Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

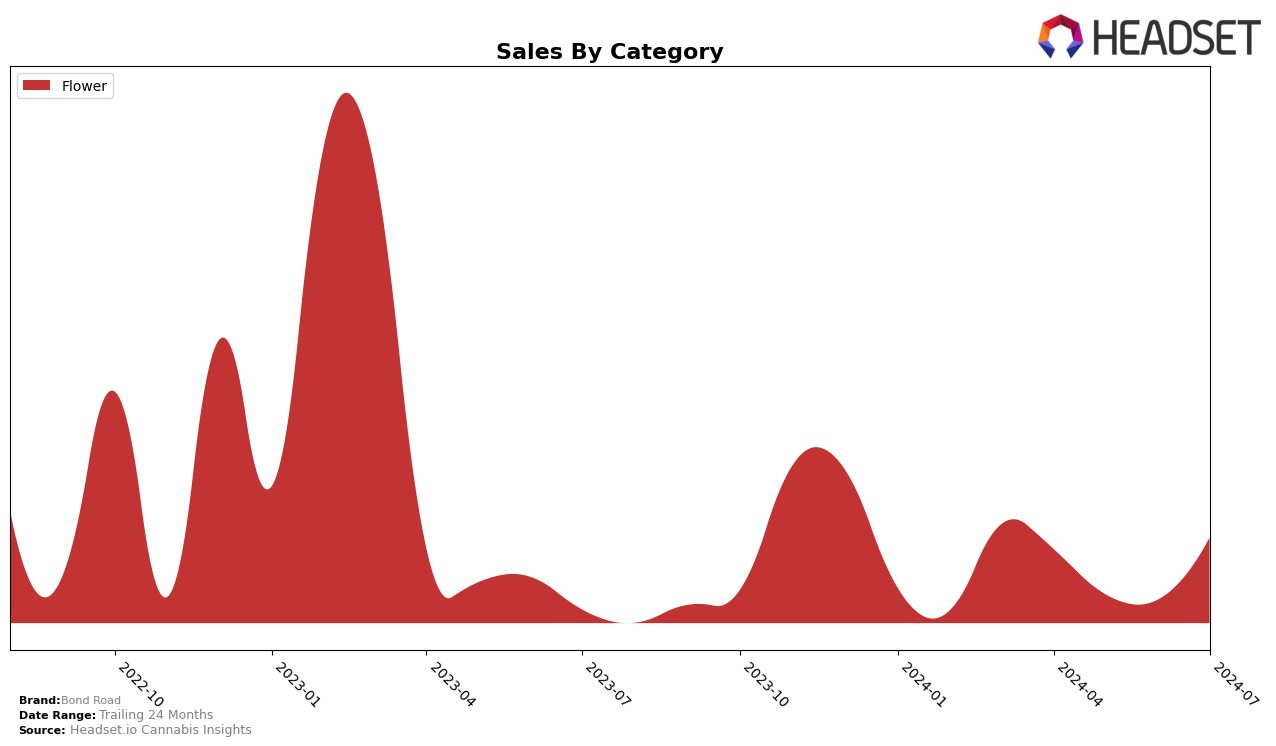

Bond Road has shown significant variability in its performance across different states and categories over the recent months. In Nevada, the brand's ranking in the Flower category has experienced notable fluctuations. Starting from a rank of 33 in April, it dropped to 49 in May and further to 51 in June, before making a strong comeback to 24 in July. This upward movement in July suggests a positive turnaround, potentially driven by strategic changes or market conditions favoring Bond Road's products. Despite the earlier dip, the brand's July sales in Nevada reached $258,500, highlighting a recovery and strong market presence.

However, Bond Road's absence from the top 30 brands in several months indicates areas where the brand might need to focus on improving its market penetration and category performance. The fact that Bond Road was not in the top 30 for May and June in the Flower category in Nevada underscores the competitive nature of the market and the challenges the brand faces. These gaps present opportunities for Bond Road to analyze market trends and consumer preferences to better position itself. The brand's ability to rebound in July is a promising sign, but consistent performance will be crucial for sustained success.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Bond Road has experienced significant fluctuations in rank and sales over the past few months. Notably, Bond Road's rank surged from 51st in June 2024 to 24th in July 2024, indicating a strong upward trend. This improvement is particularly impressive when compared to competitors like Virtue Las Vegas, which remained relatively stable but outside the top 20, and Green Life Productions, which saw a decline from 11th in April 2024 to 23rd in July 2024. Additionally, Tsunami Labs and Fleur both showed notable rank improvements, with Tsunami Labs climbing from 58th to 25th and Fleur from 39th to 26th in the same period. These shifts suggest a dynamic market where Bond Road's recent performance positions it favorably against its competitors, potentially driving increased consumer interest and sales momentum.

Notable Products

In July 2024, Bond Road's top-performing product was Glueball (3.5g) in the Flower category, which achieved the highest sales figure of 7472 units, climbing from third place in the previous two months. Bubba Fett (3.5g) secured the second position, maintaining its rank from June 2024 with notable sales of 2968 units. White 99 (3.5g) dropped to third place from its first position in June, while Mac & Cheese (3.5g) fell to fourth place after peaking in May 2024. White 99 Smalls (3.5g) entered the top five for the first time, ranking fifth with 1265 units sold. This month saw significant shifts in rankings, particularly for Glueball, which surged to the top spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.