Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

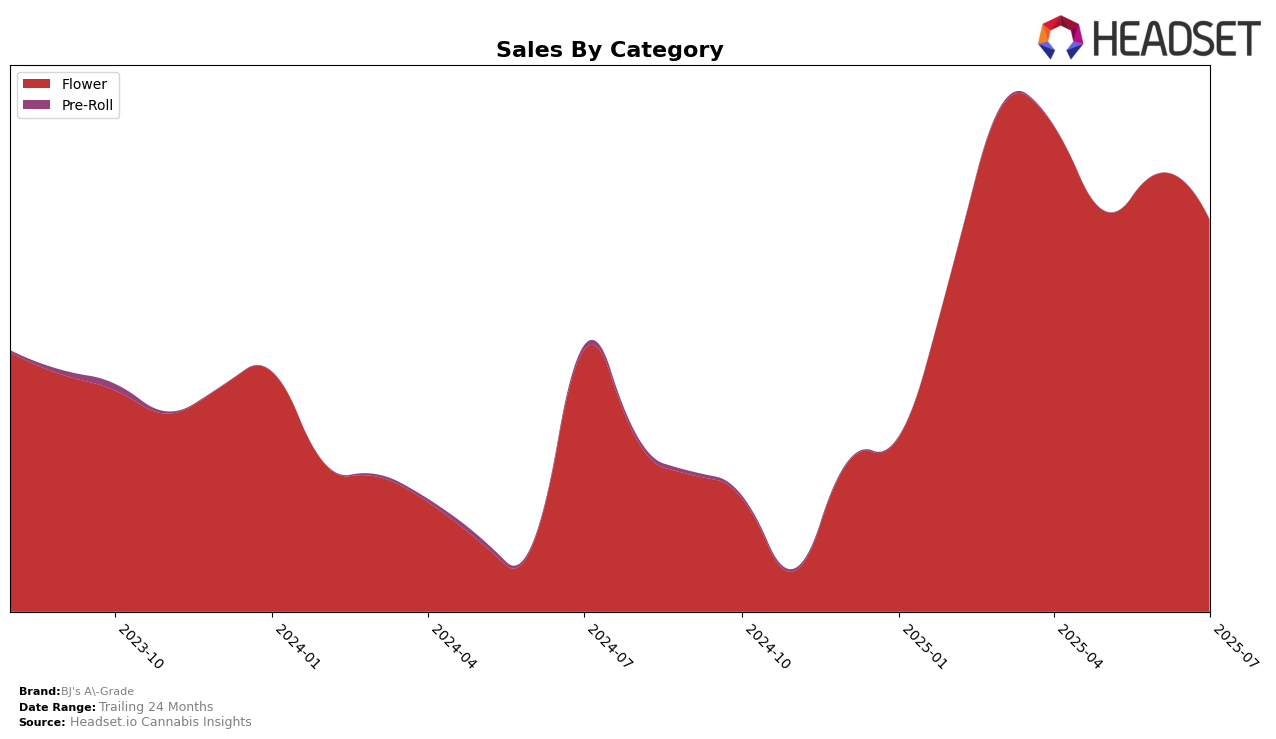

In the state of Oregon, BJ's A-Grade has shown a fluctuating performance in the Flower category over the months from April to July 2025. The brand maintained a presence in the top 30, with its ranking oscillating between 24th and 30th place. April and June witnessed BJ's A-Grade securing the 24th position, indicating a consistent demand during these months. However, May saw a dip to the 29th spot, followed by a further decline to 30th in July. This downward trend in the latter months might suggest increasing competition or shifts in consumer preferences within the Flower category in Oregon.

Sales figures for BJ's A-Grade in Oregon reveal some interesting insights. While April saw the highest sales at $259,374, there was a noticeable decline in May, with sales dropping to $213,653. June experienced a slight recovery, with sales climbing back up to $233,720, yet July's figures fell again to $209,334. The brand's ability to remain in the top 30 despite these fluctuations highlights a resilient market presence, although the drop in ranking in July could be a signal for the brand to reassess its strategies in the Flower category in Oregon. The absence of BJ's A-Grade from the top 30 in any other state or category during this period may indicate a concentrated market focus or potential growth opportunities elsewhere.

Competitive Landscape

In the competitive landscape of the Oregon flower category, BJ's A-Grade has experienced fluctuating rankings, indicating a dynamic market position. Over the past few months, BJ's A-Grade has seen its rank vary from 24th in April and June to 29th in May and dropping to 30th in July. This volatility suggests a competitive pressure from brands like Cultivated Industries, which maintained a stronger presence, ranking as high as 12th in May before falling out of the top 20 by July. Meanwhile, Dog House showed resilience by improving its rank from 35th in May to 29th in July, closely aligning with BJ's A-Grade's position. Additionally, emerging brands such as Alta Gardens have shown significant upward momentum, moving from 99th in April to 46th by July, potentially posing a future threat to BJ's A-Grade's market share. This competitive environment underscores the need for BJ's A-Grade to strategize effectively to maintain and improve its market position amidst evolving consumer preferences and brand performances.

Notable Products

In July 2025, the top-performing product from BJ's A-Grade was Apple Tart (14g) in the Flower category, maintaining its leading position from June with sales reaching 4028 units. White Widow (Bulk) climbed to second place, up from fifth in June, showing a significant increase in popularity. Perm Marker (Bulk) debuted in the rankings at third place, indicating a strong market entry. Sinsi Star (Bulk) followed closely in fourth place, while Purple Train Wreck (Bulk) rounded out the top five. Notably, Apple Tart (14g) saw a notable sales increase from the previous month, highlighting its continued consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.