Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

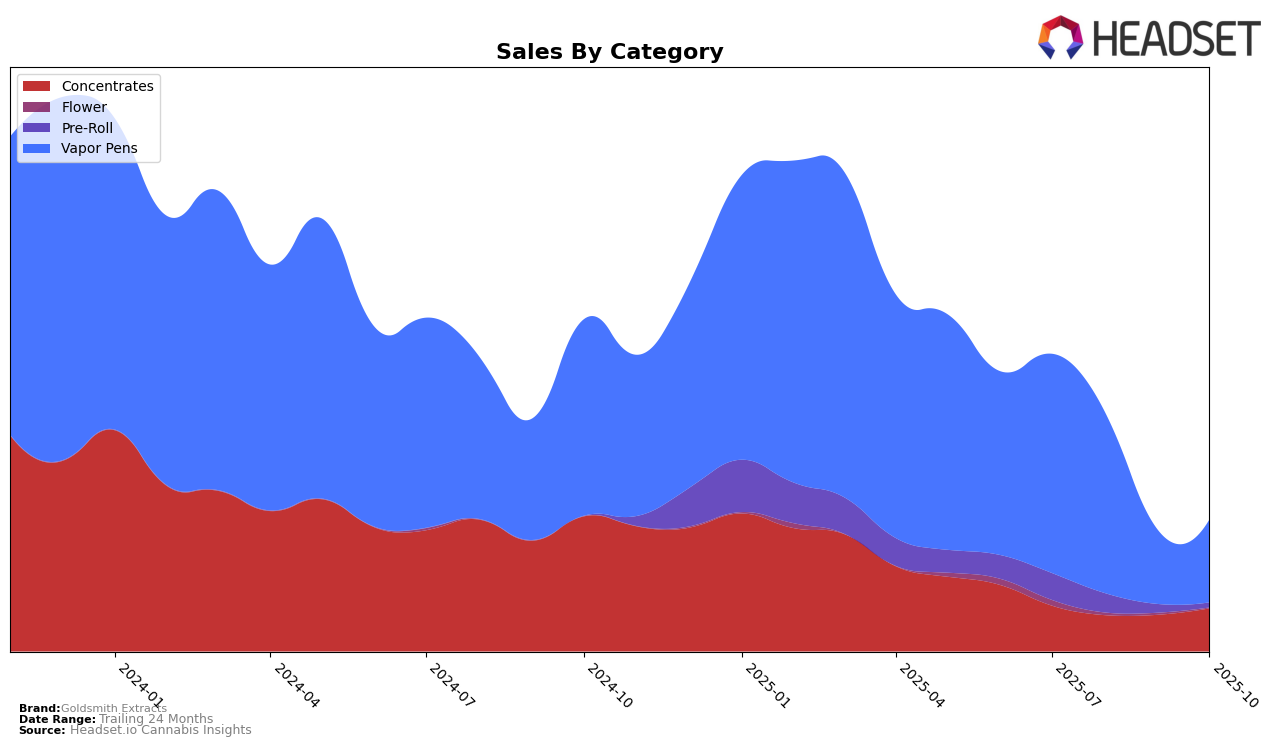

Goldsmith Extracts has shown varying performance across different product categories in Arizona. In the Concentrates category, the brand has maintained a consistent presence in the top 30, with a slight improvement from 32nd place in July 2025 to 29th place by October 2025. This movement indicates a positive trend, as the brand has managed to secure its position within a competitive market. However, in the Pre-Roll category, Goldsmith Extracts did not manage to break into the top 30 rankings for September and October 2025, which could be seen as a potential area for improvement or a strategic shift in focus. This absence suggests that there may be challenges or increased competition in this category that the brand needs to address.

In the Vapor Pens category, Goldsmith Extracts experienced fluctuating rankings, starting at 28th in July and dropping to 42nd in September, before climbing back to 38th in October. This volatility reflects the dynamic nature of consumer preferences and market competition within this category. Despite the ups and downs in rankings, the brand's sales figures in this category suggest a recovery trend from September to October, indicating potential growth opportunities if the brand can capitalize on this momentum. The performance across these categories highlights the brand's resilience and adaptability in a competitive landscape, but also points to areas where strategic adjustments could enhance their market position further.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Goldsmith Extracts has experienced notable fluctuations in its market position over recent months. As of October 2025, Goldsmith Extracts ranked 38th, showing a slight improvement from its September position of 42nd. This upward trend is crucial as it indicates a recovery from a dip in sales during September. Comparatively, Elevate Cannabis Co maintained a relatively stable presence, ranking 37th in October, slightly ahead of Goldsmith Extracts. Meanwhile, Earth Extracts showed a consistent performance, ranking 36th in October, which suggests a steady consumer base. Interestingly, Halo Cannabis (formerly The Green Halo) made a significant leap from 58th in September to 39th in October, indicating a potential threat to Goldsmith Extracts' market share. Despite these challenges, Goldsmith Extracts' resilience in climbing back up the ranks highlights its potential for growth in the competitive Arizona vapor pen market.

Notable Products

In October 2025, the top-performing product for Goldsmith Extracts was the Grand Daddy Purple Distillate Syringe (1g) in the Concentrates category, maintaining its number one rank from September with a sales figure of 330 units. The Purple Punch Badder (1g), also in the Concentrates category, held steady at the second position, showing a slight increase in sales compared to the previous month. Notably, the Jack Herer Distillate Syringe (1g) emerged in the rankings for the first time, securing the third spot in October. In the Vapor Pens category, Northern Lights Distillate Disposable (1g) and Pineapple Express Distillate Disposable (1g) debuted in the fourth and fifth positions, respectively. The consistent performance of top Concentrates products underscores their continued popularity, while the introduction of new Vapor Pens products indicates a potential shift in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.