Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

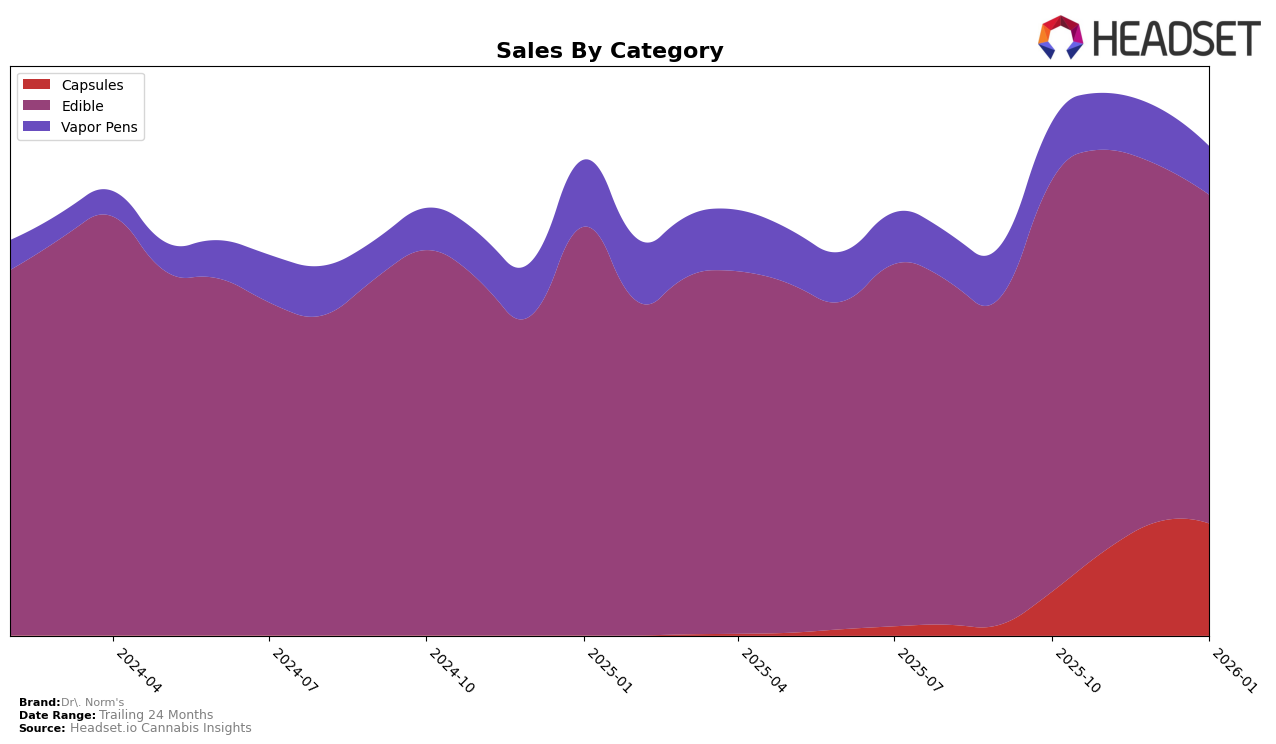

Dr. Norm's has shown notable performance in the California market, particularly in the Capsules category. Over the span from October 2025 to January 2026, the brand improved its ranking from 12th to 8th, maintaining this position into January. This upward movement is indicative of a strong market presence and increasing consumer preference within this category. The surge in sales from October to November, followed by a slight stabilization, suggests that Dr. Norm's has effectively captured a growing segment of the capsules market, perhaps through strategic positioning or product innovation.

In contrast, Dr. Norm's performance in the Edible category within California has experienced a slight decline. The brand's ranking remained stable at 15th from October to November 2025 but dropped to 17th by December and maintained that rank in January 2026. This downward trend in rankings, coupled with a decrease in sales figures, could point to increased competition or shifting consumer preferences. Notably, the absence of Dr. Norm's from the top 30 brands in other states or provinces emphasizes the brand's concentrated focus or success within California's market, which might suggest areas for potential expansion or diversification.

Competitive Landscape

In the competitive landscape of the California edible market, Dr. Norm's has experienced notable fluctuations in its ranking over the past few months. Starting in October 2025, Dr. Norm's held the 15th position, maintaining this rank in November before dropping to 17th in December and January 2026. This decline in rank coincides with a decrease in sales, suggesting a potential challenge in maintaining market share. Meanwhile, competitors like Kiva Chocolate and Big Pete's Treats have shown resilience, with Kiva Chocolate improving its rank to 15th in December and Big Pete's Treats climbing to 15th in January. Clsics also presents a competitive threat, having fluctuated around the 13th to 18th positions but showing a slight recovery in January. These dynamics highlight the competitive pressure Dr. Norm's faces, emphasizing the importance of strategic adjustments to regain and sustain a higher market position.

Notable Products

In January 2026, Dr. Norm's top-performing product was the Wicked Watermelon Hash Gummy (100mg) in the Edible category, maintaining its leading position from previous months despite a slight decline in sales to 3067 units. The Indica Max Tablets 20-Pack (1000mg) remained steady at the second position, showing consistent performance since November 2025. Mango Madness Max Solventless Hash Gummy (100mg) secured the third spot, reappearing in the rankings after missing in December, with sales of 2320 units. Key Lime High Max Gummy (100mg) dropped to fourth place, experiencing a gradual decline over the months. The Fruity Pebbles Rice Crispy Bar (100mg) rounded out the top five, consistently holding its position since October 2025, although its sales figures slightly decreased to 1945 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.