Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

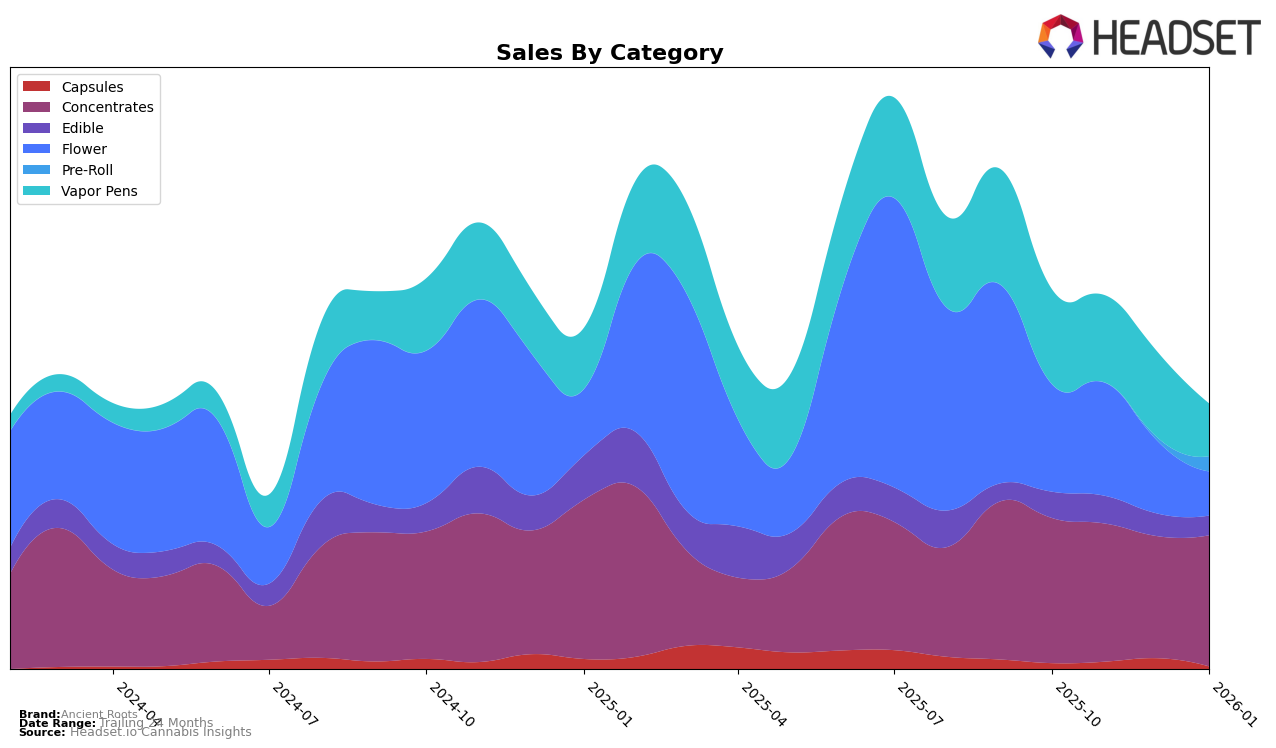

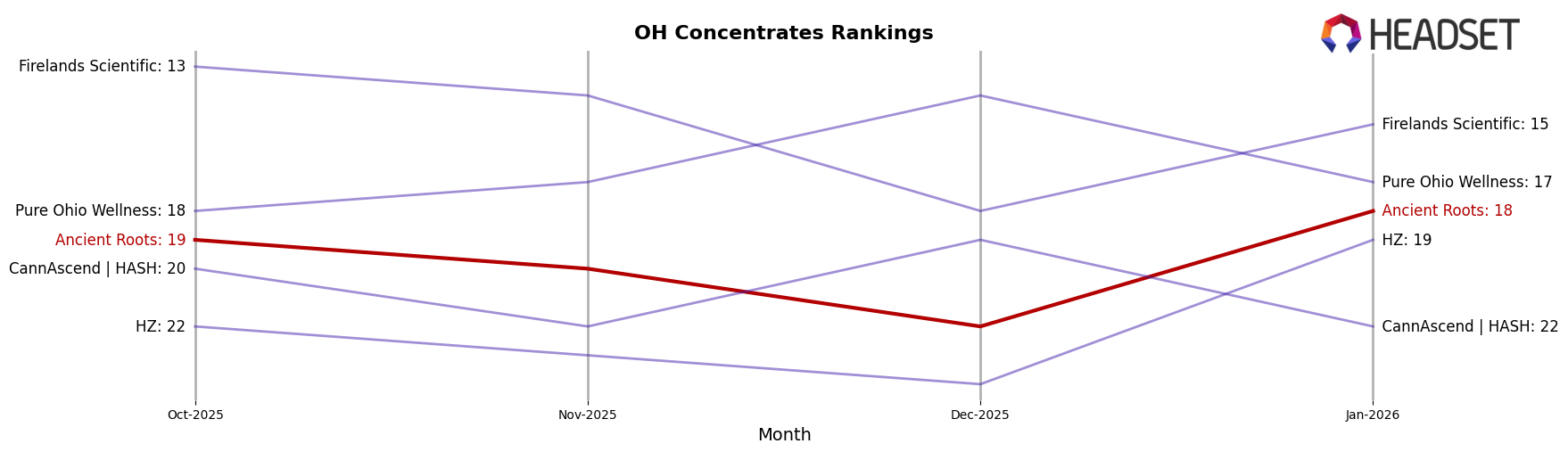

Ancient Roots has demonstrated a varied performance across different product categories in Ohio. In the Concentrates category, the brand has shown resilience, maintaining a steady presence within the top 30 rankings. Specifically, they moved from the 19th position in October 2025 to the 18th position by January 2026, despite fluctuations in sales figures. This upward movement in rankings, even with a dip in sales during November and December, indicates a competitive edge in the Concentrates market. On the other hand, the Flower category has been more challenging, with Ancient Roots consistently ranking outside the top 30, peaking at 61st in November 2025 before dropping further. This suggests a potential area for strategic improvement or re-evaluation of offerings to capture a larger market share.

The Vapor Pens category presents a similar narrative to Flower, with Ancient Roots struggling to break into the top 30 rankings in Ohio. The brand's position slipped from 66th in October 2025 to 72nd by January 2026, reflecting a need for innovation or marketing efforts to enhance visibility and sales. The downward trend in sales over these months further underscores the challenges faced in this category. However, the brand's ability to maintain its rank in the Concentrates category while experiencing setbacks in others could imply a focused strength that might be leveraged for future growth. This mixed performance across categories highlights both opportunities and challenges for Ancient Roots as they navigate the competitive landscape in Ohio.

