Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

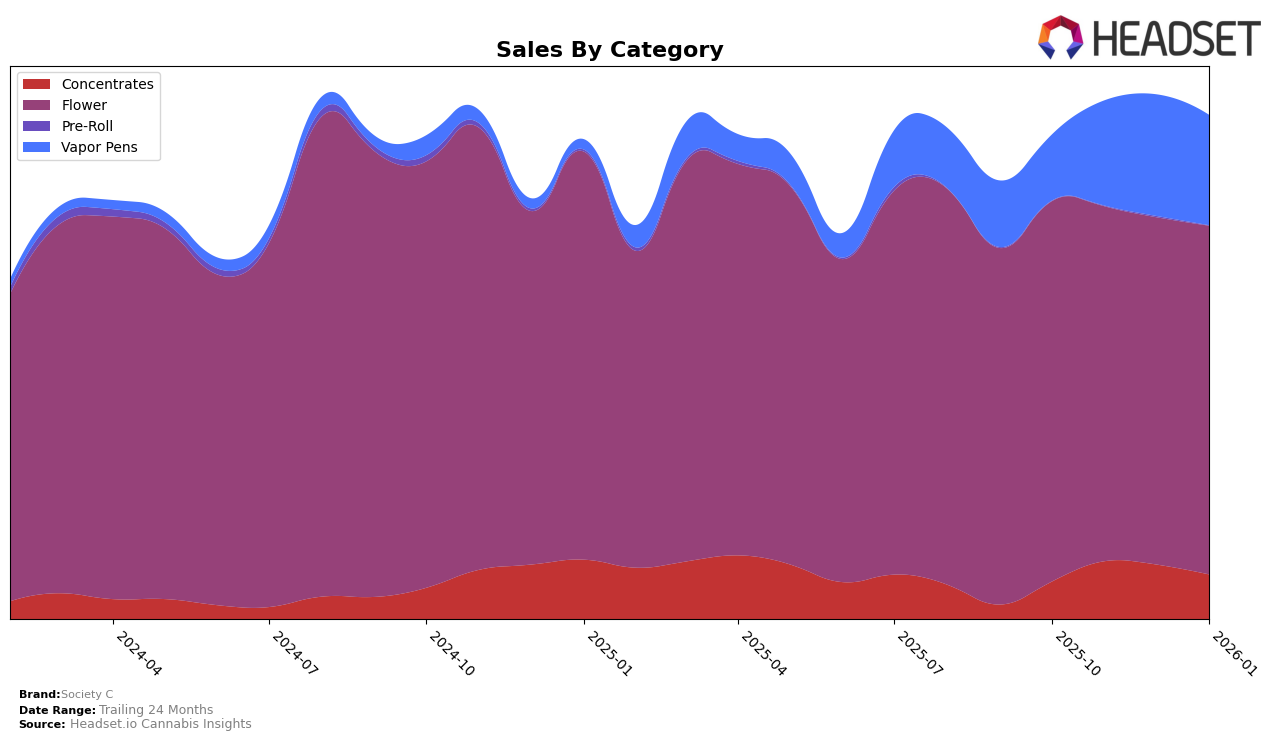

Society C has demonstrated notable performance across various categories in the state of Michigan. In the Concentrates category, the brand showed a strong presence, moving from the 5th rank in October 2025 to the 3rd position in November and December, before slightly dropping back to 5th in January 2026. This fluctuation indicates a competitive environment where Society C is maintaining a top-tier position. In the Flower category, Society C consistently held the 2nd rank in October and November, slipping slightly to 3rd in December and January. This slight decline suggests an area where they might need to strategize to regain their previous standing.

In the Vapor Pens category, Society C showcased a significant upward trend, starting at the 13th position in October 2025 and climbing to 7th by December, where they maintained their rank into January 2026. This upward trajectory highlights their growing influence and potential in the vapor market. Notably, Society C did not appear in the top 30 brands in any other states or provinces across these categories during this period, which could be interpreted as a limitation in their geographical market penetration or a strategic focus on Michigan. This regional concentration might suggest an opportunity for expansion or a deliberate strategy to dominate the Michigan market before scaling elsewhere.

