Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

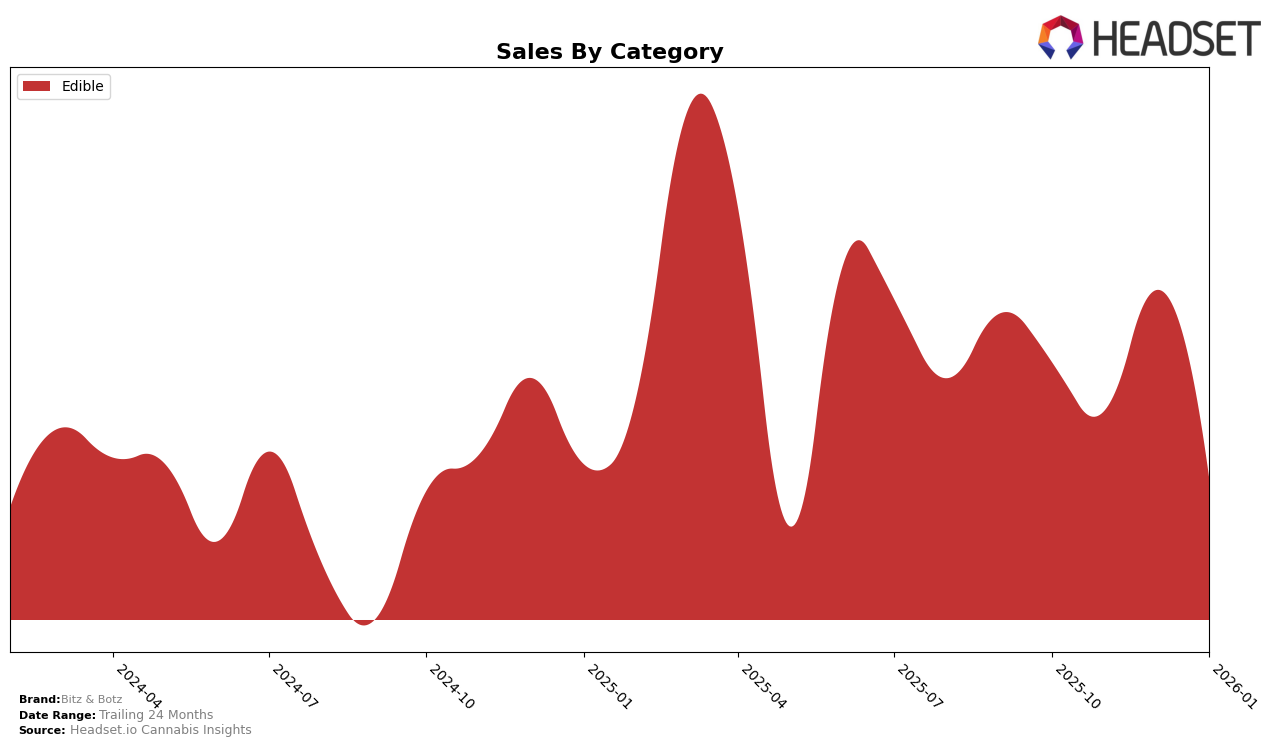

In the Oregon edibles market, Bitz & Botz has shown a notable consistency, maintaining a steady presence within the top 15 brands. From October 2025 to January 2026, their ranking hovered between 13th and 15th place, indicating a stable performance in a competitive category. Despite a slight dip in sales in January 2026 to $96,021, the brand managed to climb to 13th place in December 2025, suggesting a resilience and potential for growth. This pattern reflects a brand that, while not at the very top, has carved out a reliable niche in the Oregon market.

Outside of Oregon, Bitz & Botz's performance in other states and categories remains a mystery, as they did not appear in the top 30 rankings. This absence could be interpreted as a challenge for the brand to expand its footprint and increase its visibility across other regions. The lack of presence in the top rankings outside Oregon may highlight areas for potential strategic focus, such as enhancing marketing efforts or diversifying product offerings to capture a larger share of the market in different states and categories.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Oregon, Bitz & Botz has experienced notable fluctuations in its ranking and sales performance over the past few months. From October 2025 to January 2026, Bitz & Botz's rank shifted from 14th to 15th, indicating a slight decline in its competitive position. During this period, Bitz & Botz faced stiff competition from brands like Hapy Kitchen, which maintained a higher rank, moving from 12th to 14th, and Dr. Feel Good, which improved its position from 15th to 13th. Despite these challenges, Bitz & Botz's sales saw a significant boost in December 2025, surpassing its competitors Mellow Vibes (formerly Head Trip) and Golden, before experiencing a decline in January 2026. This dynamic market environment underscores the need for Bitz & Botz to strategically enhance its offerings and marketing efforts to regain and sustain a competitive edge in Oregon's edible cannabis sector.

Notable Products

In January 2026, the top-performing product from Bitz & Botz was Sour White Cherry Gummy (100mg), leading the sales ranking for the first time with 4,142 units sold. Pineapple Gummy (100mg) secured the second position, climbing up from its consistent fifth position in the previous months with 3,548 units sold. Fruit Punch Gummy (100mg) maintained a steady presence, ranking third, slightly dropping from its earlier fourth position in December 2025. Hybrid Pineapple Orange Guava Gummy (100mg) experienced a decline, moving from the second position in December 2025 to fourth in January 2026. Sour Mango Gummy (100mg), which previously held the top spot in November 2025, fell to fifth place in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.