Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

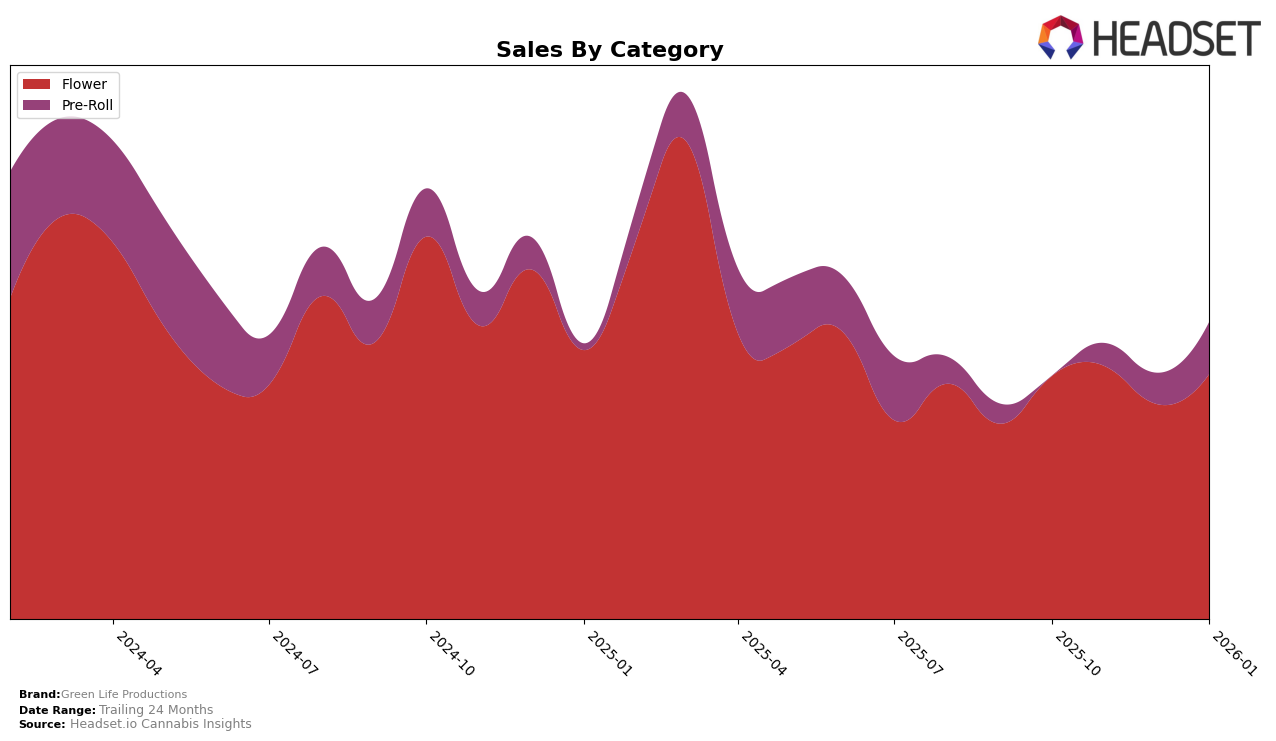

Green Life Productions has shown notable performance in the Nevada market, particularly in the Flower category. Over the four-month period from October 2025 to January 2026, the brand experienced some fluctuations in its rankings, starting at 20th in October, dipping to 24th in December, and then recovering slightly to 21st in January. This movement indicates a relatively stable presence in the top 30, although there is room for improvement to move up the ranks. The sales figures during this period reflect this trend, with a slight dip in December followed by a rebound in January, suggesting a resilience in their market strategy.

In the Pre-Roll category, Green Life Productions has demonstrated a more dynamic and positive trajectory in Nevada. Starting from outside the top 30 in October, the brand surged to 19th in November and continued to climb, reaching 16th by January 2026. This upward movement is significant, highlighting an effective strategy or increased consumer demand for their pre-roll products. The sales data corroborates this trend, with a consistent increase each month, culminating in a notable sales figure in January. This performance in the Pre-Roll category contrasts with their Flower category, showcasing potential strengths in product diversification or market appeal.

Competitive Landscape

In the Nevada flower category, Green Life Productions has demonstrated a relatively stable performance in recent months, maintaining a consistent presence within the top 25 brands. Despite a slight dip in December 2025, where it ranked 24th, Green Life Productions quickly rebounded to 21st place by January 2026. This resilience is notable, especially when compared to competitors such as THC Design, which fluctuated significantly, moving from 39th in October 2025 to 22nd in January 2026. Meanwhile, Polaris MMJ showed a strong upward trajectory, peaking at 14th in December 2025, highlighting a potential threat to Green Life Productions' market share. Another competitor, Neon Moon, experienced a sharp decline from 8th in October 2025 to 23rd in January 2026, which could indicate volatility in its market strategy. Hustler's Ambition also presents a competitive challenge, consistently ranking close to Green Life Productions, with a slight edge in January 2026 at 19th place. These dynamics suggest that while Green Life Productions maintains a solid position, it faces significant competitive pressures that could impact its future sales and ranking trajectory.

Notable Products

In January 2026, Green Life Productions saw GG4 On Fire (3.5g) leading as the top-performing product, climbing from the fifth position in December to first place with sales of 1086 units. Baby J's - Lemon Meringue Pre-Roll 6-Pack (1.8g) debuted impressively in second place with a notable sales figure of 1043 units. Miss X (3.5g) maintained a strong presence, securing the third spot despite not ranking in December, with sales reaching 1006 units. Miss Kashmir (3.5g) entered the rankings at fourth place, showing a strong start. Additionally, Baby J's - Miss X Pre-Roll 6-Pack (1.8g) rounded out the top five, marking its first appearance in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.