Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

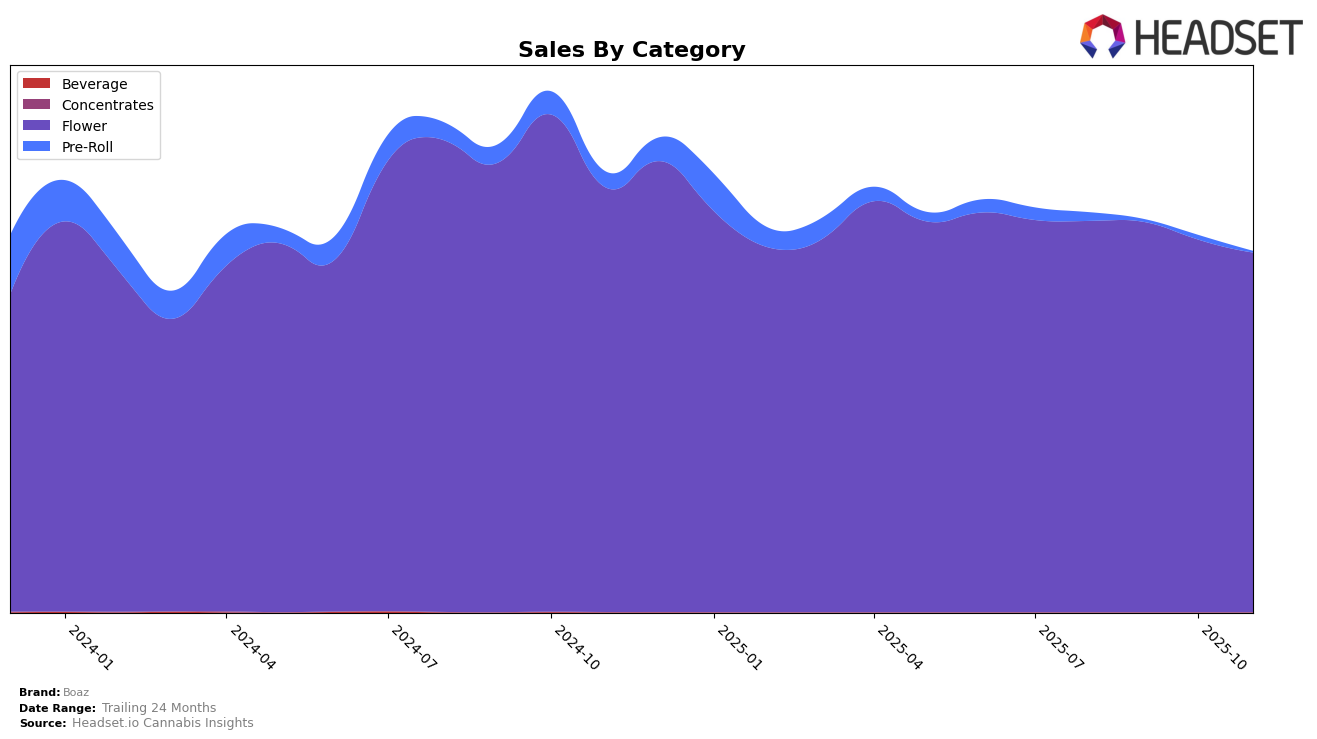

In the province of Alberta, Boaz has shown a consistent presence in the Flower category, fluctuating between the 28th and 32nd ranks over the past few months. While not always maintaining a top 30 position, their ability to re-enter the rankings in September and November indicates a resilience in the competitive market. Despite a slight decline in sales from August to November, the brand's ability to bounce back into the top 30 suggests strategic adjustments or market responses that could be worth exploring further.

The performance of Boaz in Alberta highlights some challenges and opportunities in the Flower category. The brand's absence from the top 30 in August and October suggests volatility, which could be attributed to various market dynamics or internal brand strategies. However, their reappearance in the rankings in September and November is a positive indicator, hinting at potential market share recovery or successful promotional efforts. Observing Boaz's strategy in the upcoming months could provide insights into their competitive tactics in Alberta's cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Boaz has experienced fluctuations in its rank, moving from 32nd in August 2025 to 28th in September, back to 32nd in October, and again to 28th in November. This pattern indicates a consistent struggle to maintain a stable position within the top 30. In contrast, RIPPED demonstrated a more favorable trajectory, ranking 30th in August and improving to 26th by November, suggesting a stronger market presence. Meanwhile, Common Ground showed a notable improvement from 35th in August to 29th in November, reflecting a positive trend in sales performance. On the other hand, Natural History saw a decline from 26th in August to 30th in November, indicating potential challenges in maintaining its market share. The dynamic shifts among these competitors highlight the competitive pressures Boaz faces, necessitating strategic adjustments to enhance its market position and sales performance in the Alberta Flower category.

Notable Products

In November 2025, Windmill Indica Milled (7g) emerged as the top-performing product for Boaz, regaining its position from August after a brief dip in the rankings. It recorded sales of 3198 units, reflecting a strong performance. Windmill Sativa Milled (7g), which held the top spot for the previous two months, ranked second, indicating a slight decrease in sales activity. Windmill Hybrid Milled (7g) consistently maintained its third position across all months, showing stable demand. The Pre-Roll categories, including Windmill Sativa and Indica Pre-Roll 2-Pack (1g), remained static at fourth and fifth places, respectively, with minimal sales fluctuations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.