Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

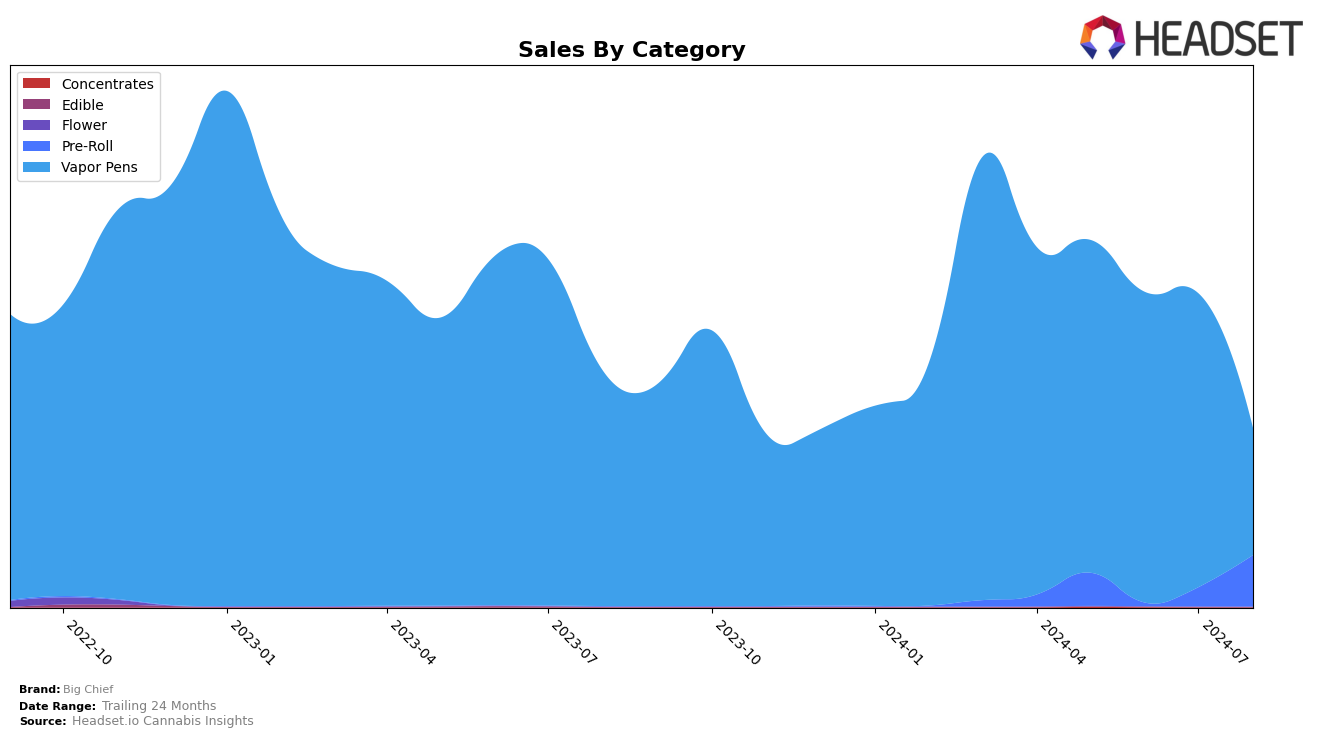

Big Chief has shown a mixed performance across different categories and states in recent months. In California, the brand's presence in the Vapor Pens category has been inconsistent, failing to make it into the top 30 rankings for both June and August 2024. This indicates a potential struggle to maintain a competitive edge in a highly saturated market. Conversely, in Nevada, Big Chief has demonstrated notable strength in the Pre-Roll category, climbing to a rank of 27 in August 2024, up from 48 in July 2024. This upward movement suggests a growing consumer preference for Big Chief's pre-roll products in Nevada.

In the Vapor Pens category in Nevada, Big Chief has experienced a decline, dropping from a consistent rank of 17 in May and June 2024 to 32 in August 2024. This downward trend could be indicative of increased competition or shifting consumer tastes within the state. Despite this, the brand managed to maintain a strong sales figure of $256,630 in July 2024 before the decline. The varying performance across these states and categories highlights the dynamic nature of the cannabis market and underscores the importance of regional strategies for maintaining brand competitiveness.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Big Chief has experienced notable fluctuations in its ranking and sales over the past few months. In May 2024, Big Chief held a solid 17th position, maintaining this rank in June before slightly improving to 16th in July. However, a significant drop to 32nd place in August indicates a sharp decline in market performance. This downward trend contrasts with competitors like Roots, which, despite fluctuating ranks, managed to improve from 35th in May to 30th in August, and Vegas Valley Growers North, which maintained a relatively stable position around the 28th to 30th range. The volatility in Big Chief's ranking suggests potential challenges in maintaining market share, possibly due to increased competition or shifts in consumer preferences. For a more comprehensive understanding of these dynamics and to strategize effectively, acquiring advanced data insights would be beneficial.

Notable Products

In August 2024, the top-performing product for Big Chief was Biscotti Distillate Cartridge (1g) in the Vapor Pens category, which ascended to the first rank with notable sales of 780 units. Skywalker OG Distillate Cartridge (1g) held the second position, having dropped from its previous top rank in June. Girl Scout Cookies Distillate Cartridge (1g) maintained a steady third rank since July. Granddaddy Purple Distillate Cartridge (1g) slipped to the fourth position from its second rank in May and June. Gorilla Glue #4 Distillate Cartridge (1g) entered the rankings at the fifth position for the first time in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.