Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

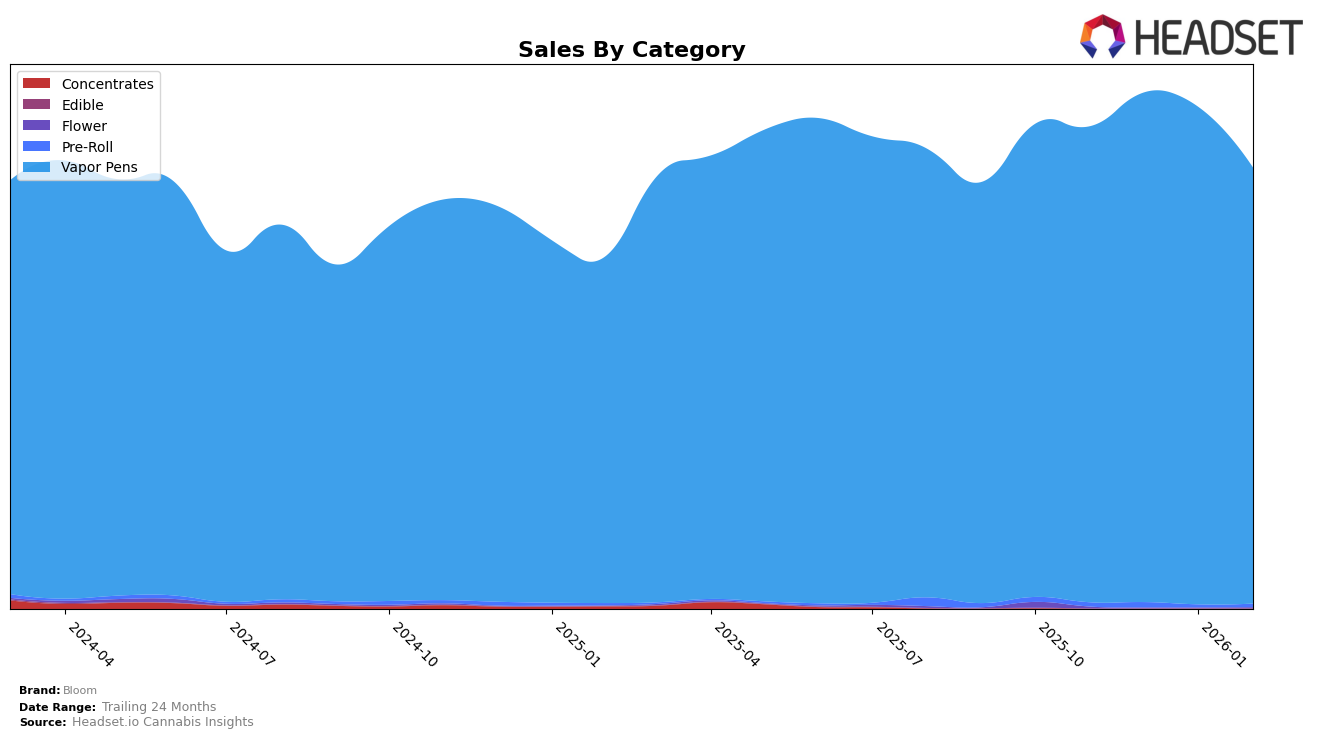

Bloom's performance in the Vapor Pens category showcases a varied trajectory across different states. In California, Bloom has maintained a consistent presence, hovering around the 14th position over the past few months, despite a notable drop in sales from January to February 2026. In contrast, Illinois has shown a stable ranking for Bloom, consistently holding the 10th spot, indicating a steady market presence. Meanwhile, Maryland reflects a more dynamic movement, where Bloom climbed from an unranked position in November 2025 to the 14th position by January 2026, before slightly dropping again in February. This indicates a growing recognition and consumer interest in the brand within the state.

Other states, such as Michigan, present a more challenging environment for Bloom, where the brand did not make it into the top 30 ranks in the latest months of the dataset, suggesting potential market penetration issues. In New Jersey, Bloom's rankings have fluctuated, with a noticeable drop to 15th place in January 2026, before recovering to the 10th position in February. This volatility might reflect changing consumer preferences or competitive pressures. Similarly, in New York, Bloom has seen a gradual improvement in its rankings, moving from 28th to 22nd place over the months, although it slightly dipped back to 25th in February, indicating an overall positive trend but with some competitive challenges.

Competitive Landscape

In the competitive landscape of vapor pens in California, Bloom has shown a steady presence, maintaining its rank within the top 15 over the past few months. Notably, Bloom improved its rank from 15th in November 2025 to 13th in January 2026, before slightly dipping back to 14th in February 2026. This fluctuation in rank is indicative of a dynamic market where competitors like West Coast Cure consistently hold a stronger position at 12th place, reflecting higher sales figures. Meanwhile, Papa's Herb made a significant leap from 17th to 13th in February 2026, suggesting a potential threat to Bloom's position. Clsics and Dabwoods Premium Cannabis have also been close competitors, with Clsics experiencing a similar rank fluctuation and Dabwoods maintaining a consistent presence just behind Bloom. These dynamics highlight the competitive pressures Bloom faces, necessitating strategic adjustments to bolster its market position and sales performance in the California vapor pen category.

Notable Products

In February 2026, Bloom's top-performing product was the Classic - Maui Wowie Live Resin Surf Disposable (1g) in the Vapor Pens category, maintaining its number one rank for two consecutive months, with sales of 6185. The Classic - Pineapple Express Live Resin Surf Disposable (1g) held the second position, showing a consistent presence in the top three since November 2025. The Classic - Apricot Punch BDT Distillate Disposable (0.5g) climbed to third place from fourth in January 2026, indicating a positive sales trend. Notably, the Classic - Blue Dream Live Resin Surf Disposable (1g) emerged as a new contender, debuting at fourth place. Meanwhile, the Maui Wowie Distillate Disposable (1g) fell to fifth position, having fluctuated in rankings over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.