Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

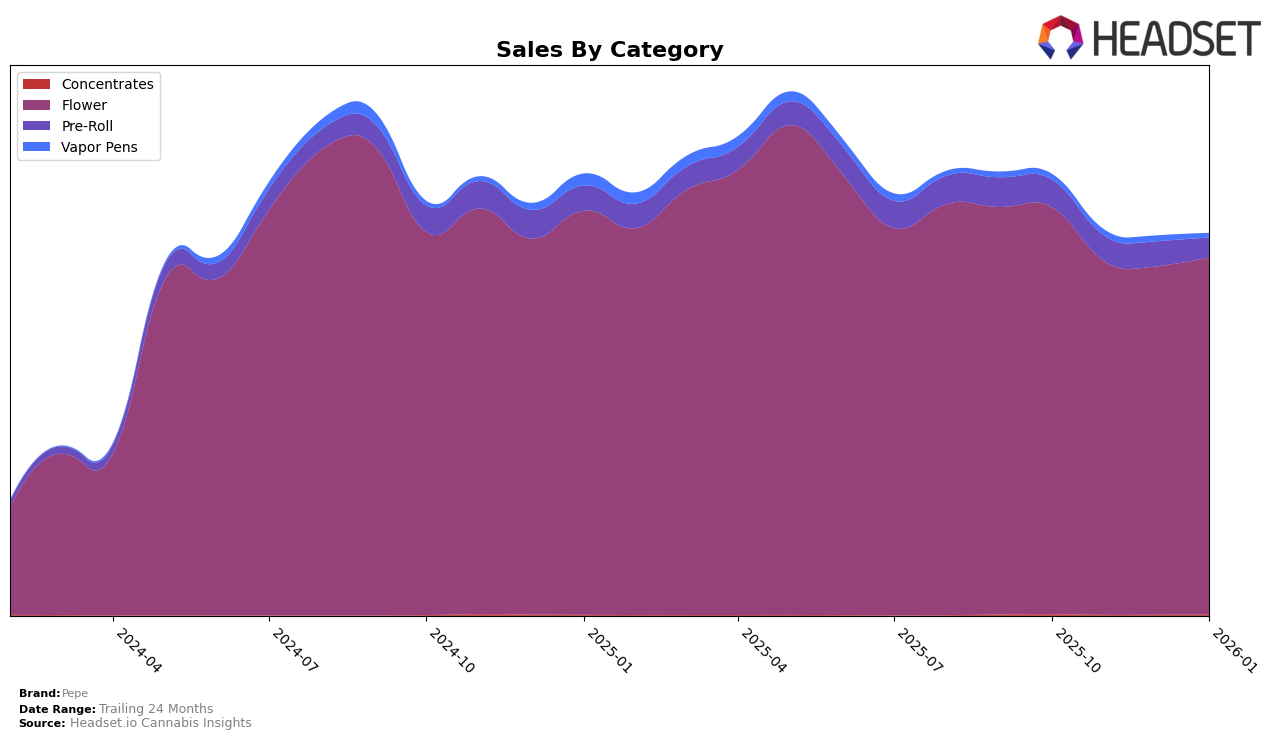

Pepe has demonstrated a steady performance in the Ontario market, particularly in the Flower category. The brand maintained a strong presence, holding a rank within the top 12 from October 2025 to January 2026, with a notable return to the 9th position in January 2026 after a slight dip in the preceding months. This resilience in ranking suggests a solid consumer base and consistent demand for their Flower products. However, the sales figures indicate a slight fluctuation, with a peak in October 2025 and a subsequent decline before a slight recovery in January 2026. This pattern of movement might suggest seasonal influences or shifts in consumer preferences that are worth exploring further.

In contrast, Pepe's performance in the Pre-Roll category in Ontario has not mirrored their Flower success. The brand did not break into the top 30 rankings during the observed months, indicating a potential area for growth or strategic realignment. The sales figures in this category also reflect a downward trend, with a notable drop from October 2025 to January 2026. This decline could be indicative of increased competition or changing market dynamics. For stakeholders and analysts, these insights into category-specific performance can guide strategic decisions and identify opportunities for improvement or investment.

