Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

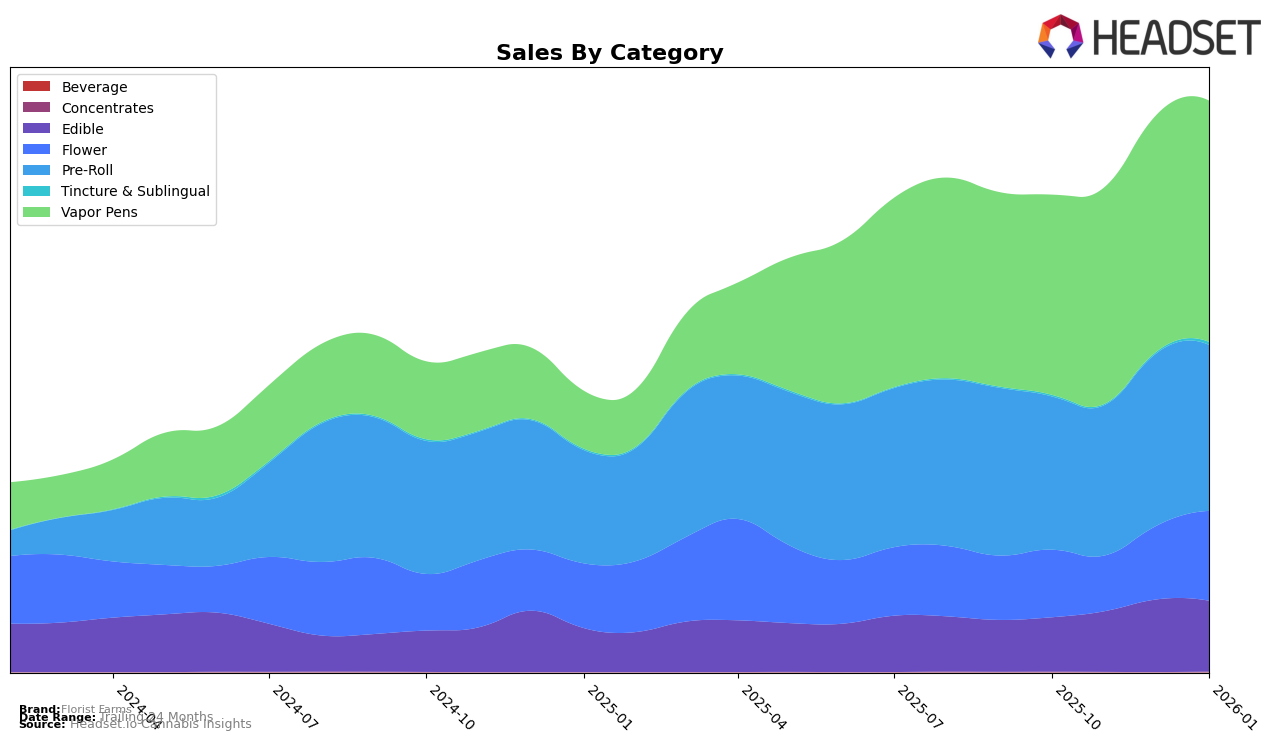

Florist Farms has demonstrated a steady performance across various categories in New York, with notable movements in the rankings over the past few months. In the Edible category, the brand maintained a consistent presence within the top 15, showing a slight improvement from 14th to 12th position by January 2026. This upward trend is indicative of a strong consumer preference for their edible offerings. On the other hand, in the Flower category, Florist Farms showed significant improvement, moving from 32nd place in November 2025 to 21st by January 2026, suggesting a growing market presence and increased consumer demand for their flower products.

The Pre-Roll category has been a stronghold for Florist Farms, consistently ranking within the top 5, and maintaining a solid 4th position in both October 2025 and January 2026. This consistent performance underscores their strength in this segment. Meanwhile, in the Vapor Pens category, the brand improved from 6th to 5th place, indicating a positive reception of their vapor pen products. Notably, the brand's absence from the top 30 in any category within New York would have been a significant concern, but their persistent presence across all major categories highlights their robust market strategy and consumer appeal.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Florist Farms has shown a promising upward trend in recent months. Starting from a consistent rank of 6th place from October to December 2025, Florist Farms managed to climb to 5th place by January 2026. This improvement in rank suggests a positive reception of their products, likely driven by a strategic marketing push or product innovation. In comparison, Rove experienced a slight decline, moving from 5th to 6th place in January 2026, which may have contributed to Florist Farms' rise. Meanwhile, Fernway and Mfny (Marijuana Farms New York) maintained their strong positions at 3rd and 4th place, respectively, indicating stable consumer loyalty. PAX held steady at 7th place, showing consistent performance but not enough to challenge Florist Farms' recent gains. The competitive dynamics in this category suggest that Florist Farms is effectively capitalizing on market opportunities to enhance its brand presence and sales in the New York vapor pen market.

Notable Products

For January 2026, the top-performing product from Florist Farms remains the Sleep - THC/CBN 1:1 Bedtime Blueberry Gummies 10-Pack, maintaining its number one rank consistently from October 2025 with sales of 5,355 units. The Happy - CBC/THC 1:1 Strawberry Lemonade Gummies 10-Pack continues to hold the second position, showing a steady increase in sales each month. Witches Brew Live Resin Infused Pre-Roll 5-Pack has climbed to the third position since its fifth-place ranking in November 2025. Candy Jack Live Resin Infused Pre-Roll 5-Pack remains stable at fourth place since November 2025. Meanwhile, Blue Dream Live Resin Cartridge has dropped to fifth place from its second-place ranking in October 2025, indicating a decline in its popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.