Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

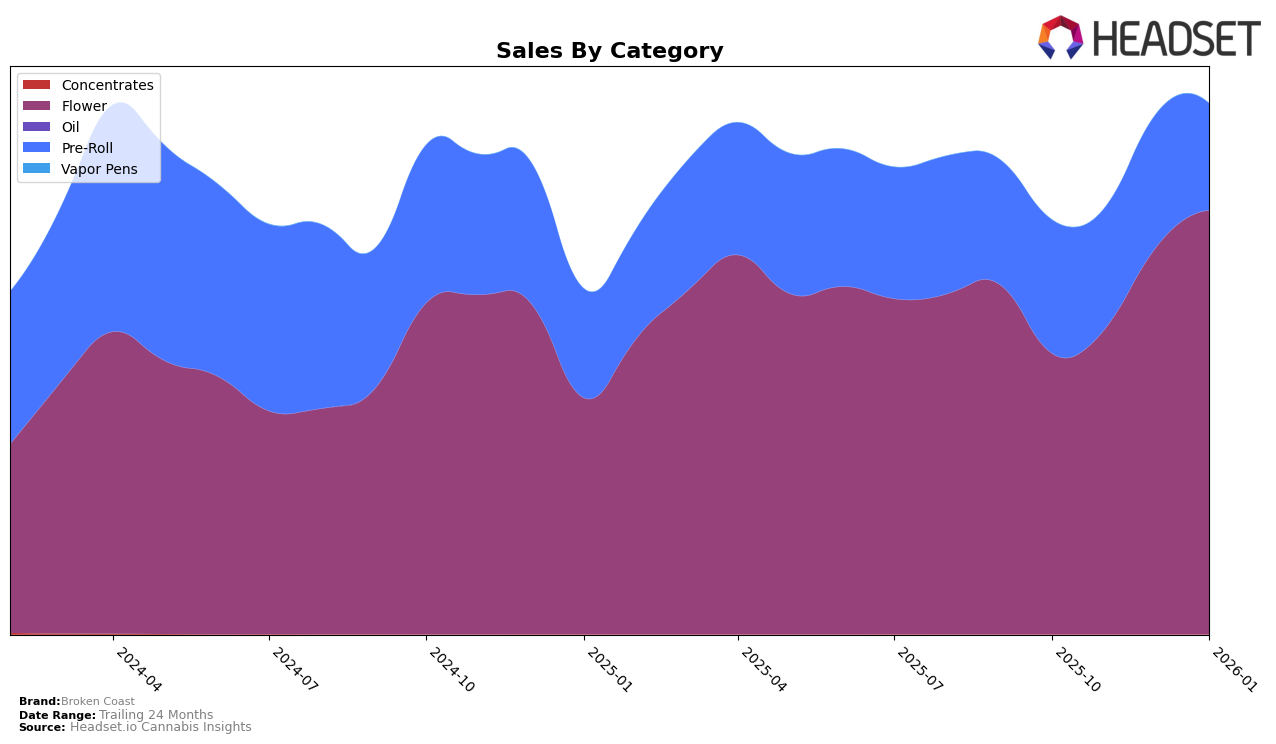

Broken Coast has demonstrated notable performance in the Flower category across several provinces. In Alberta, the brand maintained a steady top 10 ranking from October to December 2025, before climbing to the 7th position in January 2026. This upward trend is indicative of strong consumer demand and effective market strategies. Meanwhile, in British Columbia, Broken Coast made significant strides, improving its Flower category ranking from 62nd in October 2025 to 24th by January 2026. Such movement highlights a substantial increase in market penetration and brand recognition within the province. In Ontario, the brand's Flower category ranking fluctuated slightly but showed a promising jump to 31st in January 2026, suggesting a positive reception among consumers.

In contrast, the Pre-Roll category has presented challenges for Broken Coast, particularly in Alberta, where the brand's ranking declined from 23rd in October 2025 to 30th by January 2026. This drop could indicate increased competition or shifting consumer preferences. In British Columbia, Broken Coast was initially absent from the top 30 in October 2025, but managed to secure the 58th position by January 2026. While this marks progress, it also highlights the competitive nature of the Pre-Roll market in the province. Interestingly, Broken Coast made its debut in the Saskatchewan Flower category rankings in January 2026, entering directly at the 30th position. This entry suggests the brand's initial efforts in Saskatchewan are beginning to bear fruit, although further analysis would be needed to understand the full impact.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Broken Coast has shown a notable upward trend in its ranking, moving from a consistent 10th place from October to December 2025 to 7th place in January 2026. This improvement in rank is accompanied by a steady increase in sales, indicating a positive reception in the market. In contrast, Redecan experienced a decline, dropping from 6th to 8th place over the same period, with a notable decrease in sales, particularly from December to January. Meanwhile, Good Supply, although starting strong at the top rank, saw a decline to 6th place by January 2026, reflecting a significant drop in sales. Spinach maintained a stable position around the 5th and 6th ranks, with sales peaking in December. Divvy, initially ranked 19th, made a significant leap to 9th place by January, suggesting a strong growth trajectory. These shifts highlight Broken Coast's potential to capitalize on its upward momentum amidst fluctuating performances from its competitors.

Notable Products

In January 2026, the top-performing product for Broken Coast was the Blue Dream Blunt (1g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 9,411. Coffee Creamer (3.5g) in the Flower category held steady in second place, consistent with its ranking from the previous month. Platinum Pave Blunt (1g), another Pre-Roll product, remained in third place, showing a slight decrease in sales. Blue Dream (7g) in the Flower category retained its fourth position from December. Emergen Z Blunt (1g) in the Pre-Roll category saw a consistent fifth-place ranking, despite a decline in sales figures over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.