Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

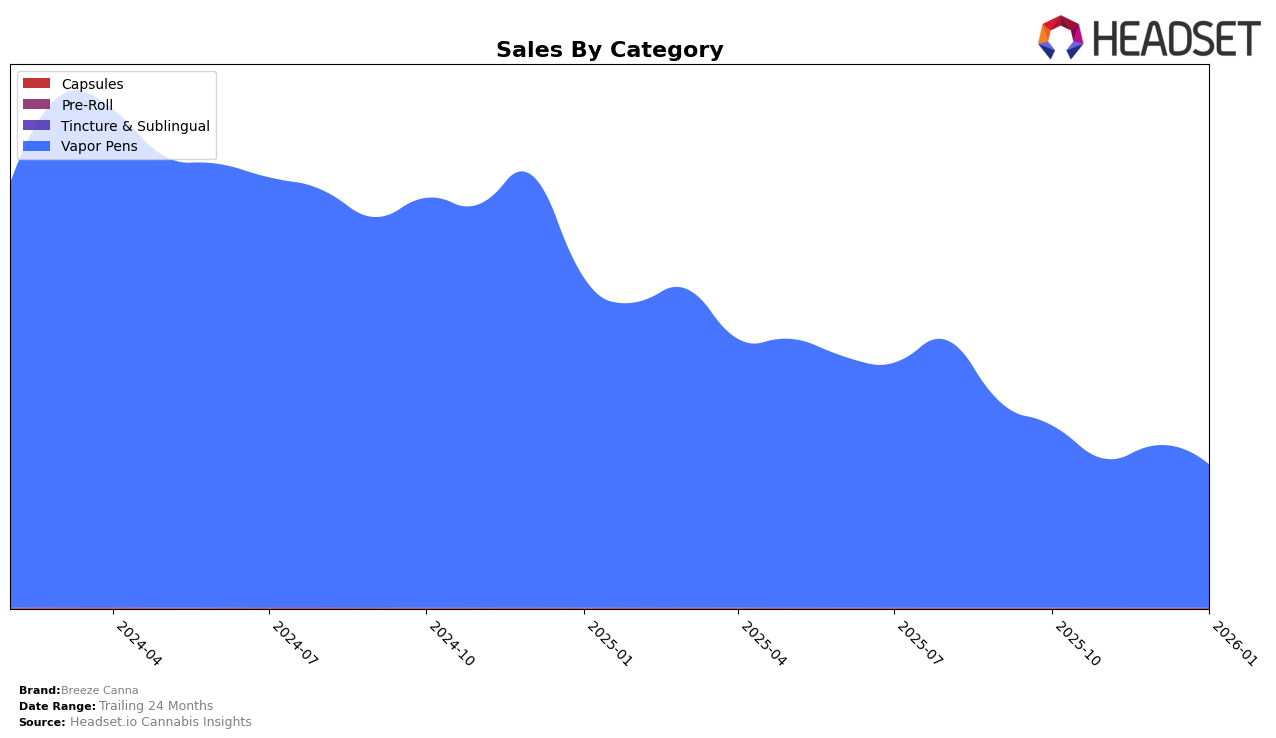

Breeze Canna has shown a mixed performance across different states and categories in recent months. In the Illinois market, the brand has seen some fluctuations in its ranking within the Vapor Pens category. Starting at 25th in October 2025, it dipped slightly to 26th in November, only to climb back up to 22nd in December before settling at 24th in January 2026. This movement indicates a somewhat volatile presence, but the ability to remain in the top 30 suggests a resilient foothold. The sales figures in Illinois also reflect this pattern, with a notable increase in December, reaching $447,741, before experiencing a drop in January. Such dynamics highlight the competitive nature of the Illinois market and the challenges Breeze Canna faces in maintaining a steady upward trajectory.

In contrast, Breeze Canna's performance in the Michigan market presents a steadier picture. Consistently ranking within the top 12 for Vapor Pens, the brand held the 9th position in October 2025 but experienced a slight decline to 12th by January 2026. Despite this slight drop in ranking, the brand's sales figures reveal a different story, with a gradual decrease over the months from $1,052,839 in October to $745,952 in January. This trend suggests that while Breeze Canna remains a strong contender in Michigan, there is an underlying pressure that could be affecting its market share. The consistent presence in the top rankings, however, indicates a strong brand recognition and a loyal customer base that continues to support its offerings in the state.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Breeze Canna has experienced a notable decline in its market position from October 2025 to January 2026. Initially ranked 9th in October, Breeze Canna slipped to 12th by December and maintained this position in January. This downward trend in rank is mirrored by a consistent decrease in sales over the same period. In contrast, competitors like Jeeter maintained a stronger position, starting at 7th and only dropping to 11th by January, while Rove remained relatively stable, moving from 8th to 10th. Vapin Ape and Jungle Juice also showed fluctuations, with Jungle Juice improving its rank from 20th to 14th by January. The competitive pressure from these brands, particularly Jeeter's strong sales performance, highlights the challenges Breeze Canna faces in regaining its market share and improving its sales trajectory in the Michigan vapor pen category.

Notable Products

In January 2026, the top-performing product from Breeze Canna was the NBreeze x Astro Hippie - Neon Straw Guava Distillate Disposable (1g), which climbed to the number one rank with sales reaching 2546 units. The Blueberry Lemonade Distillate Rechargeable Disposable (1g) maintained a strong position, ranking second for the month, reflecting consistent demand. The Citrus Soda Distillate Disposable (1g) made a notable debut at the third position, indicating a successful entry into the market. The Strawberry Kiwi Pro Live Resin Disposable (1g) and the Banana Orange Smoothie Distillate Disposable (1g) followed closely, ranking fourth and fifth respectively. Compared to previous months, the Neon Straw Guava product showed significant growth, moving from fourth in December to first in January, highlighting its increasing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.