Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

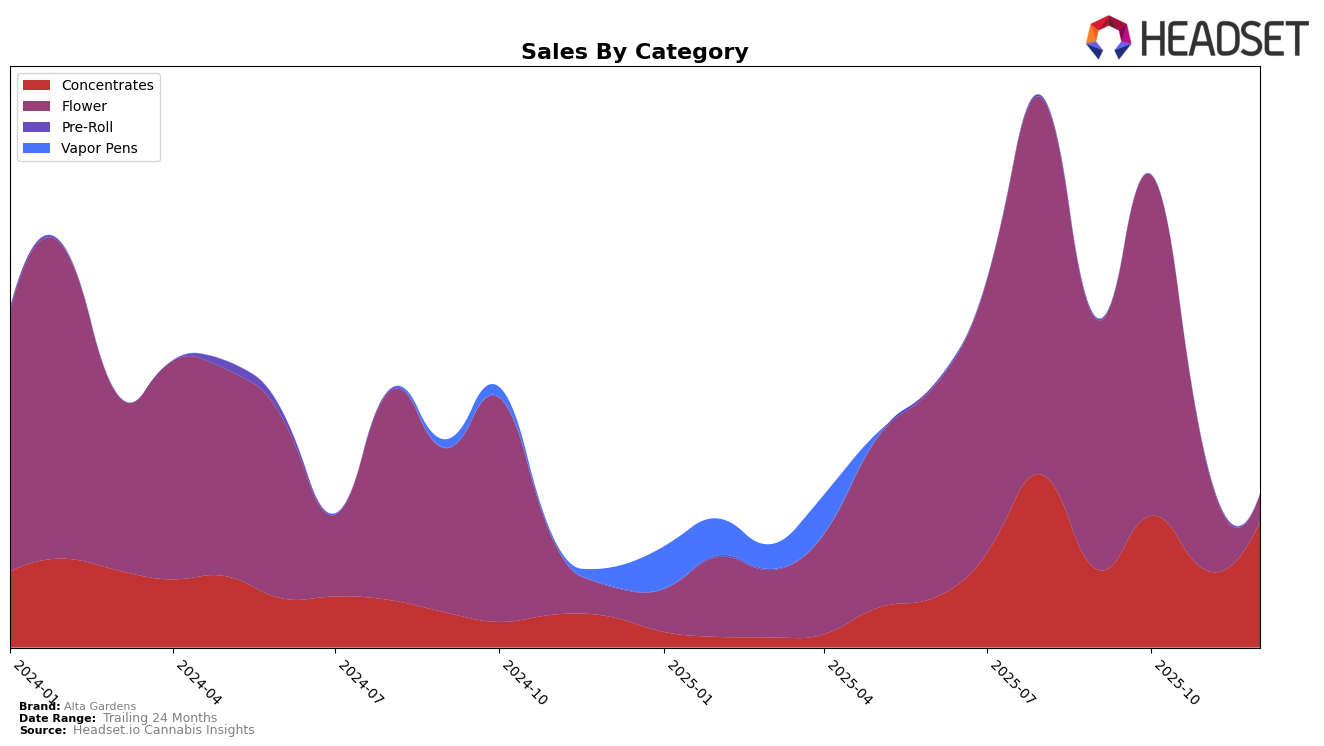

In the state of Oregon, Alta Gardens has shown a notable performance in the Concentrates category. In October 2025, the brand achieved a significant leap into the 26th position from a previous 37th in September, indicating a positive reception among consumers. However, November saw a slip back to 39th, before recovering to 29th in December. This fluctuation suggests a competitive market where Alta Gardens is managing to maintain a presence, albeit with some volatility. The sales figures in October, reaching $67,050, highlight a peak in consumer demand during that month, which could be attributed to strategic marketing efforts or seasonal trends.

When examining the Flower category in Oregon, Alta Gardens experienced more challenges. While the brand improved its ranking from 47th in September to 39th in October, the subsequent drop to 90th in November and absence from the top 30 in December underscore a tougher market landscape. The absence from the rankings in December is a critical point, indicating potential areas for improvement in either product offering or market strategy. Despite this, the Flower category sales in October were robust, with $174,128 in revenue, suggesting that while rankings fluctuated, there was still a significant consumer interest during the fall months.

Competitive Landscape

In the competitive landscape of concentrates in Oregon, Alta Gardens has shown a dynamic performance in the latter months of 2025. Starting from a rank of 37th in September, Alta Gardens made a significant leap to 26th in October, indicating a strong upward momentum in sales performance. However, this was followed by a slight dip to 39th in November, before recovering to 29th in December. This fluctuation suggests a volatile market presence, possibly influenced by seasonal demand or promotional activities. In comparison, Dirty Arm Farm and Willamette Valley Alchemy maintained relatively stable ranks, with Dirty Arm Farm notably absent from the top 20 throughout these months. Meanwhile, Sand Castle Hash Co. and Covert Extraction consistently outperformed Alta Gardens, maintaining positions within the top 30, highlighting a competitive edge in market share. These insights underscore the need for Alta Gardens to strategize on maintaining consistency and capitalizing on growth opportunities to enhance its market position.

Notable Products

In December 2025, Alta Gardens' top-performing product was Good Burger Cured Resin (1g) in the Concentrates category, achieving the highest sales with 949 units sold. Following closely was Cuban Affair Cured Resin (1g), securing the second position. Illuminati OG Cured Resin (1g) ranked third, while Oregon Gushers Cured Resin (1g) and College Park Cured Resin (1g) occupied the fourth and fifth positions, respectively. Notably, all these products were not ranked in the previous months, indicating a significant rise in popularity and sales for December. This surge highlights a strong market demand for Alta Gardens' Concentrates products during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.