Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

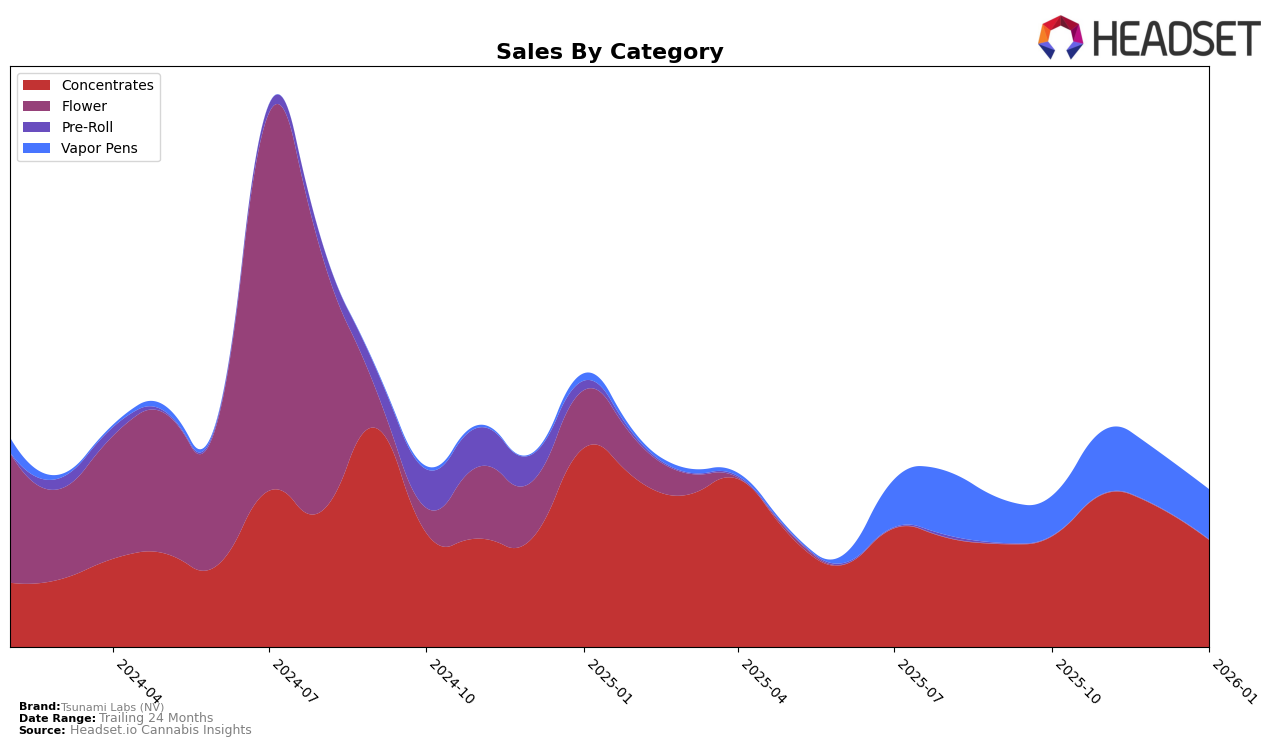

Tsunami Labs (NV) has demonstrated notable performance in the Concentrates category within the state of Nevada. Over the four-month period from October 2025 to January 2026, the brand showed a strong upward trend, climbing from a rank of 12 in October to a peak position of 7 in December, before settling at 11 in January. This fluctuation in ranking, coupled with a peak in sales in November, suggests a robust demand for their products during the holiday season, although a slight decline in January indicates potential seasonal variability. The consistent presence in the top 15 underscores their competitive positioning within this category.

In contrast, Tsunami Labs (NV) faced more challenges in the Vapor Pens category, where their rankings remained outside the top 30, peaking at 41 in November. Despite a significant sales increase in November compared to October, their rank did not see a substantial improvement, indicating fierce competition or a less favorable market perception in this category. The brand's inability to break into the top 30 suggests a need for strategic adjustments to enhance their market share and visibility in the Vapor Pens segment in Nevada. This disparity between categories highlights the importance of targeted strategies to leverage strengths and address weaknesses in different product lines.

Competitive Landscape

In the Nevada concentrates market, Tsunami Labs (NV) has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting from October 2025, Tsunami Labs (NV) was ranked 12th, climbing to 9th in November, and further improving to 7th in December, before dropping to 11th in January 2026. This trajectory indicates a competitive landscape where Tsunami Labs (NV) faces significant challenges and opportunities. In comparison, Neon Moon maintained a strong presence, peaking at 5th in November and stabilizing at 9th in January, suggesting a consistent demand for their products. Meanwhile, Matrix NV showed a remarkable leap from being outside the top 20 in October to securing the 10th position by January, indicating a strategic push in sales efforts. Khalifa Kush and Gunslinger had more sporadic appearances, with Gunslinger re-entering the rankings at 12th in January after being absent in previous months. These dynamics highlight the competitive pressures and the need for Tsunami Labs (NV) to innovate and adapt to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product from Tsunami Labs (NV) was Pineapple Inferno Live Resin Sugar (1g) in the Concentrates category, securing the number one rank with sales of 175 units. Kush Live Resin Diamonds HTE Cartridge (0.5g) in the Vapor Pens category followed closely at the second position. Silver Hawks Haze Live Resin Badder (1g) improved its rank from fourth in December 2025 to third in January 2026. Gelatti Live Resin Diamonds Cartridge (0.5g) maintained a consistent presence in the top five, moving from fifth in November and December 2025 to fourth in January 2026. Government Oasis Live Resin Diamonds HTE Cartridge (0.5g) saw a slight decline, dropping from third in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.