Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

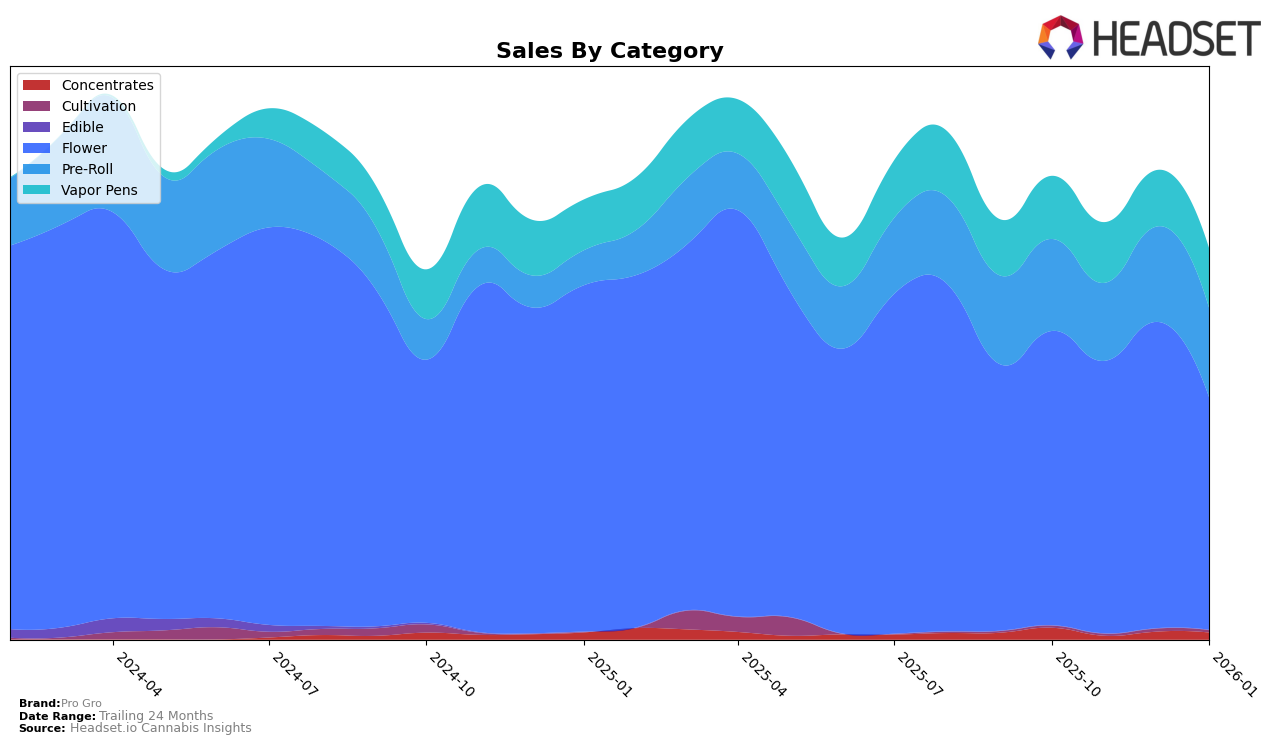

Pro Gro's performance in the state of Michigan showcases a mixed yet intriguing trajectory across various cannabis categories. In the Flower category, Pro Gro consistently maintained a strong presence, holding the 4th position for two consecutive months before slipping slightly to 5th in January 2026. This indicates a robust demand for their flower products, even amid fluctuations in sales figures. However, in the Concentrates category, Pro Gro appeared in the rankings only in October 2025, securing the 28th position, and subsequently fell out of the top 30. This absence in the following months suggests challenges in sustaining market visibility in this particular segment.

The Pre-Roll category saw Pro Gro oscillating between the 9th and 10th positions, reflecting a stable yet competitive standing in Michigan. Despite slight rank variations, the brand maintained a consistent presence, indicating a reliable consumer base. In contrast, Vapor Pens showed more variability, with rankings fluctuating from 16th to 18th and back to 15th over the four months. This suggests a volatile market position, possibly influenced by external market dynamics or shifts in consumer preferences. The brand's ability to regain a higher rank in January 2026 is noteworthy, hinting at potential strategic adjustments or successful product offerings that resonate with consumers.

