Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

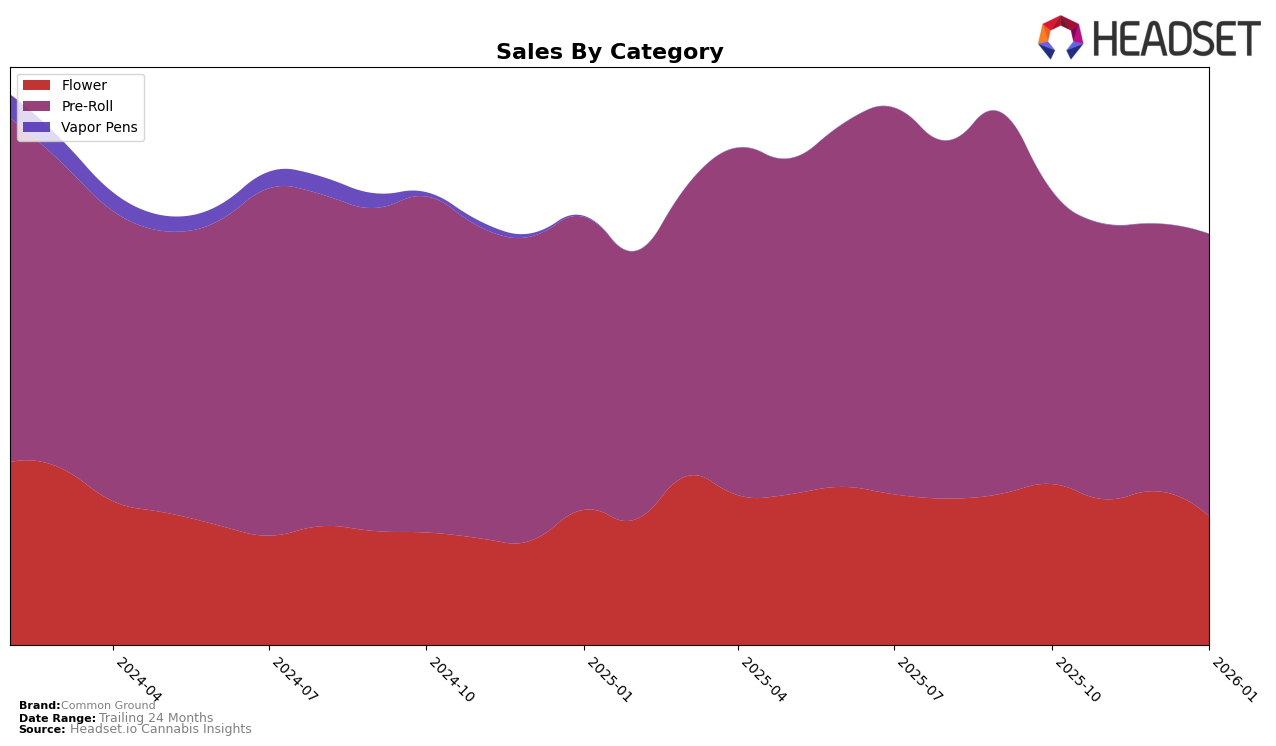

Common Ground's performance in the Alberta market has shown some fluctuations across different categories. In the Flower category, the brand has seen a mixed trajectory with a ranking of 26 in October 2025, dipping to 29 in November, climbing to 23 in December, and then falling back to 27 by January 2026. This indicates a volatile presence in the Flower market, where maintaining a consistent ranking seems challenging. Meanwhile, in the Pre-Roll category, Common Ground did not break into the top 30 until January 2026, when it reached a rank of 31, suggesting a potential upward trend that could be worth watching if it continues.

In British Columbia, Common Ground's Pre-Roll category showed a notable improvement, jumping from a rank of 60 in October 2025 to 28 by January 2026. This significant rise in rankings suggests a growing popularity or market penetration in the region. However, in Ontario, both the Flower and Pre-Roll categories have seen a decline in sales over the months, with the Flower category not making it into the top 50 rankings. This could indicate a need for strategic adjustments to regain market share in Ontario. Notably, in Saskatchewan, the Pre-Roll category saw Common Ground in the top 30 until December 2025, after which it did not rank, highlighting a potential area of concern for the brand in maintaining its position.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Common Ground has experienced a relatively stable yet challenging position over the recent months. From October 2025 to January 2026, Common Ground's rank fluctuated slightly, maintaining a position in the mid-40s, specifically from 42nd to 46th, indicating a consistent presence but also highlighting room for improvement in market penetration. Notably, competitors such as Shatterizer and BLKMKT have shown a similar downward trend in sales, with Shatterizer dropping from 37th to 48th and BLKMKT from 38th to 43rd, which could suggest a broader market contraction or increased competition. Meanwhile, Jays (Canada) briefly improved its rank in December 2025, suggesting potential volatility in consumer preferences. Despite the competitive pressures, Common Ground's consistent ranking indicates a loyal customer base, though the brand may need to innovate or adjust its strategies to climb higher in the rankings and increase sales in this competitive market.

Notable Products

In January 2026, Amherst Sour Diesel Pre-Roll 10-Pack (5g) retained its top position among Common Ground's products, maintaining its rank as number one from previous months with sales of 6991 units. Strawberry Pie Pre-Roll 5-Pack (2.5g) continued to hold the second rank, although its sales showed a slight decline. Pink Rozay Pre-Roll 2-Pack (2g) entered the rankings at third place, showing strong initial sales. Jelly Doughnutz Pre-Roll 10-Pack (5g) followed closely in fourth place, also debuting in the rankings this month. Strawberry Pie Milled (7g) experienced a drop to the fifth position, continuing its downward trend from October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.