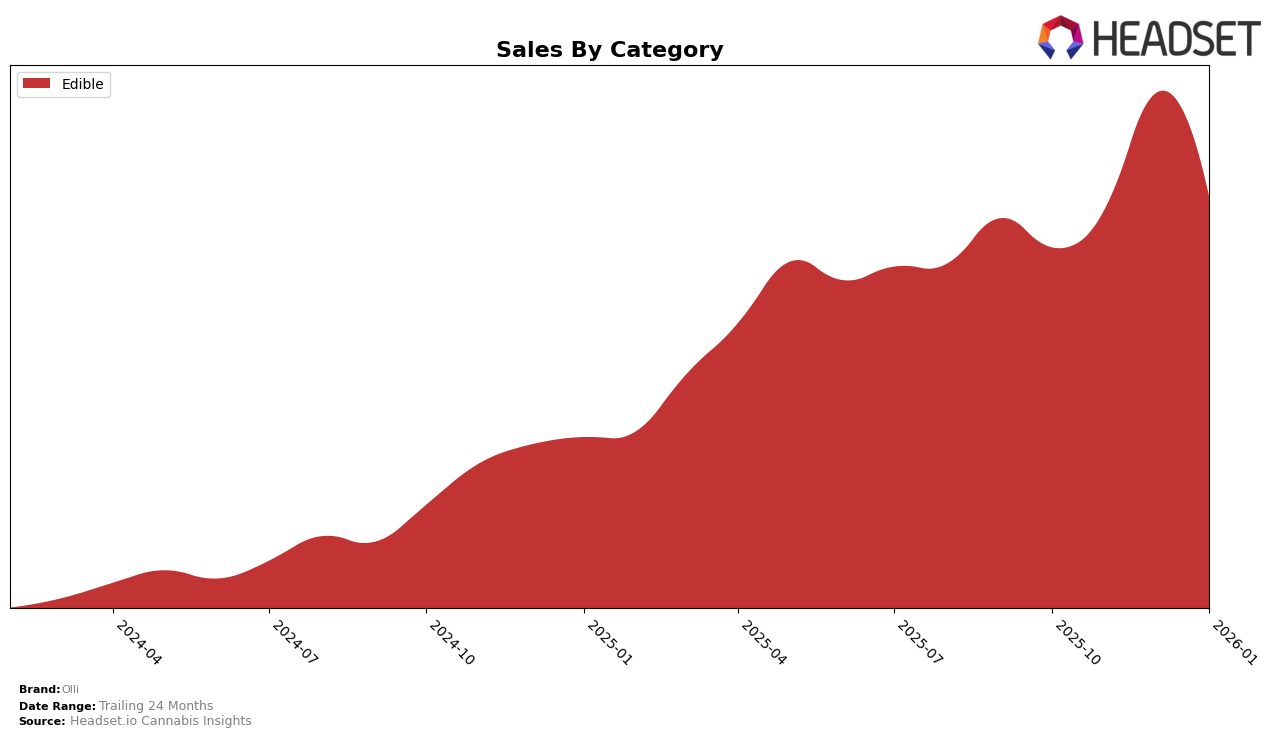

Olli has demonstrated a strong presence in the Edible category across several Canadian provinces, with noteworthy performances in both Alberta and Ontario. In Alberta, Olli consistently maintained a top 5 ranking, peaking at the 4th position in December 2025. This rise was accompanied by a notable increase in sales, suggesting a robust demand for their products in this province. Meanwhile, in Ontario, Olli has remained a solid contender, consistently holding onto a top 6 ranking over the months, with a peak in sales during December 2025. This consistency highlights Olli's strong market position and consumer preference in these regions.

In contrast, Olli's performance in British Columbia and Saskatchewan presents a more varied picture. In British Columbia, Olli entered the top 30 rankings in November 2025, climbing to the 14th position by December before slightly dropping back to 15th in January 2026. This indicates a growing but still developing market presence. In Saskatchewan, Olli made a notable entrance into the rankings at the 7th position in January 2026, marking a significant breakthrough given their absence in the top 30 in the previous months. This sudden appearance suggests a potential strategic push or a shift in consumer preferences in Saskatchewan that could be worth monitoring for future trends.

Competitive Landscape

In the Ontario edible cannabis market, Olli has demonstrated a stable yet slightly fluctuating presence, maintaining a rank of 6th in October and November 2025, improving to 5th in December 2025, before returning to 6th in January 2026. This indicates a competitive positioning amidst significant players such as Shred, which consistently holds the 3rd rank, and Fly North, which has shown a notable upward trend from 8th in October 2025 to 5th by January 2026. Meanwhile, No Future experienced a decline from 4th to 7th over the same period, suggesting potential opportunities for Olli to capitalize on shifting consumer preferences. Despite these fluctuations, Olli's sales figures reflect a solid performance, particularly in December 2025, where it saw an increase, aligning with its temporary rise in rank. As the market dynamics continue to evolve, Olli's ability to maintain its position amidst these competitive shifts highlights its resilience and potential for strategic growth in the Ontario edible sector.

Notable Products

In January 2026, the top-performing product from Olli was the Stikistix - CBG/THC 3:1 Razzy Pink Lemonade Soft Chew 4-Pack, maintaining its number one rank with sales of 36,937 units. The CBD/CBG/CBN/THC 1:1:1:1 Fizzy Peach Lemonade Soft Chew held steady at the second position, showing strong sales performance similar to previous months. The Stikistix - CBN/THC 3:1 Sour Berry Dreamy Limeade Gummy 4-Pack remained consistent in third place, although its sales figures dipped compared to December 2025. New to the rankings, the Sour Blueberry Blue Dream Rosin Gummies 10-Pack secured the fourth spot, while the THCV/CBC/THC 1:1:1 Sour Sunny Watermelon Lemonade Soft Chew moved to fifth place, indicating a slight decline from its earlier performance. Overall, Olli's product lineup showed stability in rankings with minor shifts in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.