Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

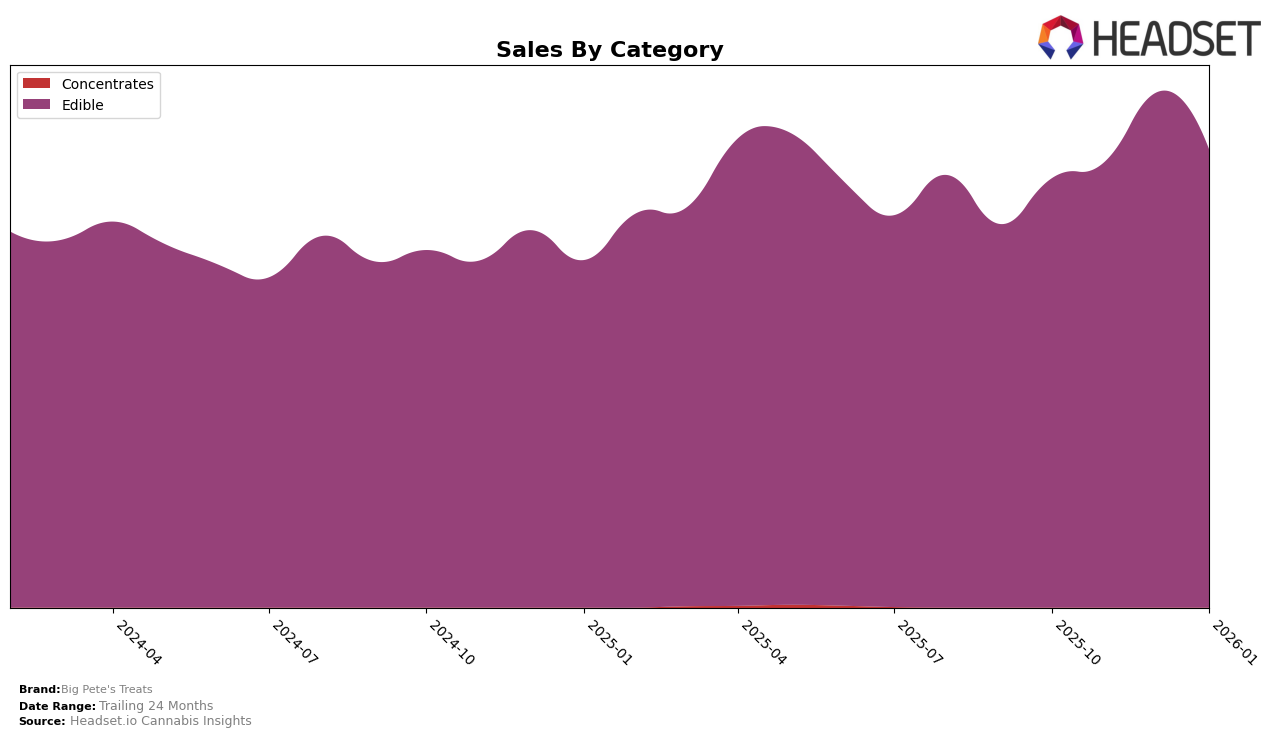

Big Pete's Treats has shown notable performance in the California edible market, maintaining a steady climb in rankings from October 2025 to January 2026. The brand improved its position from 18th to 15th, indicating a positive reception and growing market presence. This upward trend is underscored by a peak in sales during December 2025, suggesting a successful holiday season. Meanwhile, in Michigan, the brand's performance has been more volatile, with rankings fluctuating significantly, peaking at 73rd in November before dropping to 89th by January. This inconsistency highlights potential challenges in maintaining a strong foothold in the Michigan market.

In Missouri, Big Pete's Treats has demonstrated a relatively stable presence, with rankings hovering in the low 40s throughout the observed period. This consistency suggests a loyal customer base, though the brand has yet to break into the top 30. In contrast, the Ontario market presents a mixed picture, with the brand not appearing in the rankings for November and January, indicating potential distribution or market penetration challenges. However, the brand's ability to rank 33rd in December suggests there is room for growth if these challenges can be addressed. This varied performance across states and provinces highlights the complexities of navigating different cannabis markets.

Competitive Landscape

In the competitive California edible market, Big Pete's Treats has shown a steady improvement in its rankings from October 2025 to January 2026, moving from 18th to 15th place. This upward trend indicates a positive reception of their products, despite fierce competition. Notably, ABX / AbsoluteXtracts consistently outperformed Big Pete's Treats, climbing from 16th to 13th place, suggesting a stronger market presence and possibly more aggressive marketing strategies. Meanwhile, Dr. Norm's experienced a decline, dropping to 17th place by January 2026, which might have opened up opportunities for Big Pete's Treats to capture more market share. Drops and Clsics also displayed fluctuating ranks, with Drops experiencing a notable drop from 8th to 12th, potentially indicating a vulnerability that Big Pete's Treats could exploit. Overall, the data suggests that while Big Pete's Treats is on an upward trajectory, understanding the strategies of higher-ranked competitors could be key to accelerating their growth in the California edible market.

Notable Products

In January 2026, Big Pete's Treats maintained its top-performing product, Sleepy Time - THC/CBN 2:1 Indica Cherries and Berries Variety Gummies 10-Pack, which consistently held the number one rank since October 2025 with sales of 2287 units. Pineapple & Guava Live Rosin Gummies 10-Pack secured the second rank, maintaining its position from December 2025. Strawberry & Watermelon Live Rosin Gummies 10-Pack remained in third place, although its sales saw a decrease compared to the previous month. Notably, Chocolate Chip Mini Cookies 10-Pack entered the rankings in January 2026 at the fourth position, indicating a new contender in the top five. Indica Fruity Blast Crispy Marshmallow Treat continued to hold the fifth rank, showing a steady performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.