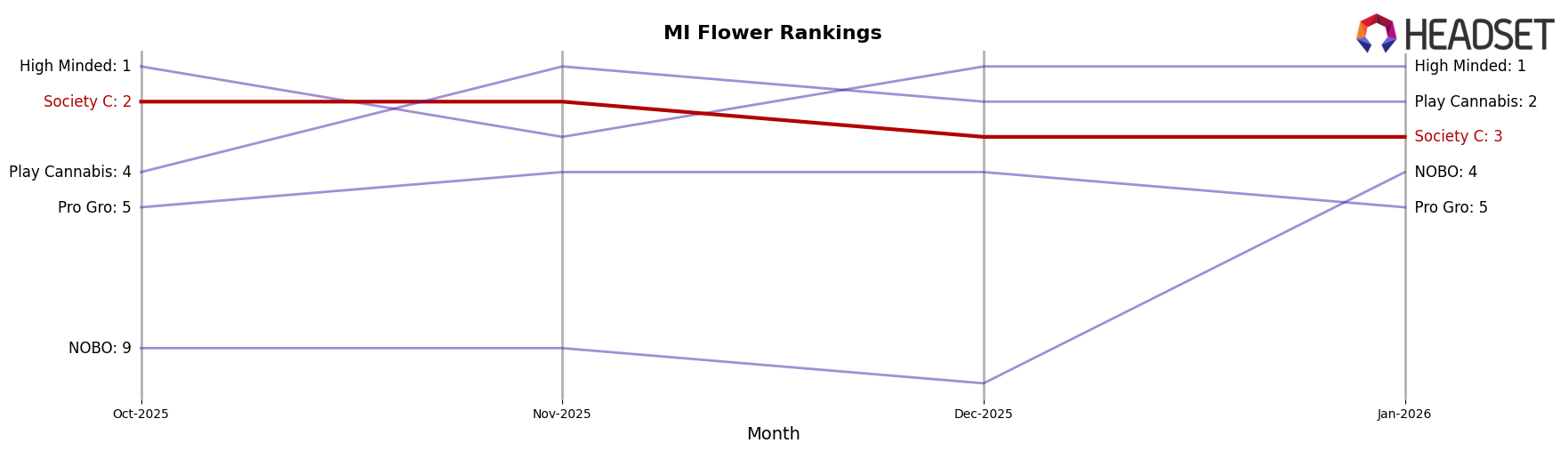

Competitive Landscape

In the competitive landscape of the Flower category in Michigan, Society C has maintained a consistent presence, ranking third in both December 2025 and January 2026. This stability is noteworthy, especially when compared to the fluctuating ranks of competitors like High Minded, which held the top position in three out of the four months analyzed, and Play Cannabis, which rose to the second position by January 2026. Despite a slight decline in sales from October to December 2025, Society C's sales rebounded slightly in January 2026, indicating resilience in a competitive market. Meanwhile, NOBO demonstrated a significant jump in rank from tenth to fourth place in January 2026, suggesting a potential threat to Society C's market share. Overall, Society C's consistent ranking amidst dynamic market shifts highlights its strong brand presence but also underscores the need to strategize against emerging competitors.

Notable Products

In January 2026, Gastro Pop (3.5g) maintained its position as the top-selling product for Society C, with sales figures reaching 24,116 units. Devil's Drip (3.5g) climbed back to the number two spot after a dip in December, showcasing a strong recovery. The Runtz (3.5g) consistently held the third position, demonstrating stable demand across the months. Omega Runtz (3.5g) made its debut in the rankings at fourth place, indicating a successful product launch. Cap Junky (28g) entered the rankings in January at fifth place, suggesting growing interest in larger quantity purchases.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.