Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

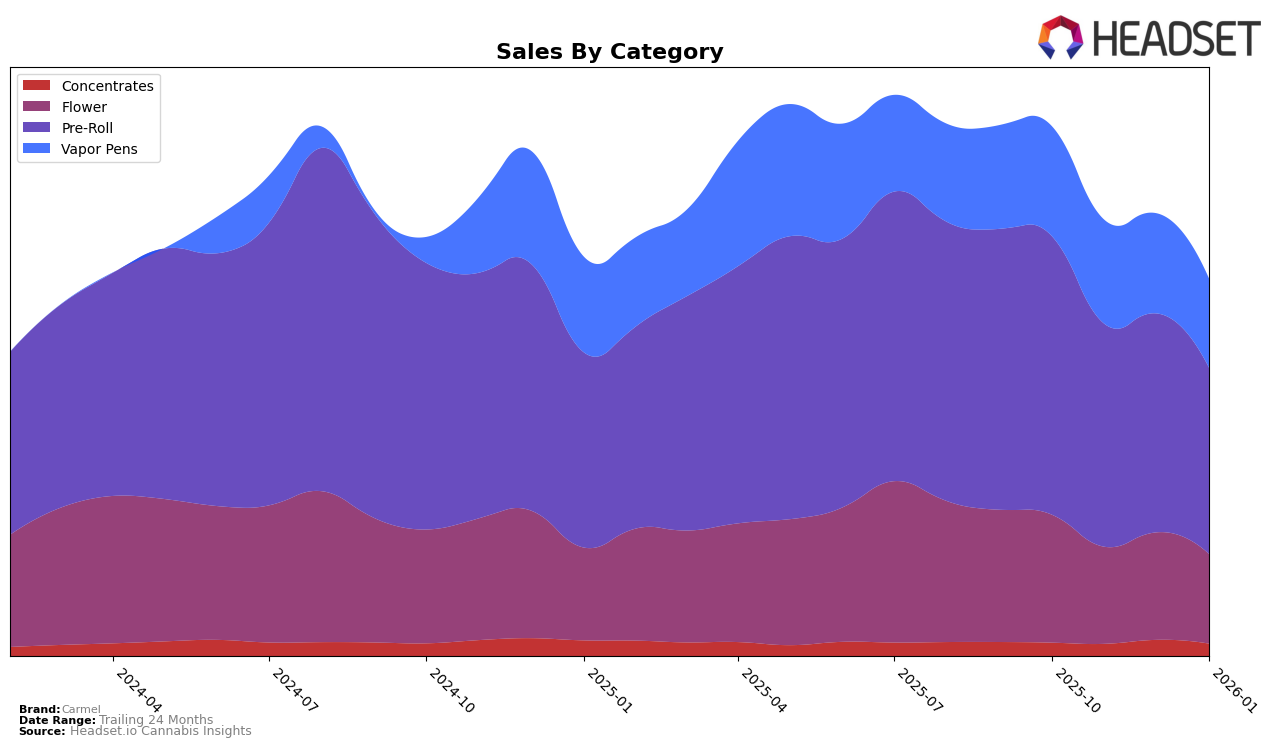

In Alberta, Carmel has shown a mixed performance across different cannabis categories. In the Flower category, the brand maintained a relatively stable position, fluctuating between ranks 21 and 24 from October 2025 to January 2026. However, the sales figures indicate a downward trend, with a notable decrease in November followed by a partial recovery in December and January. In the Pre-Roll category, Carmel consistently ranked within the top 20, showing a slight dip in December but recovering to rank 15 by January 2026. The Vapor Pens category, however, saw a decline in rank, falling from 19 to 22 over the same period, with sales figures reflecting a similar downward trajectory.

In Ontario, Carmel's performance was varied across categories. The brand's Pre-Roll segment maintained a strong presence, consistently ranking within the top 11, although sales showed a declining trend from October to January. In contrast, Carmel's Flower category struggled to break into the top 25, with rankings hovering around 26 to 29, and sales following a downward path. In British Columbia, Carmel did not make it into the top 30 for Vapor Pens in October, but managed to enter the rankings by November, albeit fluctuating between 26 and 29. This entry into the rankings suggests a potential growth opportunity, despite the relatively low sales figures compared to other regions.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll category, Carmel has experienced a notable shift in its market position from October 2025 to January 2026. Initially ranked 9th in October, Carmel saw a decline, dropping to 11th by December and maintaining this position into January. This downward trend in rank coincides with a decrease in sales, particularly evident from November to January. In contrast, Fuego Cannabis (Canada) consistently outperformed Carmel, maintaining a higher rank and demonstrating stronger sales figures, despite a slight drop from 7th to 9th place over the same period. Meanwhile, FIGR showed a positive trend, improving its rank from 12th to 10th, potentially posing a threat to Carmel's market share. Tribal also showed significant improvement, climbing from 20th to 13th, indicating a growing competitive pressure. These dynamics suggest that Carmel needs to strategize effectively to regain its competitive edge in the Ontario pre-roll market.

Notable Products

In January 2026, Carmel's leading product was the Animal Face Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its top rank for four consecutive months despite a decrease in sales to 20,997 units. The Animal Face Pre-Roll 12-Pack (6g) held steady at the second position, continuing its consistent performance over the months. The Animal Face Pure Live Resin Cartridge (1g) also remained third, showing stable sales figures compared to previous months. Notably, the Permanent Cherries Pure Live Resin Cartridge (1g) improved its ranking from fifth to fourth place, indicating a positive reception in the Vapor Pens category. Meanwhile, the Inside Joke Pre-Roll 3-Pack (1.5g) experienced a slight dip, moving from fourth to fifth place, reflecting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.