Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Massachusetts, Galactic's performance in the Flower category has seen a decline, moving from 6th place in October 2025 to 20th by January 2026. This downward trend is mirrored by a decrease in sales figures over the same period. However, in the Vapor Pens category within Massachusetts, Galactic has shown resilience, improving its ranking from 27th in November 2025 to 21st by January 2026, with a corresponding increase in sales from $279,084 to $340,452. This suggests that while Galactic faces challenges in maintaining its position in the Flower category, it is gaining traction in Vapor Pens.

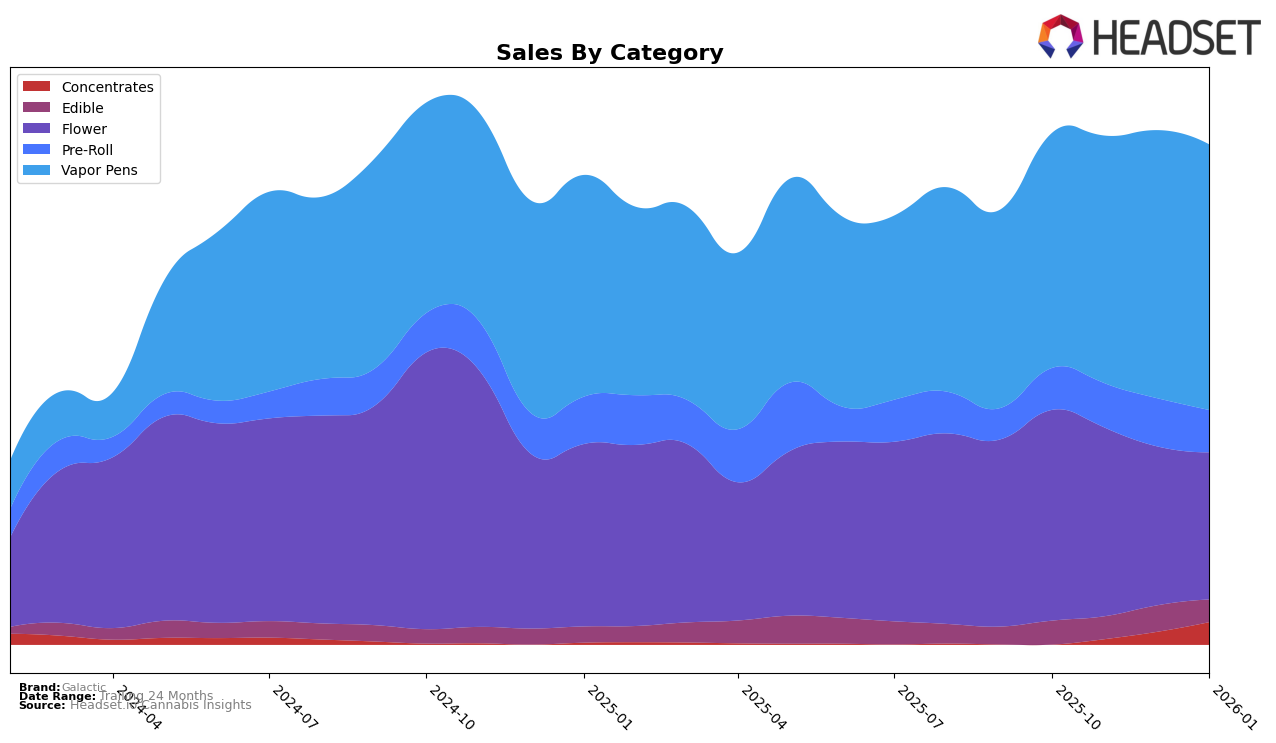

In Michigan, Galactic's presence in the Edible category has been limited, as it only entered the rankings at 41st place in December 2025, indicating room for growth. In contrast, the Vapor Pens category in Michigan has been a more stable area for Galactic, maintaining a top 20 position across the months, despite a slight dip to 19th place in January 2026. Meanwhile, in Missouri, Galactic has achieved notable success in the Vapor Pens category, consistently holding the top spot from November 2025 through January 2026, demonstrating a strong market presence. Additionally, the brand has shown significant improvement in the Concentrates category, moving from 17th to 7th place from December 2025 to January 2026, reflecting strategic growth in this segment.