Competitive Landscape

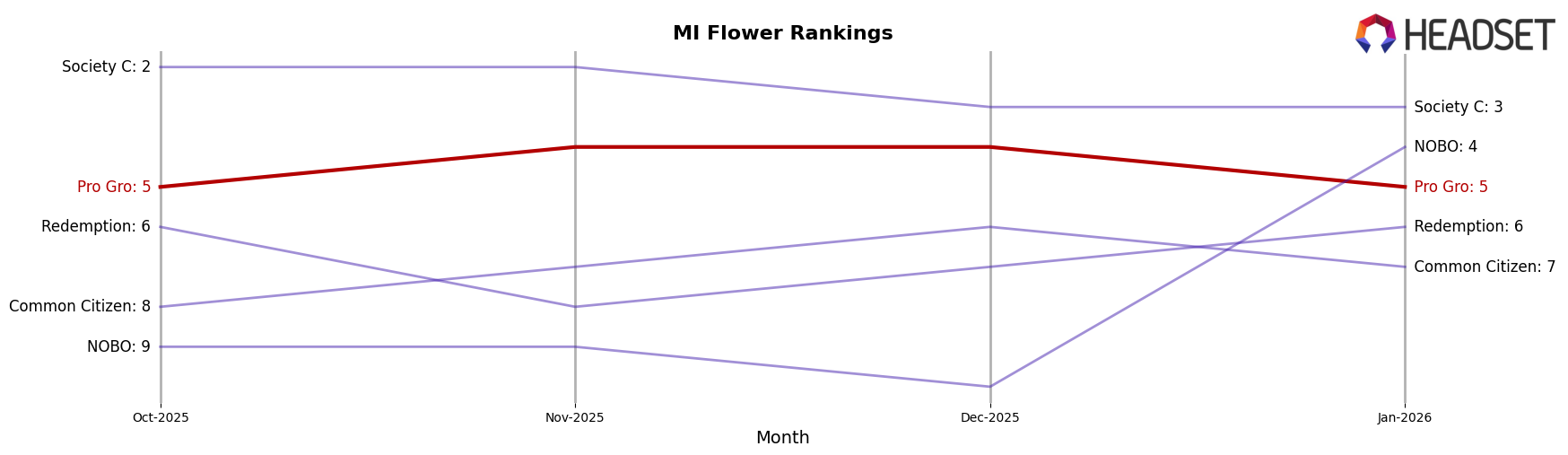

In the competitive landscape of the Michigan flower category, Pro Gro has demonstrated resilience and consistency in its market position. Over the four-month period from October 2025 to January 2026, Pro Gro maintained a strong presence, consistently ranking within the top five brands, though it experienced a slight dip from 4th to 5th place in January 2026. This shift can be attributed to the significant rise of NOBO, which jumped from 10th to 4th place, indicating a potential threat to Pro Gro's market share. Despite this, Pro Gro's sales figures remained robust, particularly in December 2025, where it saw a peak, suggesting strong consumer loyalty or effective marketing strategies during the holiday season. Meanwhile, Society C consistently outperformed Pro Gro, maintaining a top-three position, which underscores the competitive pressure from leading brands. Additionally, Redemption and Common Citizen showed fluctuations in their rankings, but neither posed a significant threat to Pro Gro's standing. Overall, Pro Gro's ability to sustain its rank amidst dynamic market shifts highlights its competitive edge, although the rise of NOBO suggests that Pro Gro must remain vigilant and possibly innovate to maintain its position.

Notable Products

In January 2026, the top-performing product from Pro Gro was the Moonbow #112 Pre-Roll (1g), maintaining its consistent number one rank from previous months despite a decrease in sales to 17,655 units. The Lunar Lemon Pre-Roll (1g) saw a significant rise in popularity, climbing from fifth place in November to second place in January, with notable sales of 15,709 units. Watermelon Zkittlez Pre-Roll (1g) entered the rankings for the first time, securing the third position. Moonmelon Pre-Roll (1g) and Don Mega Pre-Roll (1g) also debuted in the rankings, taking fourth and fifth places, respectively. This shift indicates a growing diversification in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.