Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

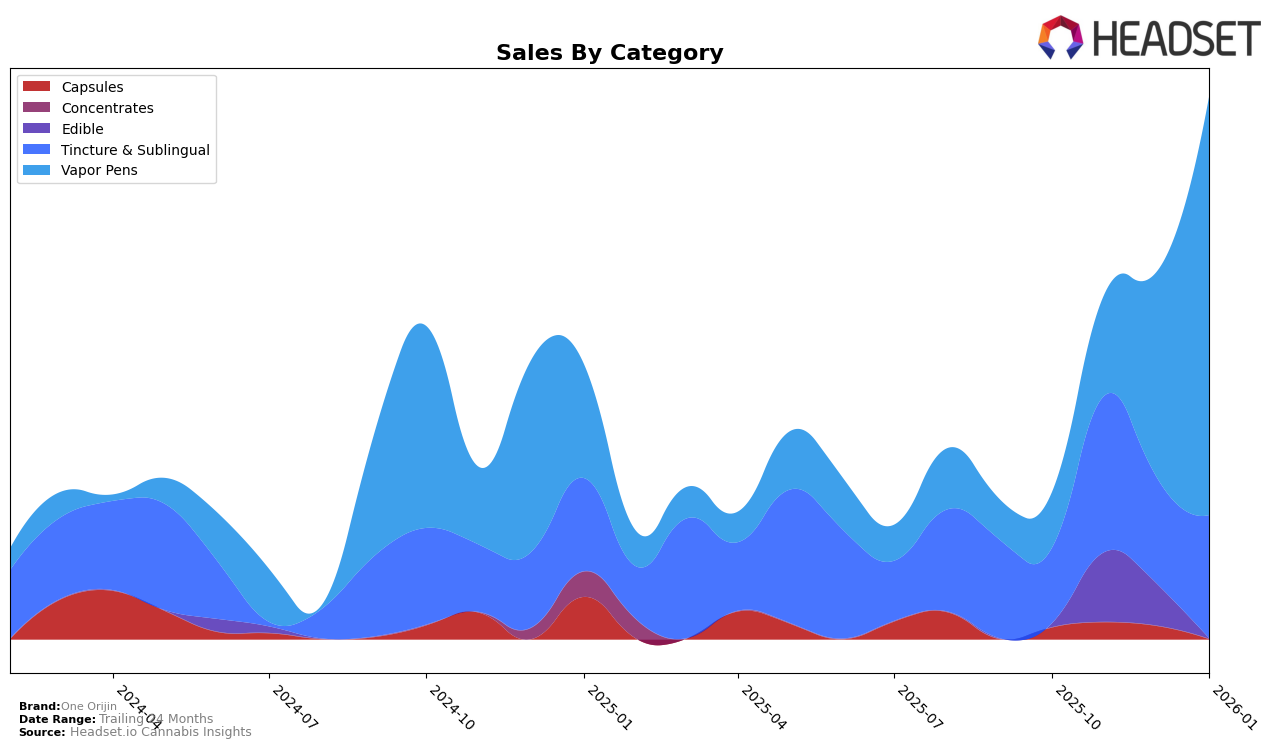

One Orijin's performance in the Vapor Pens category in Ohio has shown an upward trajectory from November 2025 to January 2026. Despite not being in the top 30 brands in October and November 2025, the brand entered the rankings at 77th place in December and improved to 68th by January 2026. This positive movement suggests a growing acceptance and popularity of One Orijin's products in the Ohio market. The sales figures support this trend, as there was a significant increase from December 2025 to January 2026, indicating a successful penetration into the market.

However, it's important to note that One Orijin's presence in other states or categories is not captured in the available data, which might imply limited reach or focus outside of Ohio for the Vapor Pens category. The absence of rankings in other states or categories could be seen as an area for potential growth, or it might reflect a strategic decision to concentrate efforts in specific markets. This concentrated performance in Ohio might serve as a case study for their strategy, offering insights into how they could replicate success in other regions or categories.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, One Orijin has shown a notable upward trajectory in its ranking, moving from not being in the top 20 in October and November 2025 to securing the 77th position in December 2025 and further improving to 68th in January 2026. This positive shift in rank indicates a significant increase in sales momentum, with January sales doubling compared to December. In contrast, competitors like Nectar experienced a decline, dropping from 51st in October to 67th in January, alongside a substantial decrease in sales. Similarly, Ancient Roots fell from 66th to 72nd over the same period. Meanwhile, Tyson 2.0 and HZ have maintained relatively stable positions, with slight fluctuations. These dynamics suggest that One Orijin is gaining traction in the Ohio vapor pen market, potentially capturing market share from its competitors.

Notable Products

In January 2026, the Sour Diesel Distillate Cartridge (1g) maintained its top position in sales for One Orijin, with a notable increase to 388 units sold. The Pineapple Cake Distillate Cartridge (0.8g) debuted strongly, securing the second rank. The CBD/THC 1:1 4 Day Tincture (440mg CBD, 440mg THC, 30ml) slipped to third place after holding the second rank for the previous two months. Grape Krush Distillate Cartridge (1g) improved its position, moving up to fourth rank from fifth in December 2025. The CBD/THC 20:1 CBD Tincture (2200mg CBD, 110mg THC, 30ml) entered the rankings at fifth position, despite lower sales figures compared to October and November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.