Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

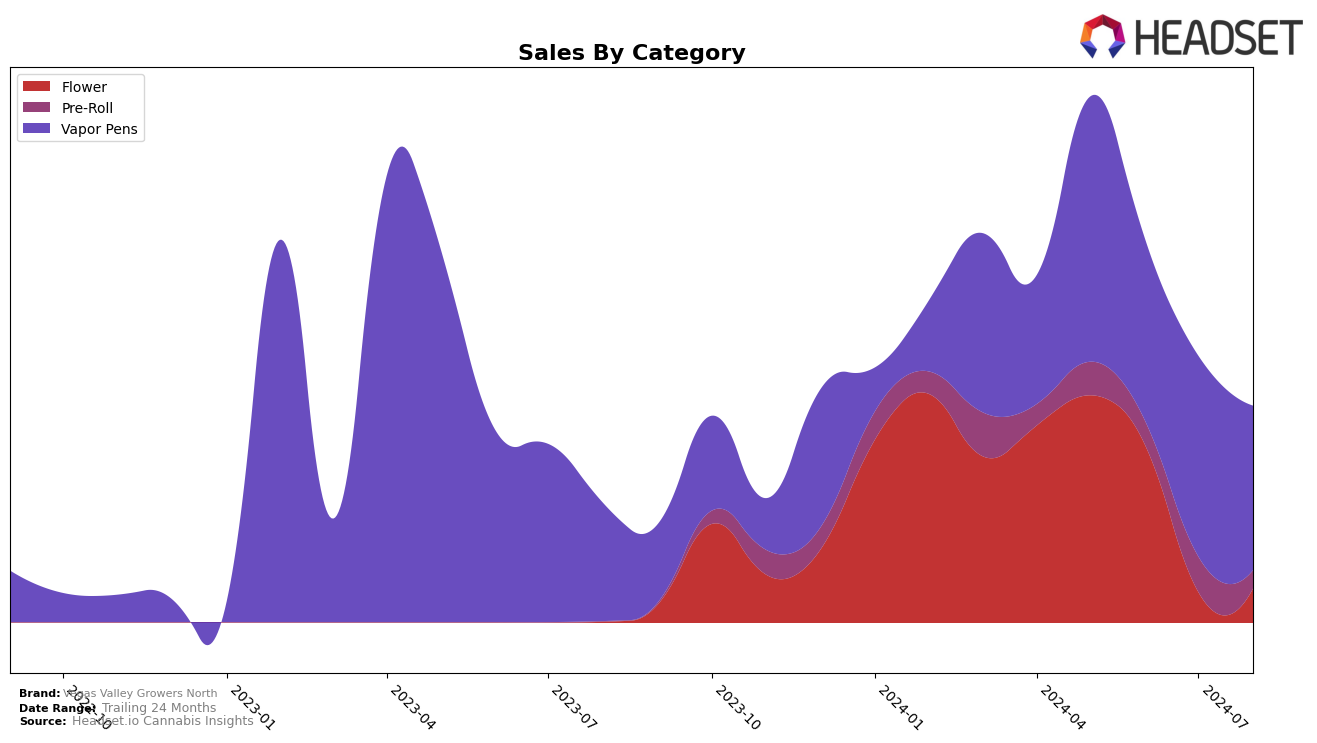

Vegas Valley Growers North has shown varied performance across different product categories in Nevada. In the Flower category, the brand has struggled to maintain a strong presence, with rankings falling out of the top 30 consistently from May to August 2024. This decline is evident in their sales figures, which dropped significantly from $111,937 in May to just $17,148 by August. Conversely, in the Vapor Pens category, Vegas Valley Growers North has maintained a more stable ranking, staying within the top 30 throughout the same period. This stability is reflected in their sales, which, despite a slight decrease, remained relatively robust, highlighting a stronger consumer preference for their vapor products compared to their flower offerings.

The Pre-Roll category presents a mixed picture for Vegas Valley Growers North. While the brand did not make it into the top 30 in August 2024, they saw a notable improvement in their ranking in July, moving up to 53rd place from 65th in June. This upward trend suggests potential growth in this segment, though the absence from the top 30 in August indicates that maintaining consistent performance remains a challenge. Overall, the brand's performance across categories in Nevada suggests that while they have strong points in certain segments like Vapor Pens, there are areas, particularly in Flower and Pre-Rolls, where they need to focus on improving their market presence and sales consistency.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Vegas Valley Growers North has experienced fluctuations in its rank and sales over the past few months. Despite a strong start in May 2024 with a rank of 28, the brand saw a dip to 30 in June before recovering slightly to 28 in July and then dropping again to 29 in August. This volatility contrasts with the more consistent performance of competitors like Big Chief, which maintained a top 20 rank until August when it fell to 32. Meanwhile, Packwoods and Beboe have shown upward trends, with Beboe climbing from 37 to 27 over the same period. Roots also demonstrated notable rank improvements, peaking at 28 in June. These shifts highlight the competitive pressure on Vegas Valley Growers North, suggesting a need for strategic adjustments to regain and sustain higher rankings and sales in this dynamic market.

Notable Products

In August 2024, the top-performing product for Vegas Valley Growers North was the Vegas M-Stick - Runtz Distillate Disposable (0.5g) in the Vapor Pens category, maintaining its number one rank from July with sales of 968 units. The Vegas M-Stick - Red Pop Distillate Disposable (0.5g), also in the Vapor Pens category, climbed to the second rank from third in July. The Wedding Cake (3.5g) in the Flower category held its third position from July. The Vegas M-Stick - Mac Distillate Disposable (0.5g) in Vapor Pens re-entered the rankings at fourth place, having been unranked in July. Finally, the Vegas M-Stick - Carmelo Distillate Disposable (0.5g) dropped to fifth place from second in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.