Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

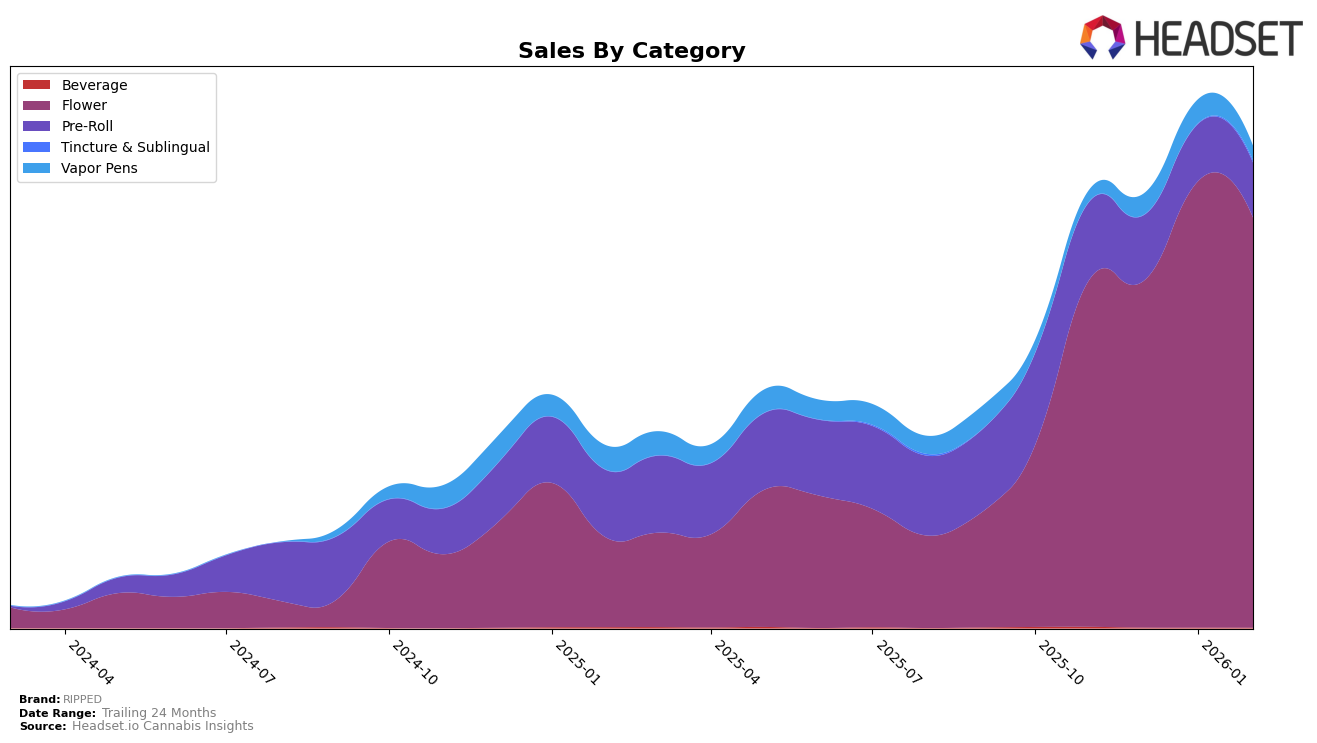

RIPPED has shown varied performance across different states and categories. In Alberta, the brand maintained a steady presence in the Flower category, ranking 21st in both January and February 2026 after a brief dip in December 2025. This indicates a recovery and stabilization in their market position. Meanwhile, in New York, RIPPED consistently held the 19th position in the Flower category for three consecutive months, underscoring a strong foothold in this market. In contrast, in Ontario, the brand experienced a gradual improvement in the Flower category rankings from 93rd in November 2025 to 78th by February 2026, suggesting a positive trend in consumer reception.

In the Vapor Pens category in Massachusetts, RIPPED's performance was less impressive, as they did not make the top 30 brands in November 2025 and showed only a slight improvement to 80th by January 2026. This indicates potential challenges in gaining traction in this category within the state. For the Pre-Roll category in Ontario, RIPPED's rankings hovered around the low 70s, with a slight improvement from 74th in December 2025 to 70th by February 2026. Despite the lower rankings, the brand's ability to maintain a presence suggests a steady demand. These insights provide a snapshot of RIPPED's market dynamics, revealing both strengths and areas for potential growth across different regions and product categories.

Competitive Landscape

In the competitive landscape of the Flower category in New York, RIPPED has maintained a consistent rank at 19th place from November 2025 through February 2026, indicating a stable market presence. Despite this consistency, RIPPED faces stiff competition from brands like Electraleaf, which consistently ranks higher, fluctuating between 16th and 18th place, and LivWell, which has seen a slight improvement in rank, moving from 15th to 17th place over the same period. Meanwhile, 1937 has shown a notable upward trend, climbing from 33rd to 20th place, potentially posing a future threat to RIPPED's market position. Although RIPPED's sales peaked in January 2026, they experienced a decline in February, which could be a concern if the trend continues, especially as competitors like Florist Farms have shown steady sales growth, maintaining a rank close to RIPPED at 21st place. These dynamics suggest that while RIPPED holds a stable rank, there is a need for strategic initiatives to bolster sales and counteract the rising competition.

Notable Products

In February 2026, the top-performing product for RIPPED was Rolls Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its position as the number one seller for four consecutive months with sales of 16,636 units. Blue Imagination Milled (7g) in the Flower category also held steady in the second position, reflecting consistent demand. Dutch Haze Infused Ground Flower (14g) showed a notable improvement, climbing to third place from fifth in January 2026, indicating a rising popularity. Electric Grape Infused Ground (14g) made a reappearance in the rankings, securing the fourth spot, suggesting a resurgence in interest. Sour x Papaya Milled (7g) experienced a drop to fifth place from its previous third position, possibly due to increased competition from other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.