Competitive Landscape

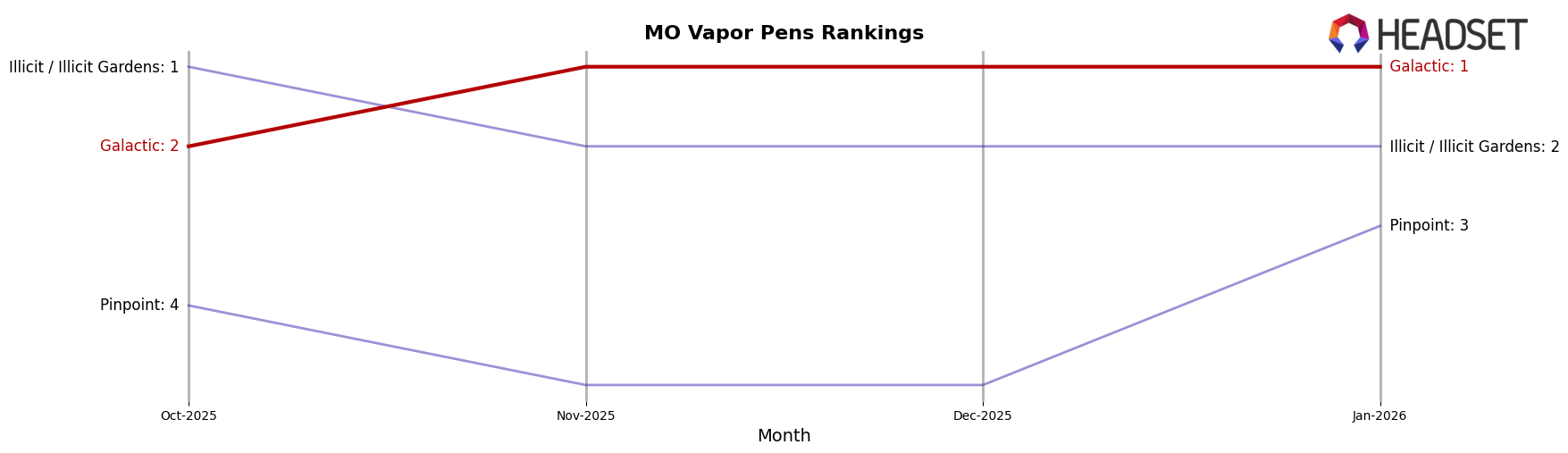

In the competitive landscape of Vapor Pens in Missouri, Galactic has demonstrated a strong performance, maintaining the top rank from November 2025 through January 2026. This consistent leadership position highlights Galactic's robust market presence and consumer preference. Notably, Galactic overtook Illicit / Illicit Gardens, which held the top spot in October 2025 but subsequently dropped to the second position. This shift indicates a strategic advantage for Galactic, as it not only increased its sales but also solidified its dominance in the market. Meanwhile, Pinpoint showed a positive trend by moving from the fifth rank in November and December 2025 to the third rank in January 2026, suggesting a potential rise in competition. Galactic's ability to maintain its leading position amidst these dynamics underscores its competitive edge and strong brand loyalty in the Missouri Vapor Pens category.

Notable Products

In January 2026, the top-performing product for Galactic was the Florida Sunshine Terpene Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from October and November 2025, with sales of 15,177 units. The Strawberry Stardust Terp Cartridge (1g) rose to the second position, showing a consistent improvement from its third-place ranking in the previous months. Blueberry Moon Terp Distillate Cartridge (1g), which was ranked first in December 2025, fell to third place. Celestial Sherbert Terp Cartridge (1g) held steady in fourth place throughout the months. Lemon Lift-Off Terp Cartridge (1g) reappeared in the rankings at fifth place, after being absent in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.