Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

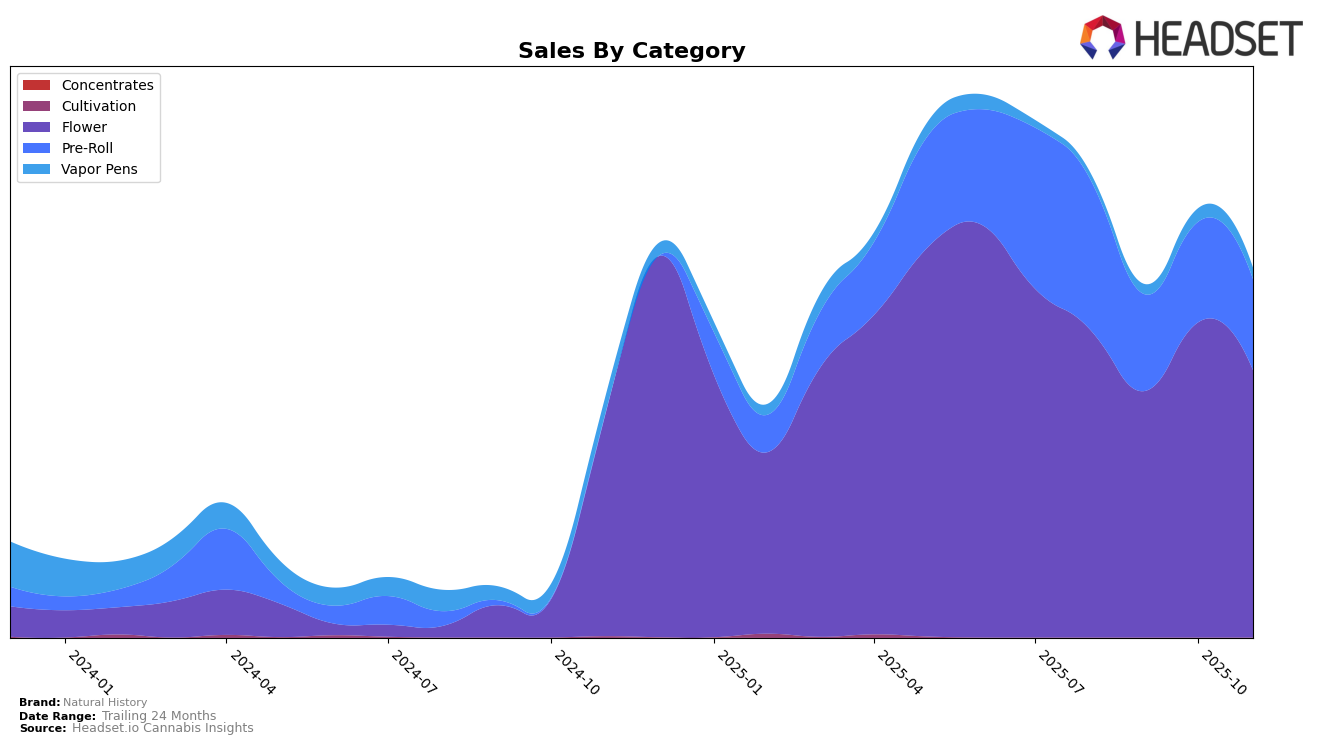

In the province of Alberta, Natural History has shown varied performance across different categories. In the Flower category, the brand has maintained a presence within the top 30 rankings, although it experienced fluctuations over the months. Starting at rank 26 in August 2025, it dropped to 34 in September, before climbing back to 28 in October and settling at 30 in November. This suggests a resilient market presence despite some variability. Notably, the brand's sales in the Flower category peaked in October, indicating a potential seasonal or promotional influence that month. However, its absence from the top 30 in the Pre-Roll category highlights a challenge, as the brand did not manage to break into the upper ranks, indicating room for improvement or strategic realignment in this segment.

Examining Natural History's performance in Alberta further, the Pre-Roll category presents a contrasting picture. With rankings consistently above the 60th position, the brand did not enter the top 30, suggesting a struggle to capture a significant share of this competitive market. The sales figures reflect a downward trend from August through November, which might indicate declining consumer interest or increased competition. This consistent lower ranking in the Pre-Roll category, coupled with decreasing sales, points to potential areas where Natural History could focus its efforts to enhance its market position. These insights into category-specific performance across the province offer a glimpse into the brand's strategic challenges and opportunities.

Competitive Landscape

In the competitive landscape of the flower category in Alberta, Natural History has experienced fluctuating rankings over the months from August to November 2025. Starting at rank 26 in August, the brand saw a dip to 34 in September, before recovering slightly to 28 in October and settling at 30 in November. This volatility in rank is contrasted by competitors such as Freedom Cannabis, which maintained a stronger position in August with a rank of 22 but experienced a significant drop to 33 by November. Meanwhile, Common Ground showed a more stable performance, improving from a rank of 35 in August to 29 in November. The sales figures for Natural History reflect this rank volatility, with a notable dip in September followed by a partial recovery in October. In comparison, Boaz and Tribal also demonstrated fluctuations in their rankings, indicating a competitive and dynamic market environment. These insights suggest that while Natural History is facing challenges in maintaining a consistent rank, there is potential for growth if the brand can capitalize on market trends and consumer preferences.

Notable Products

In November 2025, the top-performing product for Natural History was Limited Reserve - Rainbow Sherbert #11 (7g) in the Flower category, maintaining its number one rank consistently from August through November, with sales figures reaching 3433 units. The Limited Reserve Pre-Roll 2-Pack (2g) also held steady at the second position, showing strong performance across the months. Natural History Unlimited Blunts 3-Pack (1.5g) climbed back to the third position in November after a dip to fourth in October. LA Kush Cake (3.5g) made a notable entry in the rankings at fourth place, maintaining its position from October. The Limited Reserve Indica Pre-Roll 3-Pack (1.5g) remained consistent in fifth place, despite a gradual decrease in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.