Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

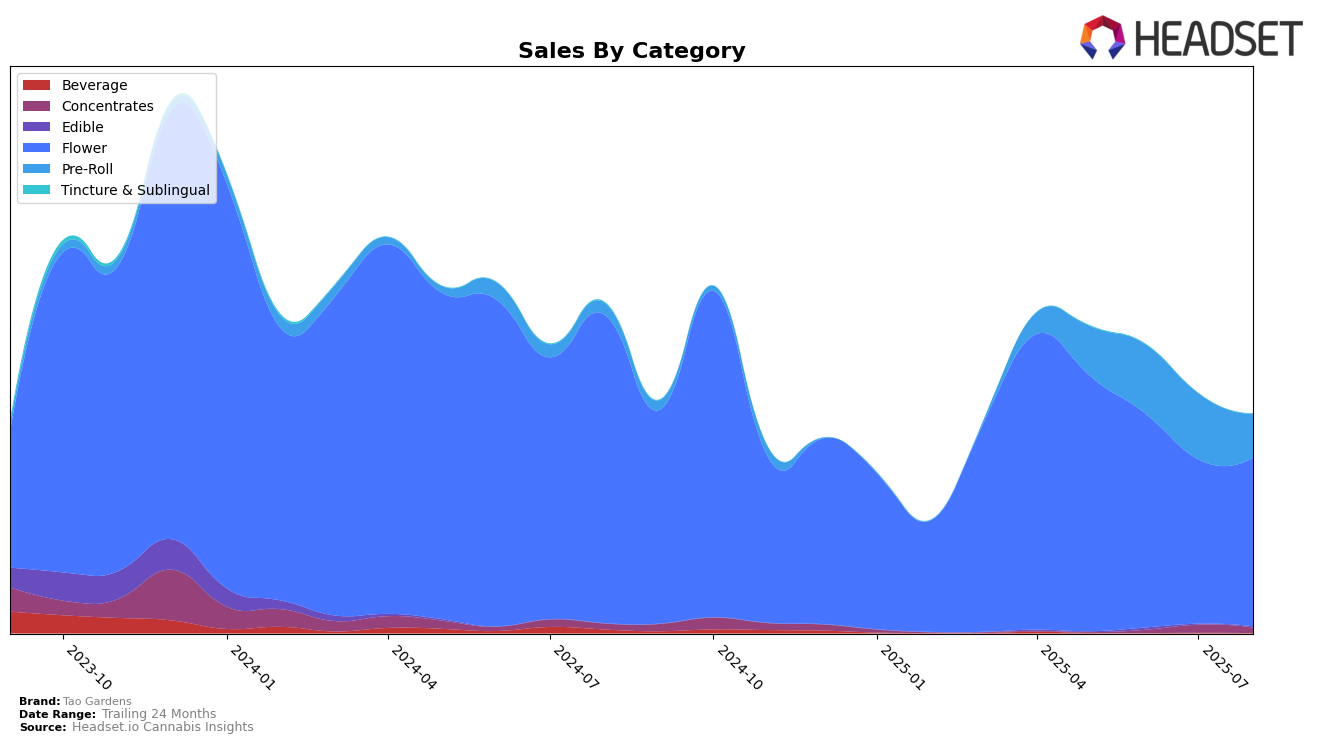

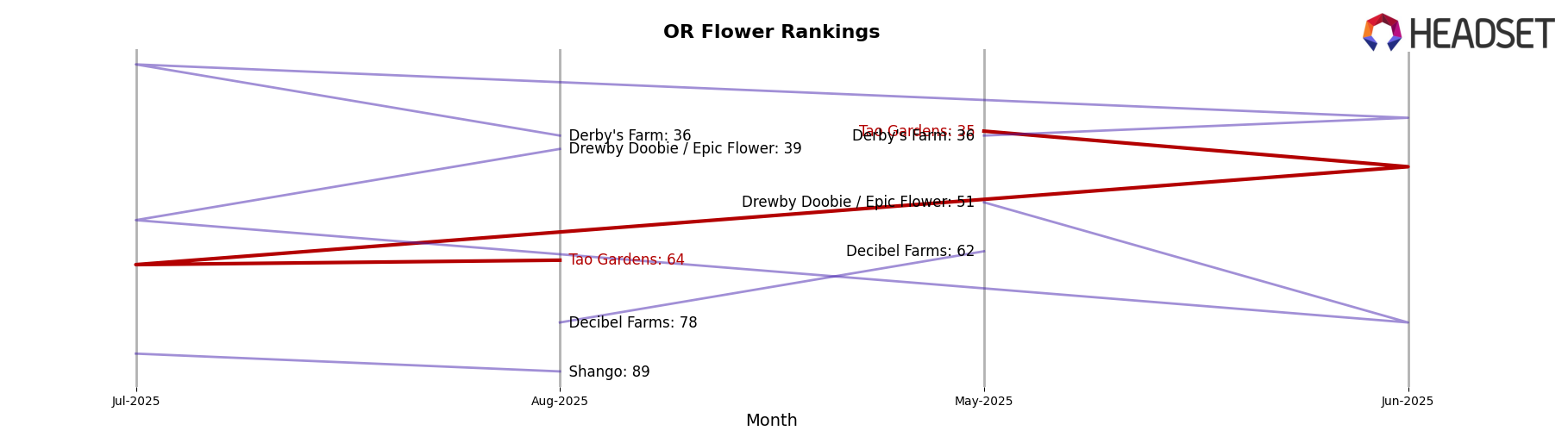

Tao Gardens has experienced varied performance across different product categories in Oregon. In the Flower category, the brand has faced challenges, with rankings slipping from 35th in May 2025 to 64th by August 2025. This decline is mirrored by a decrease in sales, dropping from $156,726 in May to $103,465 in August. Such a movement suggests a significant struggle to maintain market share within the competitive Flower segment. In contrast, the Pre-Roll category shows a more stable performance, maintaining a consistent rank around the mid-50s, though it did fall to 67th in August. Sales fluctuations in the Pre-Roll category indicate a volatile market presence, with a notable peak in June before a decline in subsequent months.

It is important to note that Tao Gardens has not been able to secure a position within the top 30 brands in either category in Oregon throughout the observed months. This absence from the top tier highlights the competitive challenges the brand faces in expanding its market influence. The Flower category, in particular, has seen a more pronounced drop in rankings, indicating potential areas for strategic improvement or market adaptation. Conversely, the Pre-Roll category's relatively stable ranking suggests a more resilient market position, albeit with room for growth. These trends underscore the importance of strategic focus and adaptation