Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

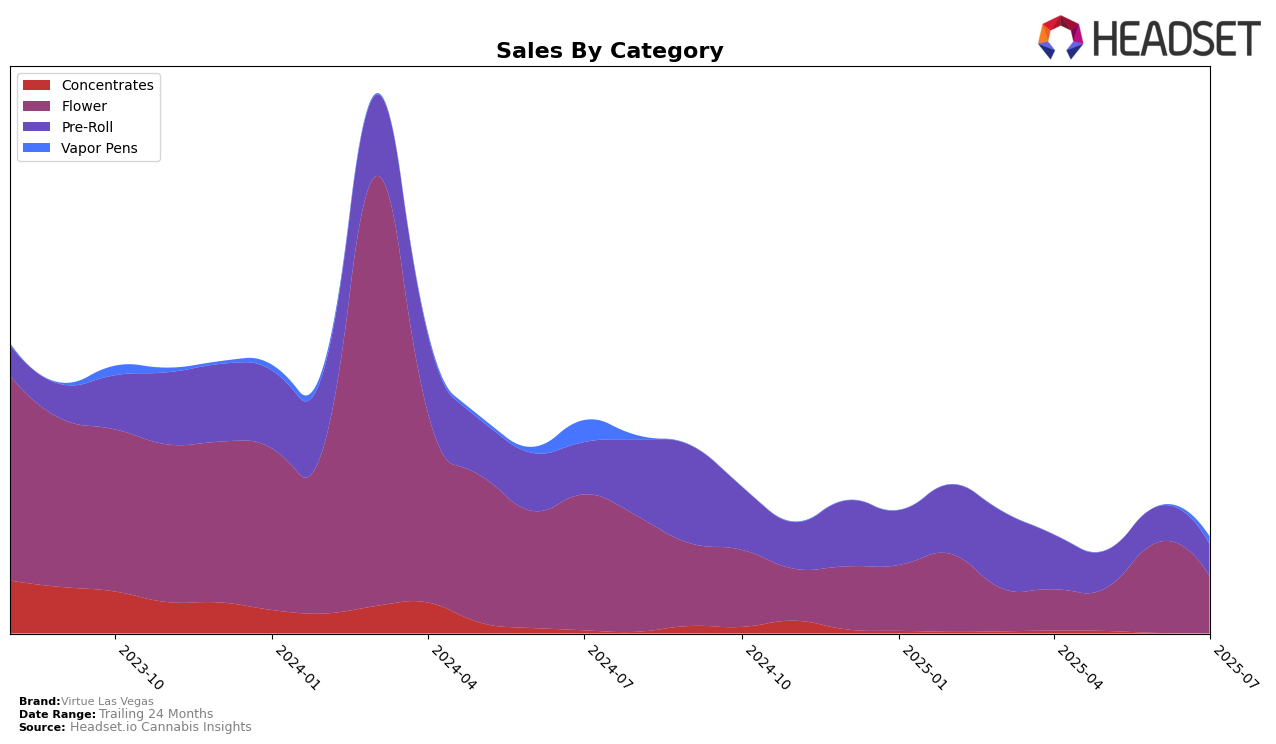

Virtue Las Vegas has demonstrated fluctuating performance across different product categories in Nevada. In the Flower category, the brand experienced a notable improvement in rank from May to June 2025, moving from 54th to 32nd place. This upward movement was accompanied by a significant increase in sales during the same period, indicating a strong market response. However, by July, the rank slipped back to 45th, suggesting potential volatility or increased competition in this segment. The Pre-Roll category presented a more stable trajectory, with Virtue Las Vegas maintaining a position within the top 30 throughout the months, although there was a gradual decline from 15th in April to 27th in July. This consistent presence in the top ranks highlights the brand's sustained appeal in this category, despite the downward trend.

In the Vapor Pens category, Virtue Las Vegas appeared in the rankings for the first time in July 2025, securing the 51st position. While this indicates a late entry into the top 30, it also suggests potential for growth in this category if the brand can capitalize on emerging market trends. The absence of ranking in the previous months implies that the brand was not a significant player in Vapor Pens until recently. This could present both a challenge and an opportunity for Virtue Las Vegas as they seek to establish a stronger foothold. Overall, the brand's performance across these categories in Nevada reflects both opportunities for growth and areas that may require strategic adjustments to enhance competitive positioning.

Competitive Landscape

In the competitive landscape of the Nevada flower market, Virtue Las Vegas has experienced notable fluctuations in its ranking and sales performance from April to July 2025. Starting at a rank of 49 in April, Virtue Las Vegas saw a significant improvement in June, climbing to 32, before dropping to 45 in July. This volatility suggests a dynamic market environment where Virtue Las Vegas faces stiff competition from brands like Hippies, which consistently outperformed Virtue Las Vegas, peaking at rank 13 in May. Meanwhile, TRENDI also posed a strong challenge, achieving a rank of 35 in June, closely trailing Virtue Las Vegas. Despite these challenges, Virtue Las Vegas's sales in June were notably higher than in other months, indicating potential for growth if they can stabilize their market position. Brands like Vlasic Labs and Vybz showed less consistent performance, often ranking lower than Virtue Las Vegas, which could provide opportunities for Virtue to capitalize on their competitors' instability.

Notable Products

In July 2025, the top-performing product for Virtue Las Vegas was the Private Reserve Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot with sales reaching 1,175 units. The Orange Push Pop Pre-Roll (1g) followed closely, securing the second position after having been ranked first in April and June. The Orange Push Pop (3.5g), a Flower product, improved its position to third place from fourth in June. Fig Bar Pre-Roll (1g) dropped to fourth place, and Diamond Dust Pre-Roll (1g) fell to fifth, experiencing a notable decline in sales from previous months. This shift in rankings highlights a dynamic change in consumer preferences within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.