Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

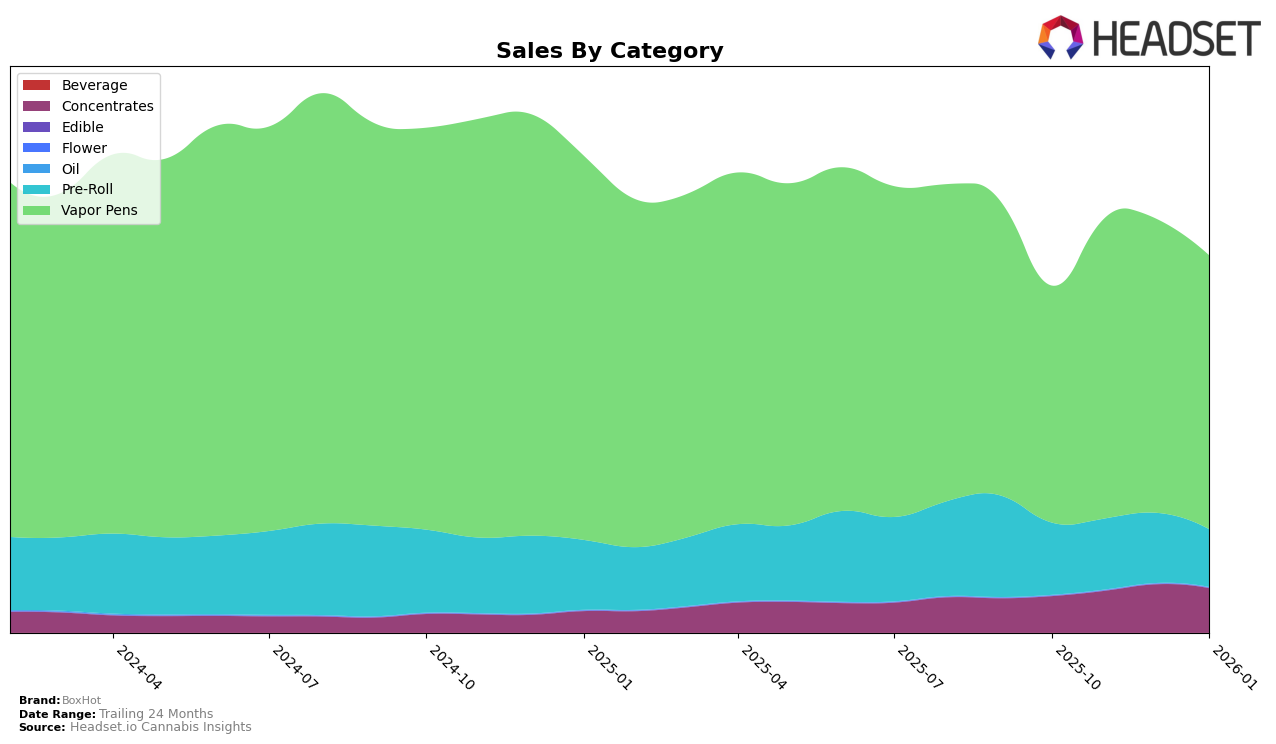

BoxHot has demonstrated a strong presence in the cannabis market, particularly in the category of Vapor Pens across several provinces. Notably, in Alberta, BoxHot consistently held the top position in the Concentrates category from October 2025 to January 2026, indicating a solid brand loyalty and market dominance. Their performance in Vapor Pens is also commendable, maintaining a steady rank of third place, except for a brief dip to fourth in November 2025. In British Columbia, BoxHot has maintained its number one rank in Vapor Pens, showcasing its strong foothold in this category. However, their Pre-Roll category performance in British Columbia has been less stellar, as they only entered the top 30 in November 2025 and have hovered around the lower end of the rankings since.

In Ontario, BoxHot has shown a steady performance in the Concentrates category, improving from being outside the top 30 in October 2025 to securing the eighth position by January 2026. This upward trajectory highlights a growing consumer base and increasing market share. However, their Pre-Roll category saw a gradual decline in rankings, dropping from 21st to 24th over the same period. Meanwhile, in Saskatchewan, BoxHot's Vapor Pens category experienced some fluctuations, with ranks ranging from seventh to twelfth but ending strong at seventh in January 2026. This indicates a competitive market landscape where BoxHot is maintaining a resilient position.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, BoxHot has consistently maintained a strong position, ranking second from October to December 2025, before experiencing a slight dip to third place in January 2026. This shift in rank is primarily influenced by the steady performance of Back Forty / Back 40 Cannabis, which has dominated the top position throughout this period. Meanwhile, Spinach has shown a gradual increase in sales, allowing it to surpass BoxHot in January 2026. Despite this, BoxHot's sales figures have remained robust, indicating a resilient market presence. However, the brand should be mindful of the upward trend of Spinach and the consistent performance of General Admission, which could pose challenges if not addressed strategically.

Notable Products

In January 2026, the top-performing product for BoxHot was Peach OG Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from previous months with sales of 18,325 units. Alien OG Distillate Cartridge (1.2g) saw a significant rise, moving up to second place from fourth in December 2025. Strawberry Diesel Distillate CO2 Cartridge (1.2g) dropped to third place, despite its consistent second-place ranking in prior months. Fatties - Exotic Trifecta of Smoking Power Distillate Infused Blunt 3-Pack (3g) in Pre-Roll maintained its fourth-place position. Cherry Kush CO2 Cartridge (1.2g) remained steady in fifth place, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.