Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

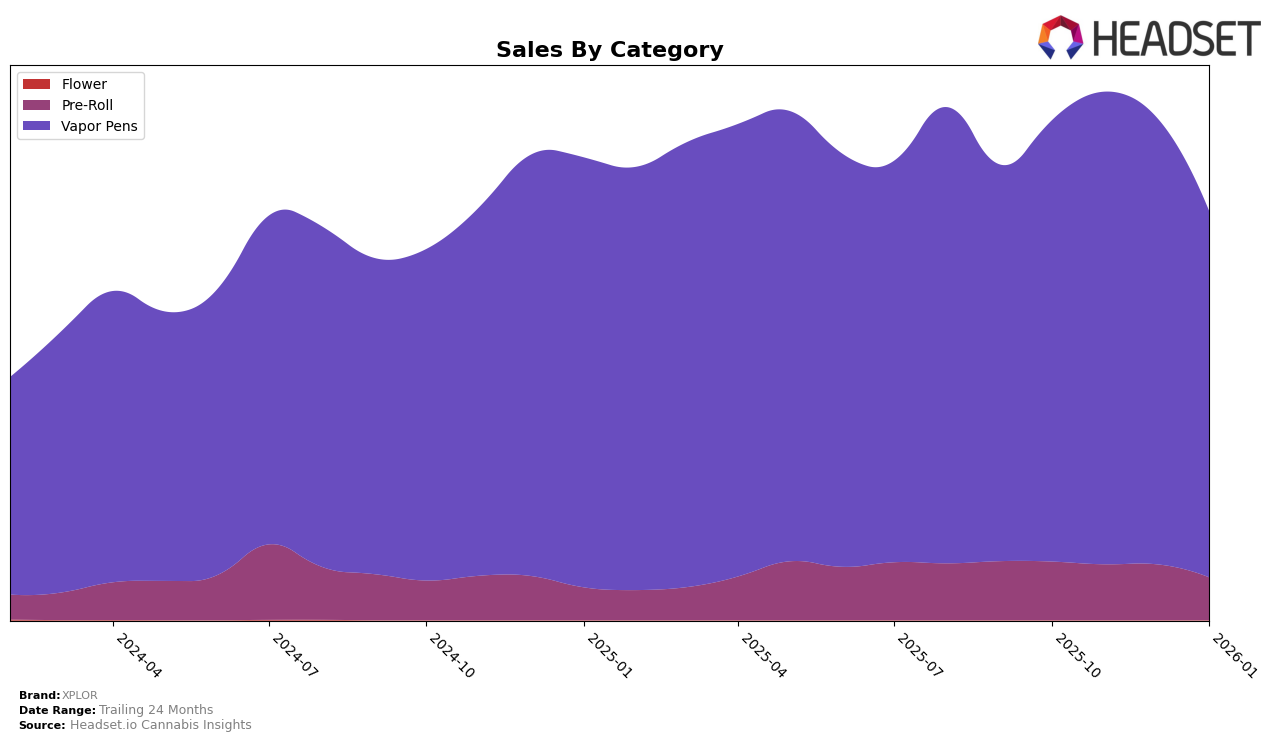

XPLOR's performance in the cannabis market reveals distinct trends across different states and categories. In the Alberta market, the brand experienced a decline in the Pre-Roll category, where it was not ranked in the top 30, indicating a challenging competitive landscape. However, in the Vapor Pens category, XPLOR showed positive momentum, climbing from the 7th position in October 2025 to the 5th position by January 2026. This upward movement suggests a strengthening presence in Alberta's Vapor Pens market, likely driven by increased consumer preference for their products in this category.

In contrast, XPLOR maintained a steady position in the Ontario Vapor Pens category, holding the 5th rank consistently until a slight drop to 6th in January 2026. This consistency indicates a stable consumer base, although the decline in rank may call for strategic adjustments. Meanwhile, the Pre-Roll category in Ontario mirrored Alberta's trend, with XPLOR not breaking into the top 30, highlighting an area for potential growth. Interestingly, in Saskatchewan, XPLOR's Vapor Pens saw a fluctuation in rankings, peaking at 3rd place before settling at 5th, suggesting a volatile yet promising market presence. These movements across different regions and categories provide a nuanced view of XPLOR's market dynamics, reflecting both opportunities and challenges.

Competitive Landscape

In the Ontario vapor pens category, XPLOR experienced a notable shift in its competitive standing from October 2025 to January 2026. Initially holding a steady 5th rank, XPLOR was overtaken by Tribal in January 2026, dropping to 6th place. This change in rank is significant as it reflects a decrease in sales performance, with XPLOR's sales declining sharply in January 2026 compared to previous months. In contrast, General Admission maintained a consistent 4th rank, showcasing stable sales figures that outpaced XPLOR. Meanwhile, DEBUNK and Adults Only remained stable in their respective ranks, indicating a more consistent market presence. This competitive landscape suggests that XPLOR may need to reassess its market strategies to regain its previous ranking and address the sales decline observed in January 2026.

Notable Products

In January 2026, the top-performing product for XPLOR was the Red Hawaiian Co2 Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking since October 2025, despite a decrease in sales to 14,368 units. Nana's Jam CO2 Cartridge (1g) also held steady in second place, showing consistent sales performance. The Rainbow Razz Co2 Cartridge (1g) returned to the rankings, securing third place after being absent in the previous months. Jungle Fruit CO2 Cartridge (1g) stayed in fourth place, with a slight dip in sales. Beast Berry CO2 Cartridge (1g) re-entered the rankings, landing in fifth place, indicating a notable drop from its previous third-place position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.