Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

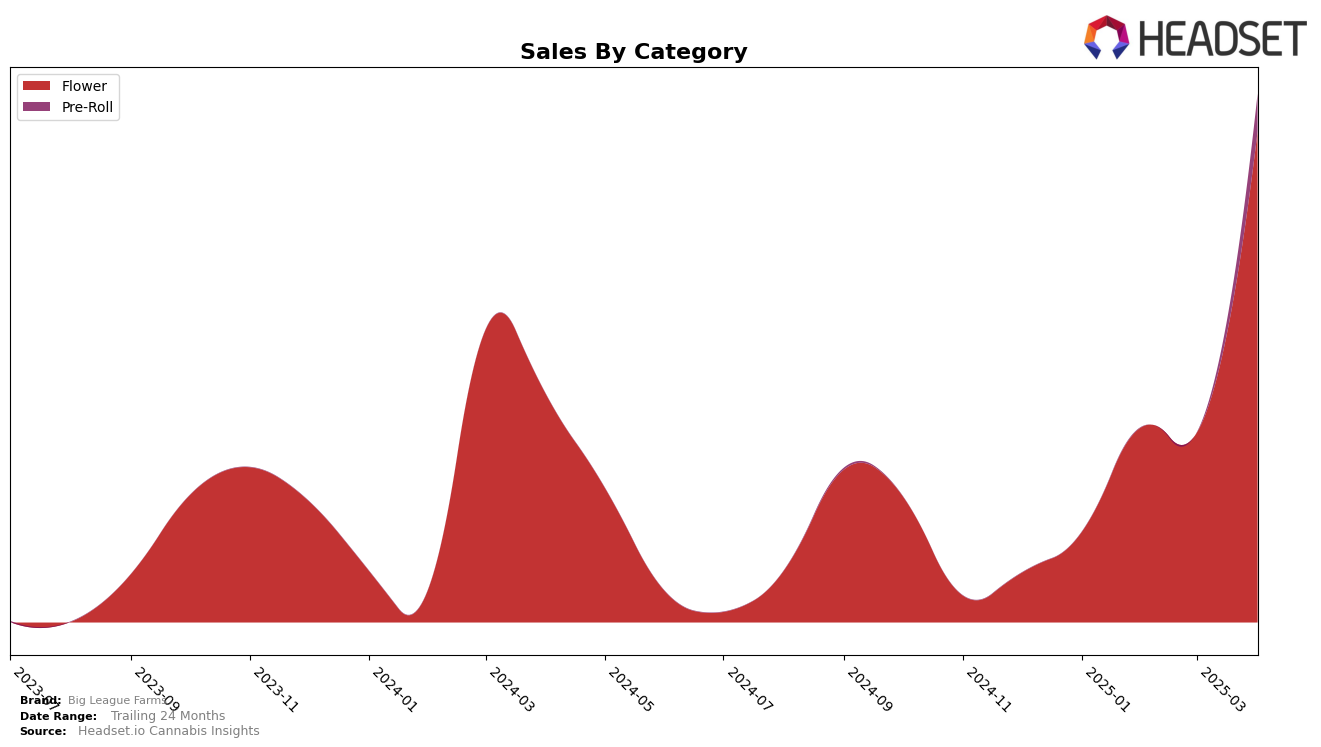

Big League Farms has shown a noteworthy improvement in the Oregon market, particularly in the Flower category. After not ranking in January, the brand made a significant leap into the top 30 by April, reaching the 30th position. This upward trajectory is indicative of a strong performance, especially considering their sales in April were more than double compared to the previous months. This kind of growth suggests an effective strategy or perhaps a positive reception of a new product line. However, the absence from the top 30 in the initial months of 2025 might have been a concern, highlighting the volatility and competitive nature of the market.

In the Pre-Roll category, Big League Farms made their debut in April, securing the 87th spot. While this ranking does not place them among the top players, it marks their entry into the market, which could be seen as a positive step towards expanding their presence in Oregon. The absence of rankings in the preceding months could indicate a late entry or a strategic pivot towards Pre-Roll products. The sales data for April shows a modest start, but it lays the groundwork for potential growth in the coming months. This initial entry into the Pre-Roll market could serve as a foundation for Big League Farms to build upon as they aim to climb the ranks.

Competitive Landscape

In the competitive landscape of Oregon's flower category, Big League Farms has shown a significant upward trajectory in recent months. After not ranking in January 2025, the brand made a notable leap to 30th place by April 2025, indicating a strong recovery and growth in market presence. This improvement in rank is particularly impressive when compared to competitors like Cosmic Treehouse, which saw a decline from 20th to 29th place over the same period. Meanwhile, Tao Gardens experienced a dramatic rise from 80th to 28th place, showcasing a competitive edge in sales growth. Despite Derby's Farm maintaining a relatively stable position, Big League Farms' rapid climb suggests a successful strategy in capturing market share, potentially driven by increased consumer interest or effective marketing tactics. As the brand continues to strengthen its foothold, monitoring these competitive dynamics will be crucial for stakeholders looking to capitalize on emerging trends in Oregon's cannabis market.

Notable Products

In April 2025, the top-performing product from Big League Farms was the Purple Punch Breath Pre-Roll (0.5g) in the Pre-Roll category, securing the first rank with sales of 2436 units. Following closely, the OMG Pre-Roll (1g) and Ice Cream Cake Pre-Roll (0.5g) occupied the second and third positions, respectively. Lemon Kush (1g) in the Flower category ranked fourth, maintaining a consistent presence in the top ranks. Lemon Pastries (1g), also in the Flower category, dropped from second place in February and third in March to fifth place in April, despite an increase in sales to 1632 units. This shift in rankings highlights the competitive dynamics and changing consumer preferences in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.