Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

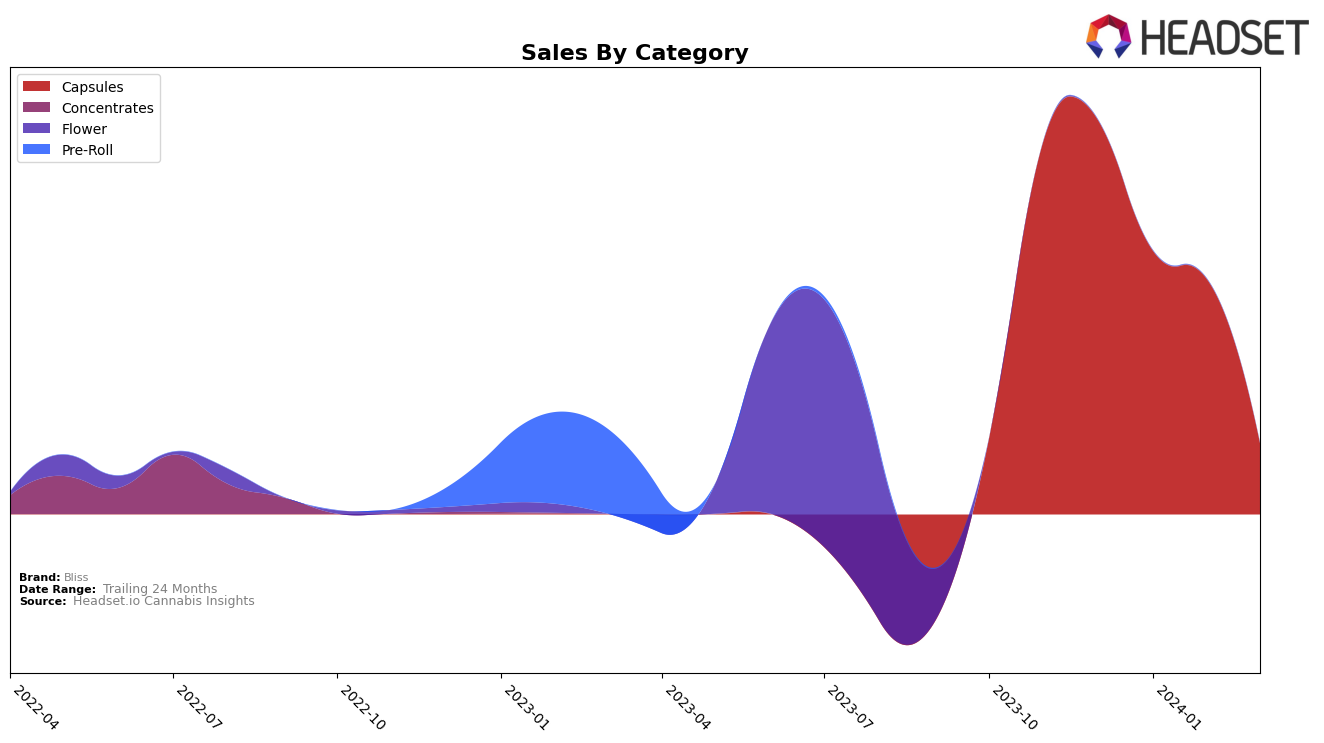

In the Ohio market, Bliss has shown a fluctuating yet noteworthy presence within the capsules category. Beginning with a strong position at rank 5 in December 2023, the brand experienced a slight decline moving into January 2024, dropping to the 8th spot. This trend of fluctuation continued into February, where Bliss managed to climb two ranks up to position 6, indicating a potential rebound. However, March 2024 saw a significant dip, with Bliss falling to the 10th rank. This trajectory suggests that while Bliss maintains a top 10 presence, its position is not solidified, and the brand faces challenges in sustaining or improving its rank consistently. Notably, the sales figures reflect this volatility, with a notable decrease from December's sales of $8,689 to March's $1,559, highlighting a potential area of concern for the brand's performance in the capsules category within Ohio.

The performance of Bliss in Ohio's capsules market is a tale of ups and downs. The initial strong positioning in December suggests a good market fit or possibly effective promotional activities during that period. However, the subsequent decline in rank and sales indicates that Bliss might be facing stiff competition or experiencing challenges in maintaining consumer interest and loyalty. The absence from the top 30 brands in any given month, which did not occur for Bliss during this period, would have been a significant setback, so maintaining a position within the top 10, despite the decline, is still a positive. This performance could signal the need for strategic adjustments or increased marketing efforts to bolster Bliss's market share and consumer base in Ohio. The detailed movements across the months also offer a rich ground for analysis on consumer behavior and market dynamics specific to the capsules category, which could be crucial for Bliss's strategy going forward.

Competitive Landscape

In the competitive landscape of the capsules category within the Ohio market, Bliss has experienced a notable fluctuation in its ranking and sales over the recent months. Initially positioned at 5th in December 2023, Bliss saw a decline to 8th in January 2024, a slight improvement to 6th in February, before dropping to 10th in March 2024. This trajectory indicates a challenging period for Bliss, especially when compared to its competitors. For instance, Ananda Bliss, despite a similar starting rank, managed to maintain a more stable performance, ending up at 8th in March with a significant increase in sales. On the other hand, Müv / MUV and One Orijin also saw variations in their rankings but did not exhibit the same level of sales decline as Bliss. Notably, Ancient Roots entered the rankings in March at 11th, indicating a competitive market with new entrants. The fluctuating rankings and the diverse performance of competitors underscore the dynamic nature of the Ohio capsules market, posing both challenges and opportunities for Bliss.

Notable Products

In March 2024, Bliss's top-selling product was CBD/THC 1:1 Calm Chaga Mushroom Capsules 22-Pack (110mg CBD, 110mg THC) from the Capsules category, maintaining its top position from February with 31 units sold. Following closely, THC/CBN 1:1 Ananda Night Reishi Mushroom Vegan Capsules 11-Pack (110mg THC, 110mg CBN) also held its previous month's rank at second. The third place was secured by Boost Vegan Capsules 22-Pack (60mg CBD, 110mg THC), which experienced a drop from being the top product in January to third place in March. Notably, the sales figures for these top products indicate a significant shift in consumer preference, with the leading product experiencing a decrease in sales from previous months. This summary highlights Bliss's dynamic product performance and shifting consumer interests within the Capsules category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.