Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

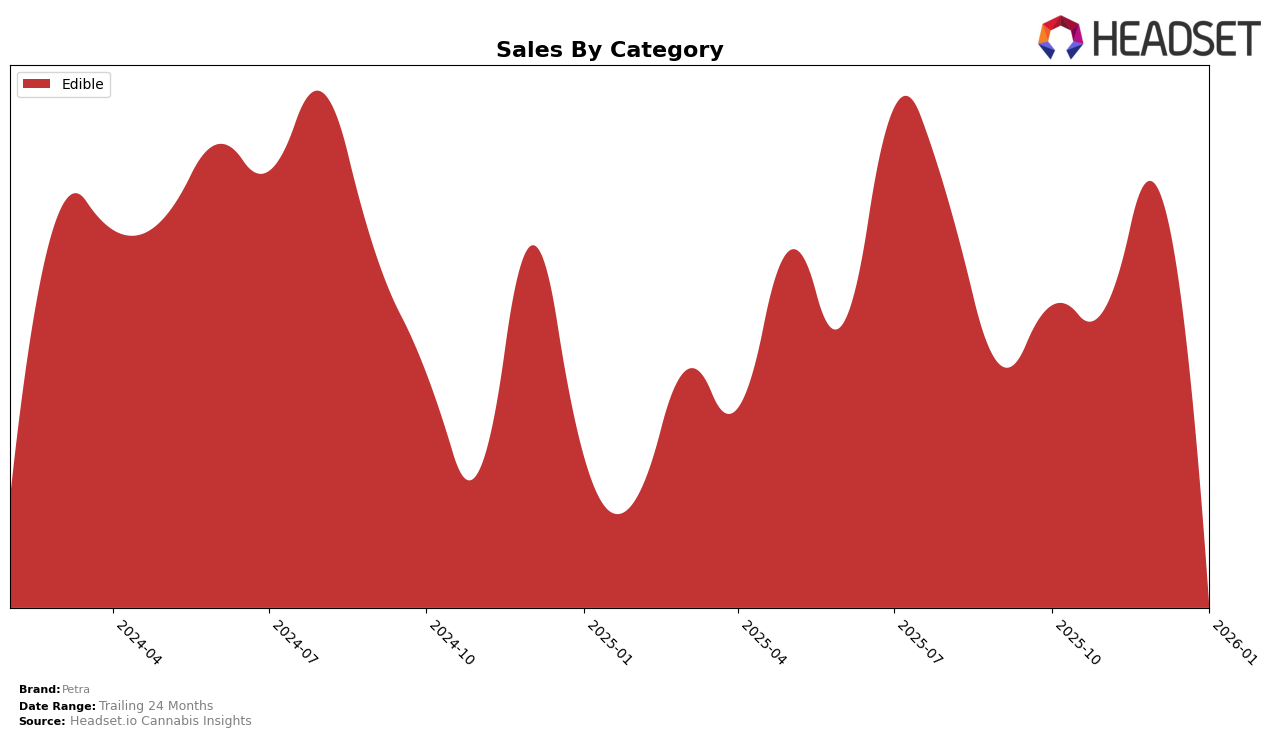

Petra's performance in the Edible category showcases varying trends across different states. In California, Petra maintained a steady presence within the top 30, with a slight fluctuation in rankings from 20th in October 2025 to 21st in January 2026. This indicates a consistent demand, albeit with a slight dip in sales at the start of the new year. In contrast, Michigan saw Petra's rank drop from 22nd to 28th over the same period, suggesting a more volatile market presence. Interestingly, despite these fluctuations, Petra's sales in Michigan showed a significant decline from December to January, hinting at potential market challenges.

In Illinois, Petra did not make it into the top 30 rankings, with positions hovering around the 50s, indicating a weaker market penetration compared to other states. Meanwhile, in Ohio, Petra consistently ranked in the low 30s, showing a stable yet modest performance. The sales in Ohio remained relatively steady, reflecting a consistent consumer base. These diverse performances across states highlight the varying market dynamics Petra faces, with some states offering more robust opportunities than others.

Competitive Landscape

In the competitive landscape of the California edible market, Petra has experienced notable fluctuations in its rankings from October 2025 to January 2026. Starting at rank 20 in October 2025, Petra improved to rank 19 in November, but then slipped back to rank 20 in December, and further to rank 21 in January 2026. This downward trend contrasts with Zen Cannabis, which maintained a steady rank of 19 throughout the same period, suggesting a stable market presence. Meanwhile, Space Gem showed a gradual improvement, moving from rank 23 in October to rank 20 by January, potentially indicating a growing consumer preference. Happy Fruit and Whoa Infused also demonstrated some rank volatility, but neither consistently outperformed Petra. These dynamics highlight the competitive pressures Petra faces, emphasizing the need for strategic adjustments to regain and sustain a higher market position in California's edible sector.

Notable Products

In January 2026, Petra's Moroccan Mints 40-Pack (100mg) maintained its top position as the leading product, despite a notable decrease in sales to 6236. Tart Cherry Mints 40-Pack (100mg) rose to the second spot, showing an improvement from its fourth-place ranking in December 2025. The CBD/THC 1:1 Saigon Cinnamon Mints 40-Pack (100mg CBD, 100mg THC) remained consistent, retaining its third-place ranking from the previous month. THC/CBN 2:1 Blackberry Mints 40-Pack (110mg THC, 55mg CBN) dropped to fourth place, a shift from its steady second-place ranking in the prior months. A new entry, THC/CBN 2:1 Blackberry Mints 40-Pack (100mg THC, 40mg CBN), debuted at the fifth position, indicating a growing interest in this product variant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.