Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

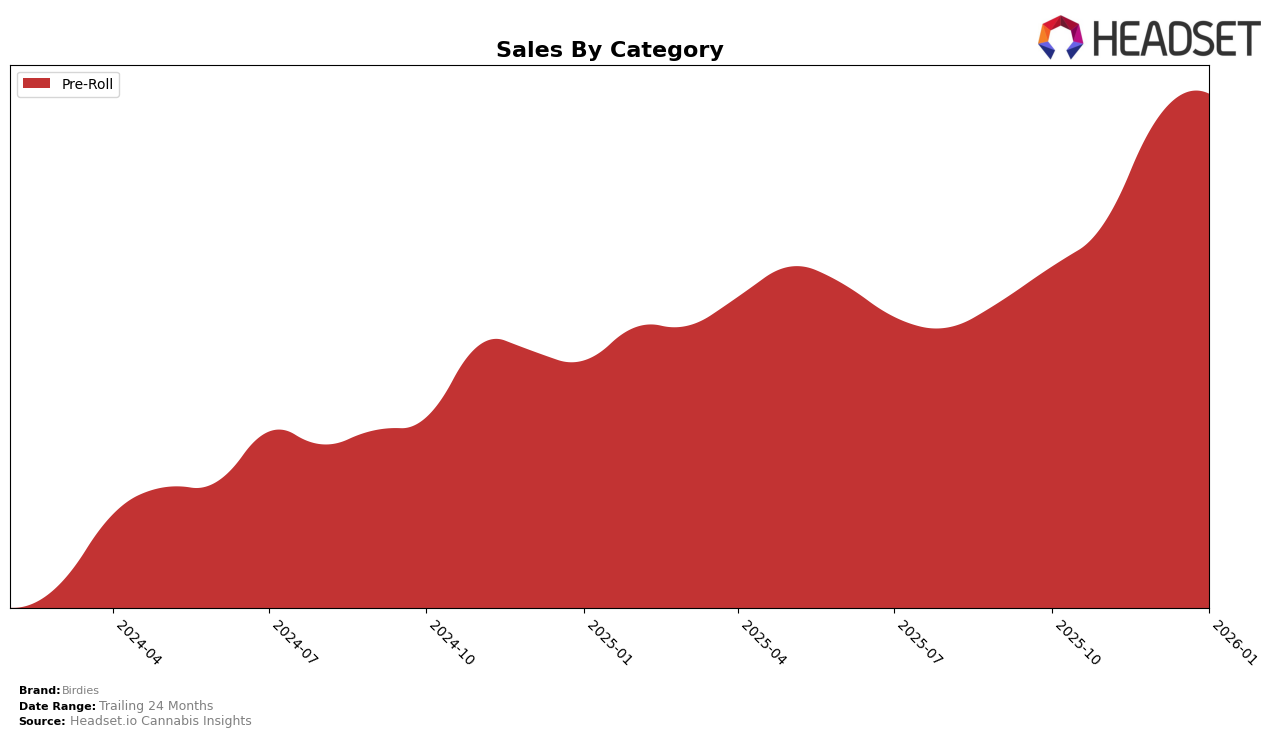

Birdies has shown a dynamic performance across different states and categories in recent months. In the Arizona market, Birdies maintained a steady presence in the Pre-Roll category, consistently holding the 13th position from November 2025 to January 2026. This stability suggests a reliable consumer base in the state, although the brand experienced a drop from the 10th position in October 2025. Such consistency, despite the slight decline, indicates resilience in a competitive market. However, the lack of a top 30 ranking in other categories or states could be a point of concern for the brand's broader market penetration strategy.

In contrast, Birdies has made significant strides in California, where it has climbed the ranks in the Pre-Roll category from 32nd in October 2025 to 15th by January 2026. This upward trajectory highlights a strong growth momentum and increased consumer preference in the state, possibly driven by strategic marketing or product differentiation efforts. The notable increase in sales from $389,655 in October to $748,400 in January further underscores the brand's successful expansion in California. Despite this progress, Birdies' absence from the top 30 in other categories remains a critical area for potential development.

Competitive Landscape

In the competitive landscape of the California Pre-Roll market, Birdies has shown a remarkable upward trajectory, climbing from a rank of 32 in October 2025 to 15 by January 2026. This significant rise in rank is indicative of a robust increase in market presence and consumer preference, as reflected in its sales growth from $389,655 to $748,400 over the same period. In contrast, brands like Caviar Gold and Lime have maintained relatively stable positions, with Caviar Gold experiencing a slight dip from 12 to 13 and Lime holding steady at 14. Meanwhile, UpNorth Humboldt and Sparkiez have seen declines in their ranks, with UpNorth Humboldt dropping from 14 to 17 and Sparkiez moving from 15 to 16. Birdies' impressive ascent suggests a successful strategy in capturing market share and enhancing brand visibility, positioning it as a formidable competitor in this category.

Notable Products

In January 2026, Birdies' top-performing product was the Sativa Classic Pre-Roll 10-Pack (7g) in the Pre-Roll category, maintaining its number one rank consistently since October 2025 with sales reaching 8,303 units. The Hybrid Classic Pre-Roll 10-Pack (7g) held its second place position, showing a steady increase in sales each month. The Indica Classic Pre-Roll 10-Pack (7g) remained in third place, although its sales slightly decreased from December 2025. The Ultra Indica THCA diamonds Infused Pre-Roll 5-Pack (4.25g) and Ultra Hybrid THCA diamonds Infused Pre-Roll 5-Pack (4.25g) remained in fourth and fifth places, respectively, with both experiencing a drop in sales compared to the previous month. Overall, the rankings for Birdies' top products have shown remarkable stability over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.