Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

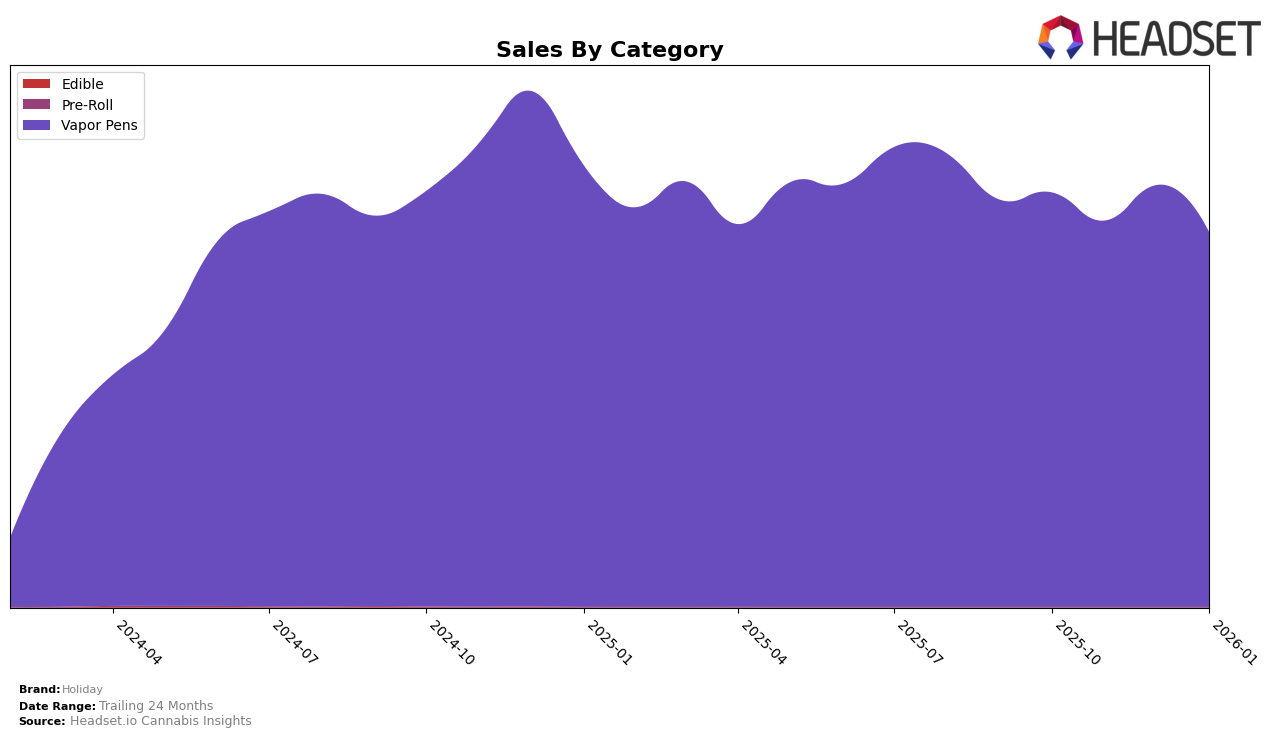

Holiday has shown varying performance across different states and categories, with notable shifts in rankings over the past few months. In Massachusetts, the brand's position in the Vapor Pens category experienced a decline, moving from 9th in October 2025 to 13th by January 2026. This drop in ranking could be attributed to a decrease in sales, which fell from $765,207 in October to $562,326 by January. Such a decline indicates that Holiday may be facing increased competition or market challenges in Massachusetts. The brand's consistent presence in the top 30, however, suggests a stable yet competitive market position.

In contrast, New York presented a slightly different scenario for Holiday in the Vapor Pens category. Although the brand's ranking fluctuated, dropping from 9th in October to 14th in December, it rebounded back to 11th by January 2026. This rebound was accompanied by a sales increase in December, reaching $1,043,784, which was the highest during the period. The improvement in ranking by January indicates a potential strategic adjustment or market recovery. Despite the fluctuations, maintaining a position within the top 15 suggests that Holiday remains a competitive player in the New York market. However, the absence from the top 30 in any category would be a significant indicator of market challenges.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Holiday has shown a dynamic performance over the past few months, with its rank fluctuating between 9th and 14th place. Notably, Holiday's rank improved from 14th in December 2025 to 11th in January 2026, indicating a positive trend in sales performance. Despite this improvement, Holiday faces stiff competition from brands like STIIIZY, which consistently held higher ranks, reaching as high as 9th in December 2025 and maintaining a strong presence with substantial sales figures. Additionally, Untitled has shown a significant upward trajectory, surpassing Holiday by moving from 11th to 9th place in January 2026. Meanwhile, Heavy Hitters and Cannabals have also been key competitors, with Heavy Hitters notably improving its rank from 17th in December 2025 to 12th in January 2026. These shifts highlight the competitive pressure on Holiday to maintain and improve its market position in the New York vapor pen category.

Notable Products

In January 2026, the top-performing product for Holiday was the Golden Hour Distillate H-Bar Disposable (1g) in the Vapor Pens category, maintaining its number 1 rank consistently since October 2025, despite a decrease in sales to 7737. The Happy Camper Distillate H-Bar Disposable (1g) also retained its second-place position, showing stable performance over the months. Leisure Distillate H-Bar Disposable (1g) held onto the third rank, although its sales figures have been declining, reaching 3916 in January. The Staycation Distillate H-Bar Disposable (1g) remained in fourth place, showing a consistent ranking since December after a previous absence in November. The THC/CBG 2:1 Airplane Mode Hybrid Distillate H-Bar Disposable (1g) re-entered the rankings at fifth place in January, after being unranked in December, indicating renewed interest or availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.