Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

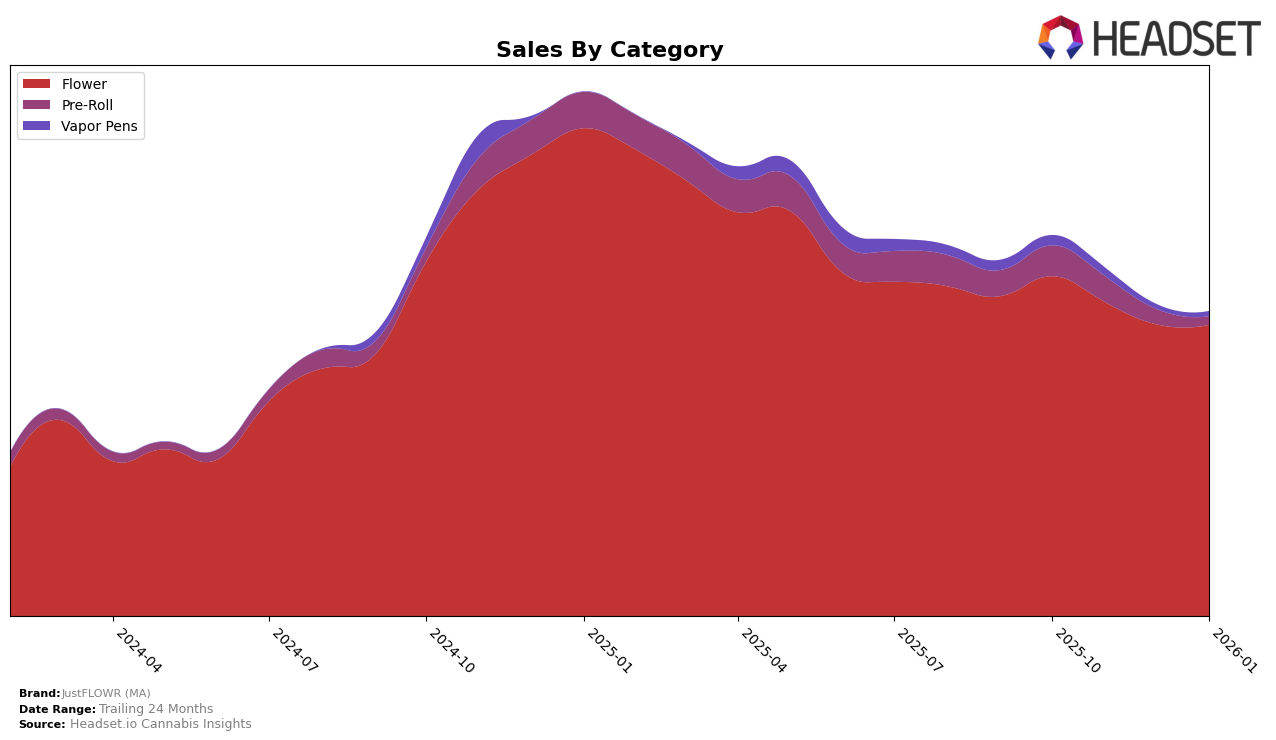

In Arizona, JustFLOWR (MA) has demonstrated remarkable consistency in the Flower category, maintaining the top position from October 2025 through January 2026. This sustained leadership highlights their strong market presence and consumer preference in the state. However, the brand's performance in the Pre-Roll category shows volatility, with a drop from 9th place in October to falling out of the top 30 by January. The Vapor Pens category also reflects a downward trend, with JustFLOWR (MA) slipping from 27th to 31st place by November, eventually exiting the top rankings. These fluctuations suggest potential challenges in maintaining a foothold in categories beyond Flower.

In Maryland, JustFLOWR (MA) holds a steady position in the Flower category, hovering around the 16th and 17th rankings. This stability indicates a consistent, albeit less dominant, market presence compared to their performance in Arizona. The brand's presence in the Pre-Roll category was noted only in October, where they ranked 19th, but they did not sustain this position in subsequent months. This absence from the top 30 in later months could indicate a need for strategic adjustments to enhance their competitiveness in Maryland's Pre-Roll market.

Competitive Landscape

In the highly competitive flower category in Arizona, JustFLOWR (MA) has maintained its top position consistently from October 2025 to January 2026. Despite a slight decline in sales figures over these months, JustFLOWR (MA) remains ahead of its closest competitor, Mohave Cannabis Co., which has consistently held the second rank. This indicates a strong brand loyalty and market presence for JustFLOWR (MA). The third competitor, Find., fluctuated between the third and fourth positions, showing less stability in rank compared to JustFLOWR (MA). The consistent top ranking of JustFLOWR (MA) suggests a robust brand strategy and customer base, which could be leveraged further to counteract the observed sales dip and reinforce its market dominance.

Notable Products

In January 2026, the top-performing product for JustFLOWR (MA) was Grapple Pie (14g) in the Flower category, securing the first rank with sales of 7527 units. Cherry Pie (4g) rose to the second position from its fifth rank in November 2025, indicating a significant increase in popularity. Zerealz (14g) debuted at the third rank, showing strong sales performance. Jon Woo (14g) experienced a slight decline, moving from second place in December 2025 to fourth in January 2026. CKD Up Candy (14g) entered the top five, claiming the fifth spot in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.