Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

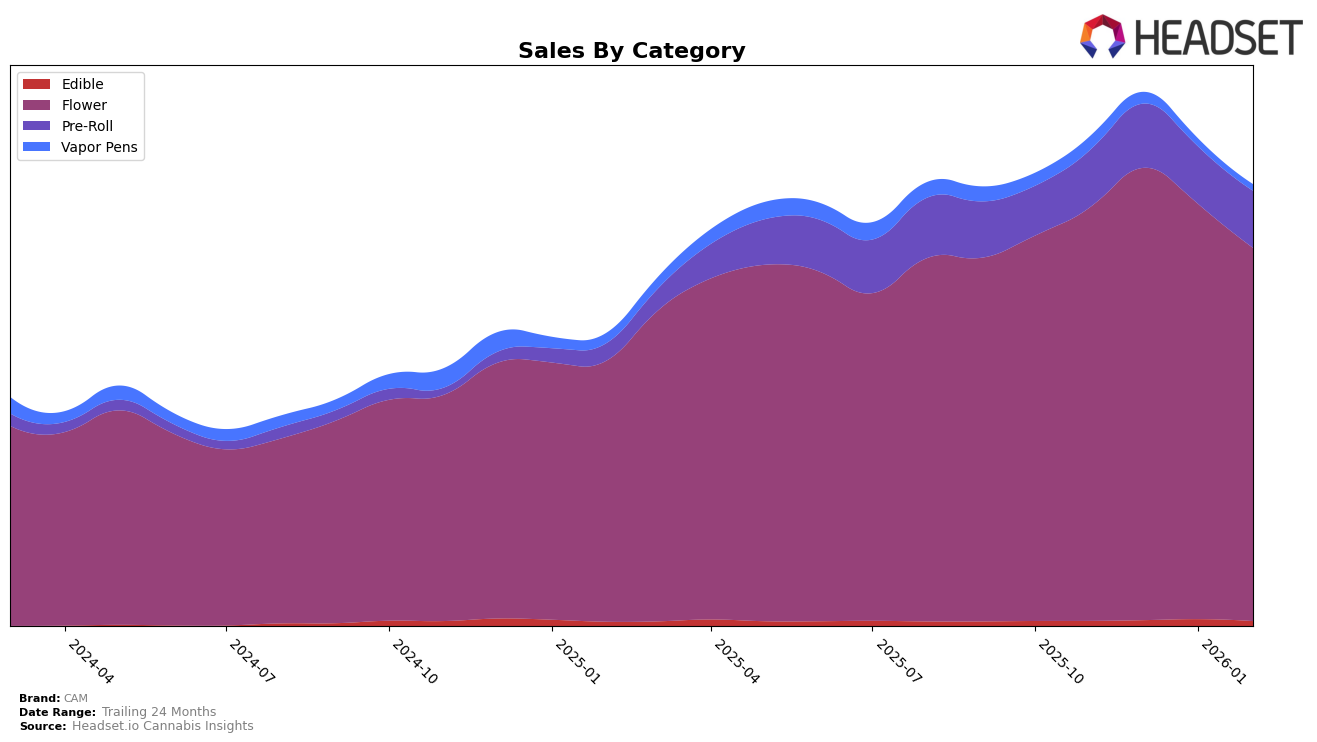

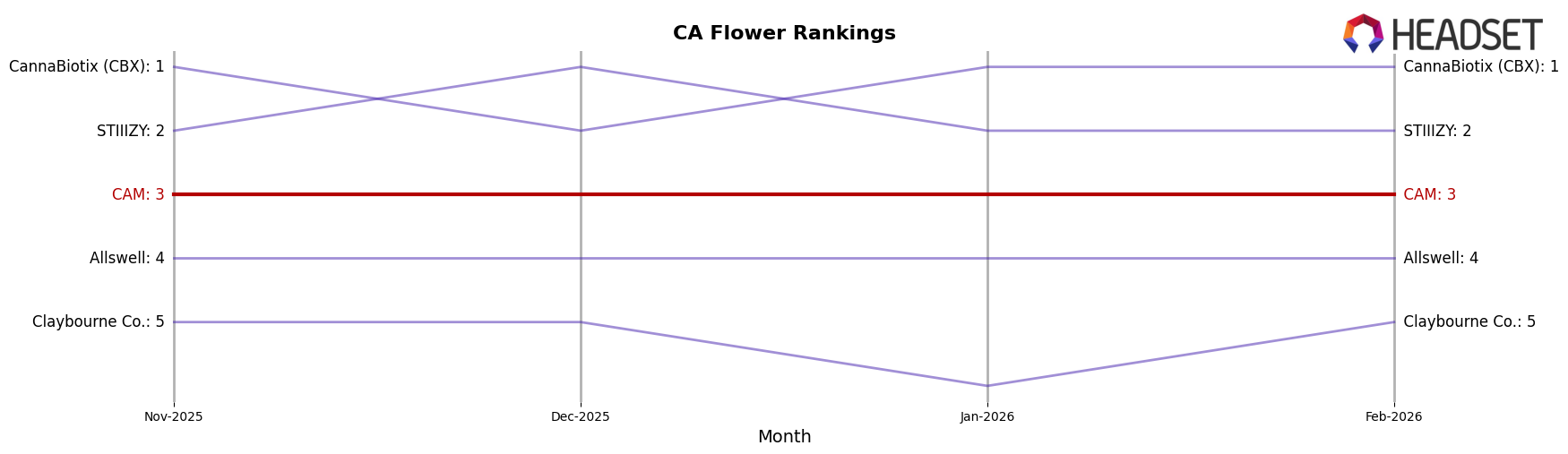

In California, CAM has consistently maintained a strong presence in the Flower category, holding a steady rank of 3rd place from November 2025 through February 2026. This consistency highlights CAM's solid footing in one of the most competitive cannabis markets. In contrast, their performance in the Pre-Roll category shows some fluctuations, with rankings oscillating between 19th and 21st place over the same period. Interestingly, CAM's presence in the Vapor Pens category in California has not been as strong, with the brand slipping out of the top 30 after December 2025, indicating potential challenges or shifts in consumer preferences that might be worth exploring further.

Turning to New York, CAM's performance in the Flower category has seen a downward trend, dropping from 25th place in November 2025 to 38th place by February 2026. This decline could suggest increasing competition or changing consumer tastes in the New York market. The absence of CAM in the top 30 for other product categories in New York might point to a more focused strategy on Flower or perhaps a need to diversify their product offerings to capture a broader audience. These movements provide a glimpse into the brand's strategic positioning and market challenges, offering a foundation for deeper analysis into CAM's market dynamics and potential areas for growth.

Competitive Landscape