Competitive Landscape

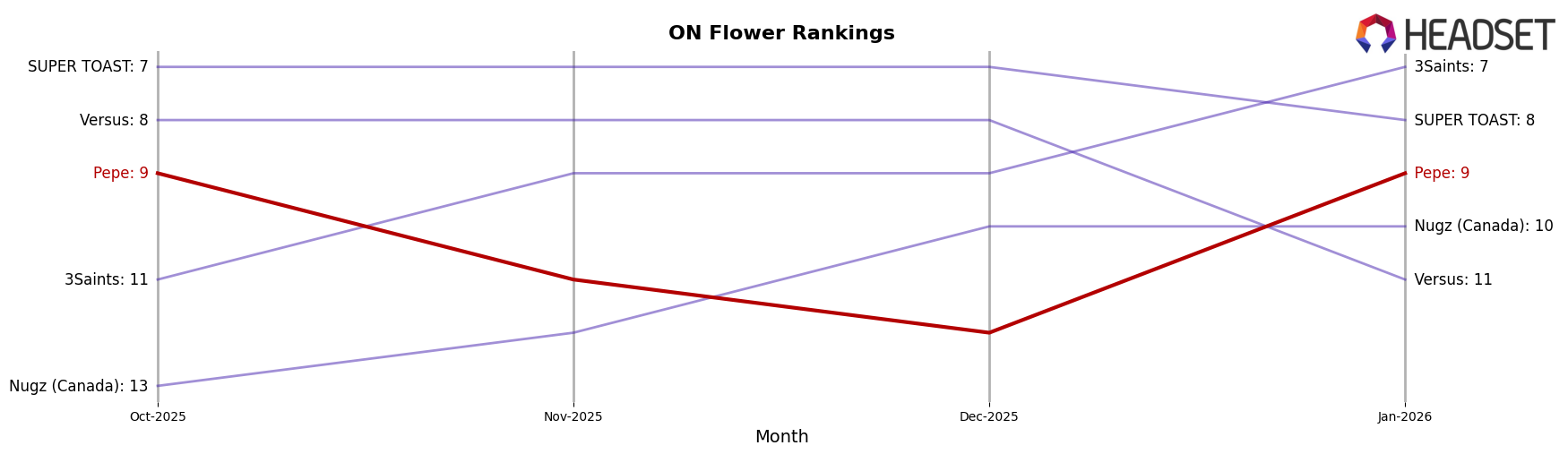

In the competitive landscape of the Flower category in Ontario, Pepe has experienced notable fluctuations in its ranking over the past few months. Starting at 9th place in October 2025, Pepe saw a dip to 11th in November and 12th in December, before recovering to 9th in January 2026. This volatility contrasts with the steady performance of competitors like 3Saints, which improved its rank from 11th to 7th over the same period, and SUPER TOAST, which maintained a consistent top 8 position. Meanwhile, Nugz (Canada) showed a gradual climb, reaching 10th place by December and holding steady into January. Despite these challenges, Pepe's sales showed resilience with a recovery in January, indicating potential for regaining its competitive edge. However, the brand must address the factors contributing to its rank volatility to better compete against consistently performing brands like Versus, which, despite a drop to 11th in January, had maintained a stable position in the top 8 in previous months.

Notable Products

In January 2026, Pepe's top-performing product was 11 Week Pink (28g) in the Flower category, maintaining its first-place rank for four consecutive months, though its sales slightly decreased to 8200. Peach Tree (28g) also held steady in the second position, showing a notable increase in sales compared to previous months. Lemonatti (28g) moved down to third place from its joint second-place rank in December 2025, while 11 Week Pink (3.5g) dropped to fourth place with a continued decline in sales. The Peach Tree Pre-Roll 10-Pack (5g) remained in the fifth position, reflecting consistent demand despite a slight drop in sales figures. This analysis highlights a strong preference for larger quantity flower products, with 11 Week Pink (28g) leading the market consistently.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.