Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

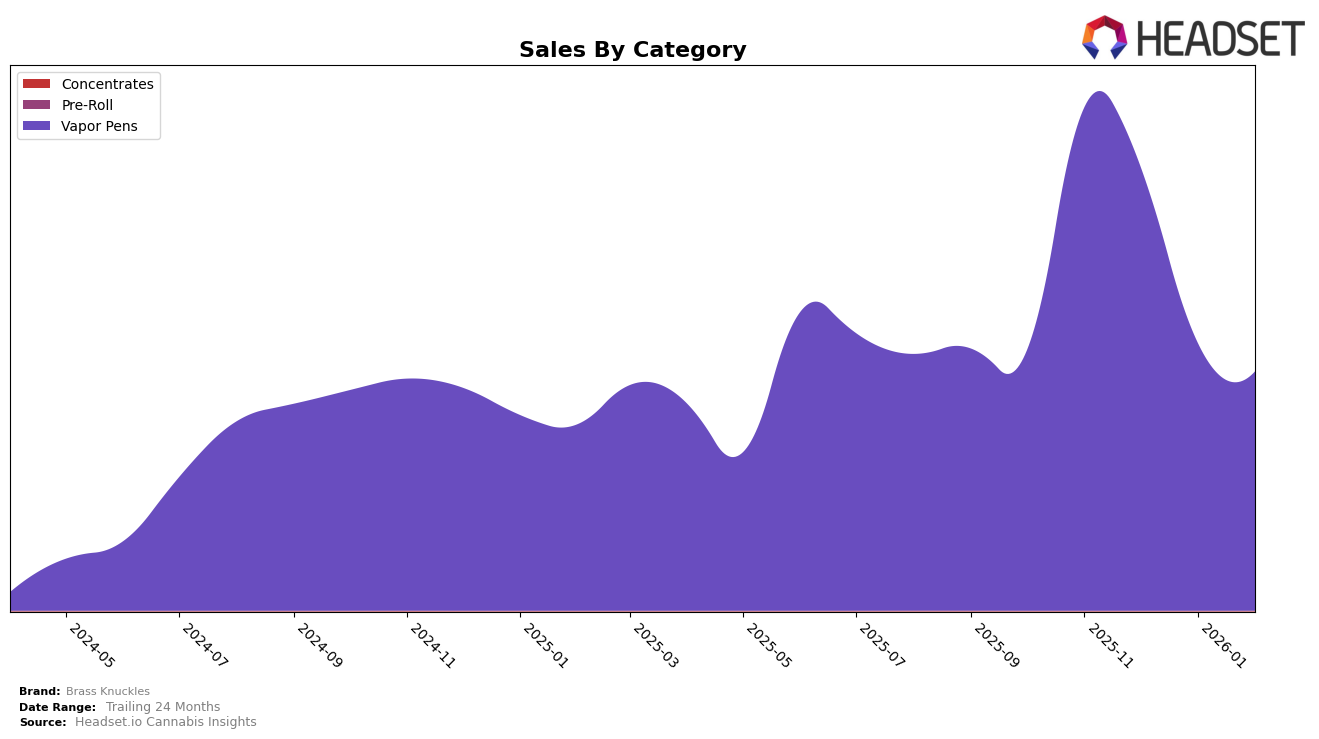

Brass Knuckles has experienced fluctuating performance across different states and categories, particularly in the Vapor Pens category. In Nevada, the brand saw a noticeable drop, moving from 7th place in November 2025 to 12th place by February 2026. This decline highlights a significant challenge in maintaining a strong market position within this state. However, it's important to note that despite the rank drop, Brass Knuckles was able to stay within the top 15, which suggests a resilient presence in the Nevada market, albeit with some competitive pressures. The sales figures also reflect this downward trend, with a decrease from over half a million dollars in November 2025 to just over three hundred thousand dollars by February 2026.

In contrast, the brand's performance in New York presents a different narrative. While Brass Knuckles maintained a consistent presence within the top 30, their ranking shifted from 7th place in November 2025 to 22nd place by February 2026. This indicates a more volatile market environment or increased competition in New York. Despite the drop in rankings, the sales figures reveal an interesting pattern, where the brand managed to increase its sales from January to February 2026, suggesting a potential recovery or strategic adjustment. The contrast between these two states underscores the varied challenges and opportunities Brass Knuckles faces across different markets.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Brass Knuckles has experienced notable fluctuations in its market position over recent months. While it maintained a strong presence in November and December 2025, ranking 7th and 8th respectively, a significant drop to 26th place in January 2026 indicates a potential challenge in sustaining its market share. However, a slight recovery to 22nd place in February 2026 suggests resilience and potential for rebound. In contrast, competitors like Mfused have seen a consistent decline from 9th to 24th place over the same period, while Littles and Off Hours have shown upward trends, with Off Hours notably rising to 20th place in February 2026. These shifts highlight the dynamic nature of the market, where Brass Knuckles faces both challenges and opportunities to leverage its brand strength amidst evolving consumer preferences and competitive pressures.

Notable Products

In February 2026, the top-performing product for Brass Knuckles was the Maui Wowie Live Liquid Diamond Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank with sales of 1079 units. Following closely, the Alaskan Thunder Fuck Super Distillate Disposable (1g) held the second position, dropping from its previous first-place rank in January. The East Coast Sour Diesel Super Distillate Disposable (1g) maintained a steady presence, holding the third rank as in January. The Acapulco Gold Live Liquid Diamonds Disposable (1g) experienced a slight decline, moving from second place in December to fourth in February. Lastly, the Blue Diesel Live Liquid Diamonds Disposable (1g) entered the rankings for the first time, securing fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.