Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

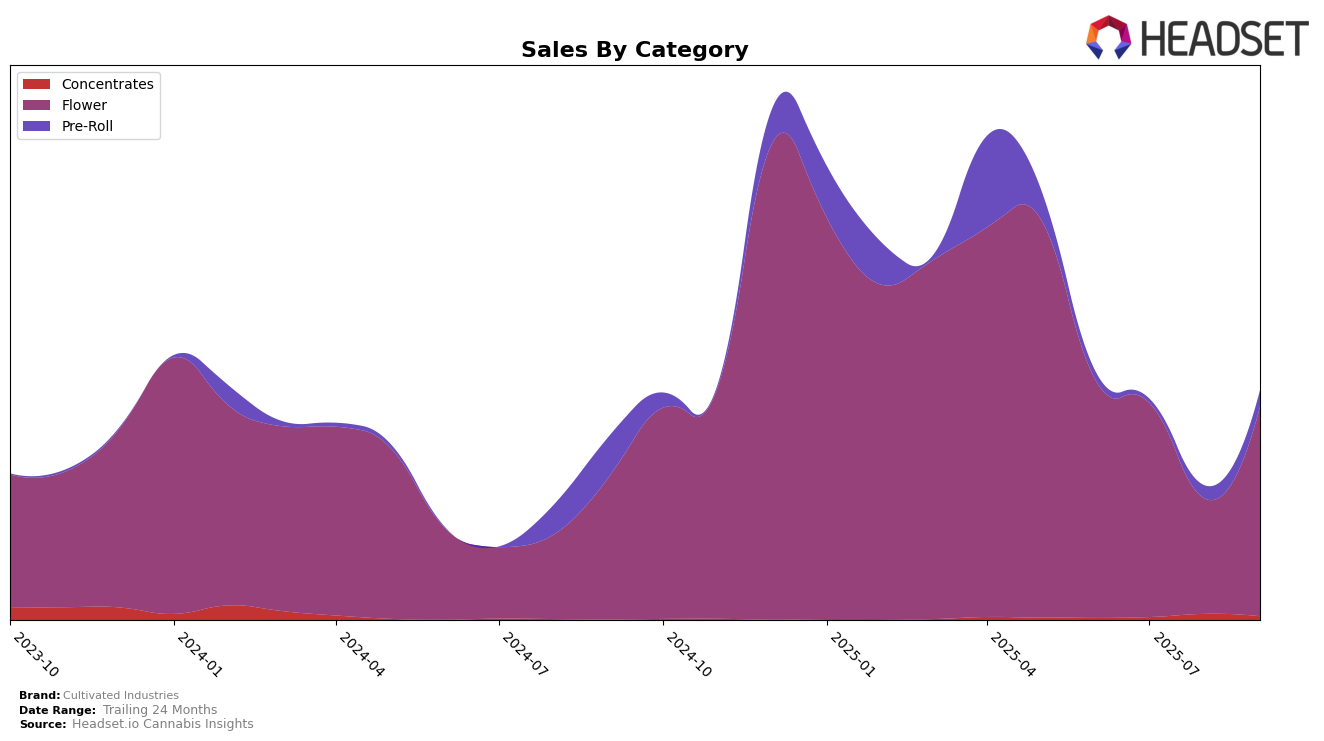

In the state of Oregon, Cultivated Industries has demonstrated fluctuating performance across different cannabis categories. Specifically, in the Flower category, the brand experienced a notable dip in rankings from June to August 2025, dropping from 24th to 53rd before recovering to 25th in September. This indicates a potential volatility in consumer preference or market competition. Despite this ranking fluctuation, the sales figures reveal a recovery in September, suggesting a positive response to either market conditions or strategic adjustments by the brand. In contrast, their presence in the Pre-Roll category was absent from the top 30 until August, when they entered at 91st and subsequently improved to 78th by September, reflecting a potential growth area for the brand in this category.

While the Flower category shows some signs of stabilization for Cultivated Industries in Oregon, the brand's performance in the Pre-Roll category suggests room for growth and increased market penetration. The absence from the top 30 rankings in earlier months highlights a challenge or a strategic focus on other categories, but the recent upward trend indicates a promising opportunity for expansion. This mixed performance across categories underscores the importance for Cultivated Industries to continually adapt to market dynamics and consumer preferences to maintain and improve their competitive standing in the cannabis market.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Cultivated Industries has experienced notable fluctuations in its market position from June to September 2025. Initially ranked 24th in June, the brand saw a dip to 30th in July and further to 53rd in August, before recovering to 25th in September. This volatility contrasts with the more stable performance of competitors like Alter Farms, which improved its rank from 38th in June to 23rd by September, and NUGZ FARM - Oregon, which maintained a relatively consistent ranking, ending at 24th in September. Meanwhile, Garden First and Midnight Fruit Company have also shown competitive resilience, with Garden First maintaining a higher rank than Cultivated Industries throughout the period. Despite Cultivated Industries' sales decline from June to August, the brand's rebound in September suggests potential for recovery, though it remains crucial for them to address the competitive pressures from these steadily performing peers.

Notable Products

In September 2025, Tokyo Snow Bulk maintained its position as the top-performing product for Cultivated Industries, with notable sales reaching 6,121 units. Strawberry Diesel OG Pre-Roll 1g also held steady in second place, showing consistent demand over the months. Artificial Candy Bulk entered the rankings in September, securing the third position. Tropicana Cherries B-Bud 3.5g and Alpha Mule 3.5g rounded out the top five, ranking fourth and fifth respectively. This marks a stable performance for Tokyo Snow and Strawberry Diesel OG, while Artificial Candy and Tropicana Cherries emerged as strong contenders in the product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.