Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

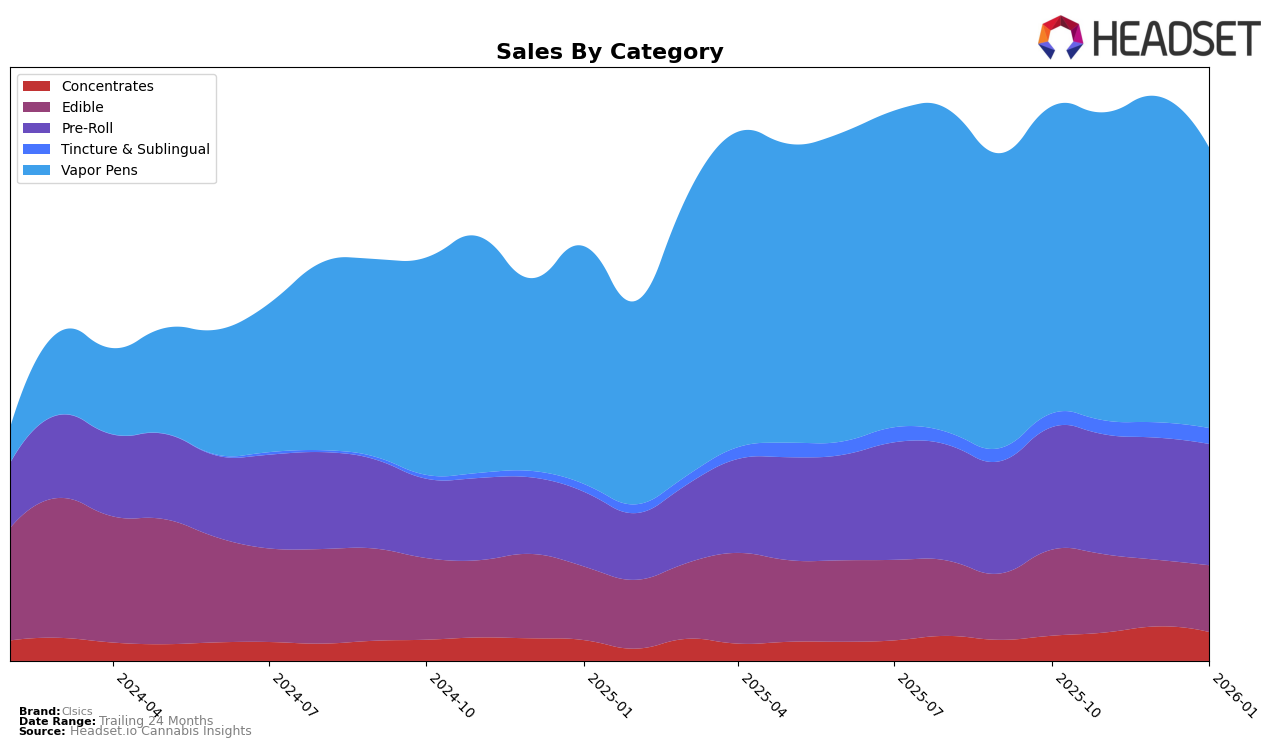

Clsics has demonstrated a varied performance across different product categories in California. In the Concentrates category, the brand showed a promising upward trend until December 2025, moving from the 25th rank in October to the 20th rank, before slipping slightly to 24th in January 2026. This could indicate a seasonal fluctuation or increased competition in the market. In contrast, the Edible category saw a consistent decline in rankings from October to December, dropping from 13th to 18th, before slightly recovering to 16th in January 2026. This could suggest a need for innovation or marketing efforts to regain lost ground in this segment.

In the Pre-Roll category, Clsics maintained a stable position, oscillating only between the 19th and 20th ranks throughout the observed months, which may imply a steady demand for their offerings in this segment. The Tincture & Sublingual category also displayed consistent performance, holding the 12th rank across all four months, indicating a solid foothold in this niche market. Interestingly, the Vapor Pens category showed a brief improvement in rank from 15th in October to 13th in December, before dropping to 14th in January 2026, despite a significant decrease in sales from December to January. This suggests that while Clsics is a competitive player in the Vapor Pens category, there might be external factors affecting sales performance.

Competitive Landscape

In the competitive landscape of vapor pens in California, Clsics has experienced fluctuating rankings over the past few months, indicating a dynamic market position. As of January 2026, Clsics held the 14th rank, a slight dip from its 13th position in December 2025. This shift is notable when compared to competitors like West Coast Cure, which maintained a consistent 12th rank from December 2025 to January 2026, and Bloom, which improved its rank from 16th in October 2025 to 13th in January 2026. Despite Clsics' sales peaking in December 2025, the subsequent decrease in January 2026 suggests potential challenges in sustaining momentum against competitors such as Dabwoods Premium Cannabis, which saw a decline in rank but still managed to outperform Clsics in earlier months. Understanding these trends and competitive dynamics is crucial for Clsics to strategize effectively and regain a stronger foothold in the market.

Notable Products

In January 2026, Clsics' top-performing product was the Blackberry Fire Live Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its number one rank from December 2025 with sales of 3698 units. The CBD/CBN/THC 1:1:1 Blueberry Milk Live Rosin Gummies 10-Pack (100mg CBD, 100mg CBN, 100mg THC) rose to the second position, improving from third place in December 2025. Berry Prism Rosin Gummies 10-Pack (100mg) held steady in third place, showing consistent performance over the last two months. Blue Crack Live Rosin Disposable (1g) remained at the fourth position, having dropped from second place in October 2025. Cereal Milk Live Rosin Disposable (1g) entered the rankings in January 2026 at fifth place, indicating a new interest in this product within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.