to market dynamics in order to enhance Tao Gardens' positioning in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Tao Gardens has experienced a notable decline in rank from May to August 2025, dropping from 35th to 64th place. This downward trend in rank correlates with a decrease in sales, suggesting that Tao Gardens is facing stiff competition. Notably, Derby's Farm has shown a strong performance, consistently maintaining a higher rank than Tao Gardens, peaking at 20th in July, which may have contributed to the pressure on Tao Gardens. Meanwhile, Drewby Doobie / Epic Flower has demonstrated a remarkable recovery, climbing from 78th in June to 39th in August, surpassing Tao Gardens. The fluctuating ranks and sales figures highlight the dynamic nature of the market, urging Tao Gardens to strategize effectively to regain its competitive edge.

Notable Products

In August 2025, the top-performing product for Tao Gardens was True Blue Pre-Roll (1g) in the Pre-Roll category, reclaiming its position at rank 1 with notable sales of 1658 units. Sticky Buns Pre-Roll (1g) followed closely at rank 2, showing a consistent performance improvement from rank 4 in June 2025. Minotaur (Bulk) made its debut in the rankings at position 3 under the Flower category. London Cake Pre-Roll (1g) entered the list at rank 4, indicating a new interest in this product. Mac 1 Pre-Roll (1g) rounded out the top five, marking its first appearance in the rankings for August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.