In the competitive landscape of the California flower category, CAM consistently held the third rank from November 2025 to February 2026, demonstrating a stable market position amidst fluctuating sales trends. During this period, CannaBiotix (CBX) and STIIIZY alternated between the first and second positions, with CannaBiotix (CBX) reclaiming the top spot in January 2026. Despite CAM's stable rank, its sales showed a downward trend from December 2025 to February 2026, which could be attributed to the competitive pressure from the top two brands. Meanwhile, Claybourne Co. and Allswell maintained their positions at fourth and fifth, respectively, indicating a clear tiered structure in the market. CAM's ability to maintain its rank despite these challenges highlights its resilience and the potential need for strategic adjustments to enhance its sales performance in the competitive California market.

Notable Products

In February 2026, CAM's top-performing product was Private Reserve - Bubba's Girl (3.5g) in the Flower category, maintaining its number one rank consistently from previous months with sales of 12,180 units. Bubba's Girl Pre-Roll (1g) held steady at the second position in the Pre-Roll category, showing a consistent upward trend from fifth place in November 2025. The newly introduced Cam Pop Pre-Roll (1g) debuted at the third rank, indicating a strong market entry. Scotties Cake (3.5g) in the Flower category experienced a slight drop to fourth place after peaking in January 2026 at third. Kosher Kush Pre-Roll (1g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.