Competitive Landscape

In the Ohio concentrates market, Ancient Roots has experienced fluctuating rankings, with a notable dip in December 2025 when it fell out of the top 20, only to recover to 18th place by January 2026. This fluctuation is significant when compared to competitors such as Firelands Scientific, which maintained a stronger presence, ranking consistently higher and achieving a peak in November 2025. Pure Ohio Wellness also outperformed Ancient Roots, particularly in December 2025, when it climbed to 14th place. Meanwhile, CannAscend | HASH and HZ have shown less stability, with CannAscend | HASH dropping out of the top 20 in November 2025 and HZ only re-entering the top 20 in January 2026. These dynamics suggest that while Ancient Roots faces strong competition, particularly from brands like Firelands Scientific, its ability to rebound in rankings indicates potential resilience and opportunities for strategic growth in the Ohio concentrates market.

Notable Products

In January 2026, the top-performing product for Ancient Roots was Cap Junk Pre-Roll 1g, securing the number one rank with sales of 208 units. Lemon Kush #2 2.83g maintained its position at rank two, consistent with its performance in the previous two months, despite a slight decrease in sales to 206 units. Lemon Kush #2 Pre-Roll 1g debuted at rank three, while Zweet Insanity 2.83g entered the rankings at position four. Cap Junk Cold Cure Live Rosin Badder 1g dropped from third place in December 2025 to fifth in January 2026, with sales declining to 103 units. This shift in rankings highlights a strong preference for pre-rolls among consumers in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.