Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

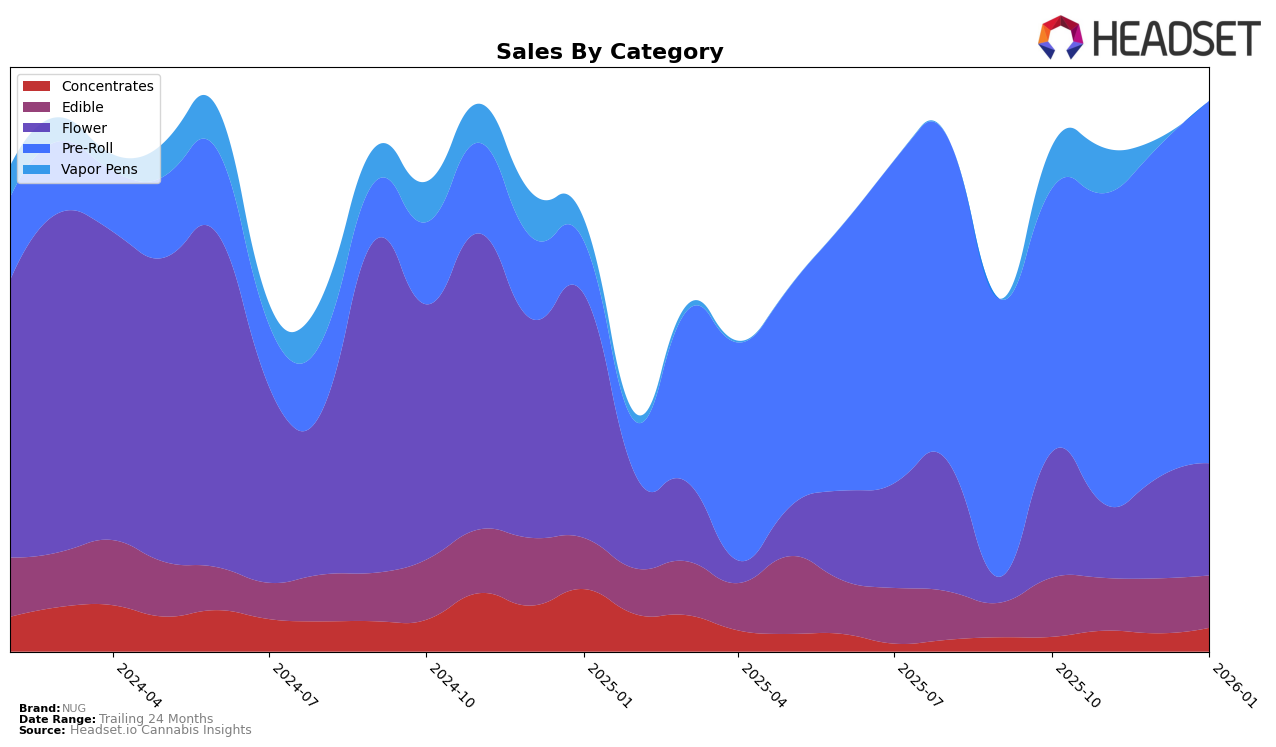

In the California market, NUG has shown varied performance across different product categories. In the Pre-Roll category, NUG has demonstrated a positive trend, climbing from the 41st position in October 2025 to the 27th position by January 2026, indicating a strengthening presence in this segment. Conversely, in the Edible category, NUG's ranking remained stagnant at the 37th position over the same period, suggesting a stable yet unremarkable performance. This consistency in ranking could be interpreted as a lack of significant growth or decline in their edible product line, which might warrant strategic adjustments to bolster their standing in this category.

Looking at Oregon, NUG's presence in the Concentrates category has been somewhat inconsistent. While they were not ranked in October and December 2025, they did achieve a 70th position in November 2025 and improved to the 58th position by January 2026. This fluctuation highlights potential volatility in their market presence or consumer demand in Oregon for concentrates. The absence from the top 30 in multiple months could be seen as a challenge for NUG, suggesting that while there are opportunities for growth, there is also a need for a focused strategy to stabilize and enhance their performance in this region.

Competitive Landscape

In the competitive landscape of the California pre-roll category, NUG has shown a promising upward trajectory in terms of rank and sales from October 2025 to January 2026. Initially ranked 41st in October, NUG climbed to 27th by January, indicating a significant improvement in market position. This upward movement contrasts with competitors like Raw Garden and Coastal Sun Cannabis, who experienced fluctuations and a general decline in their rankings over the same period. Notably, Fig Farms and Almora Farms maintained relatively stable positions, with Fig Farms slightly improving from 28th to 25th. NUG's consistent sales growth, culminating in a 37,566 increase from December to January, suggests a strengthening brand presence and consumer preference, positioning it as a rising contender amidst established competitors.

Notable Products

In January 2026, the Indica Pre-Roll (1g) emerged as the top-performing product for NUG, climbing to the first position with sales reaching 12,549 units. Previously holding the second spot consistently from October to December 2025, it overtook the Sativa Pre-Roll (1g), which dropped to second place. The Hybrid Pre-Roll (1g) maintained its steady third position throughout the months. The Indica Pre-Roll 5-Pack (5g) remained in fourth place, showing a gradual increase in sales. Notably, the Hybrid Pre-Roll 5-Pack (5g) stabilized in the fifth rank after being introduced to the ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.