Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

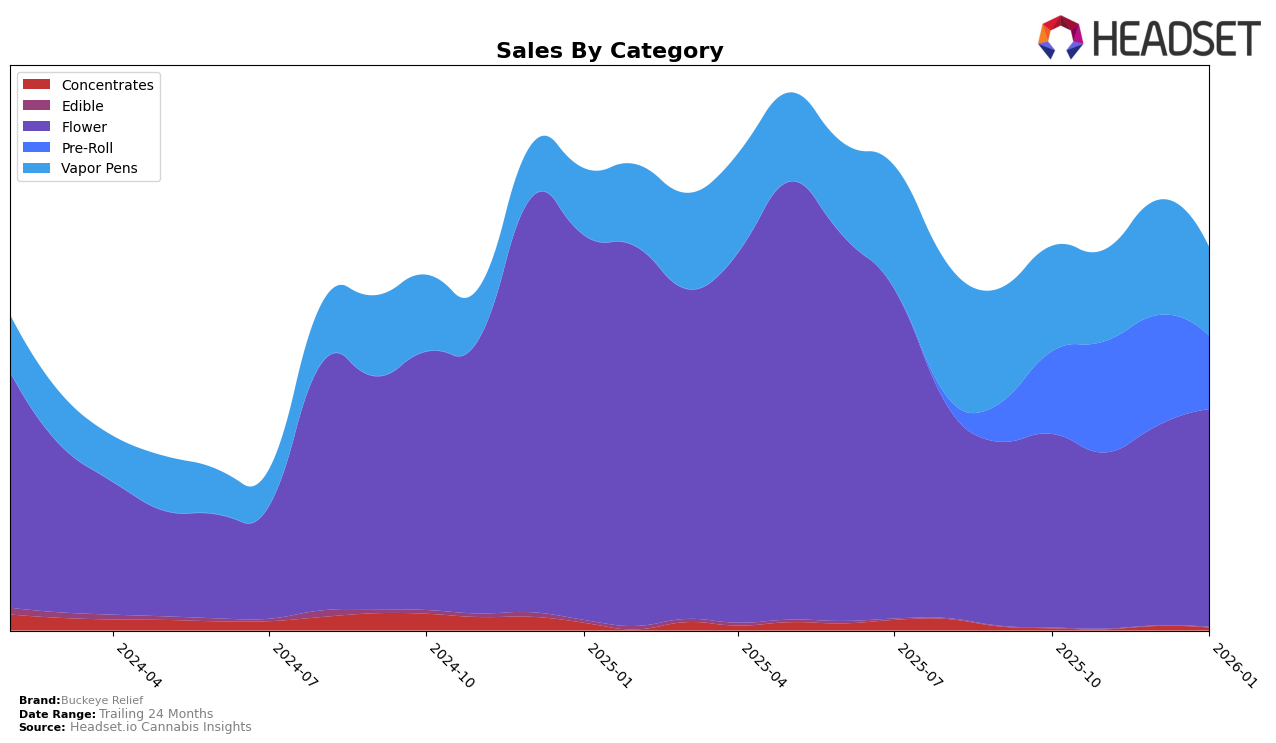

Buckeye Relief has shown a consistent presence in the Ohio market, particularly in the Flower category. Over the observed months, the brand maintained a stable position, oscillating between the 11th and 12th ranks. This suggests a steady demand and a loyal customer base in this category, despite the competitive nature of the market. Interestingly, the sales figures in the Flower category saw a noticeable increase from November to January, indicating a positive sales trend during this period. However, the brand did not manage to break into the top 10, which could signal room for growth or increased competition from other brands.

In contrast, Buckeye Relief's performance in the Pre-Roll category has been remarkable, consistently holding the top position for three consecutive months before slipping to second in January. This indicates a strong product offering and consumer preference for their pre-roll products in Ohio. However, the Vapor Pens category presents a different story, with rankings fluctuating between 8th and 10th place. The brand's decline to 10th place in January, coupled with a decrease in sales from December, suggests challenges in maintaining a competitive edge in this category. The absence of Buckeye Relief in the top 30 of other states or provinces highlights a focus on the Ohio market, which might be both a strategic choice and a limitation in terms of market expansion.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Buckeye Relief has demonstrated a consistent presence, maintaining a rank between 11th and 12th from October 2025 to January 2026. Despite a slight dip in November, Buckeye Relief's sales trajectory shows a positive trend, culminating in a notable increase by January 2026. This performance is juxtaposed with Farkas Farms / Bullseye Gardens, which experienced a more volatile rank, peaking at 6th in December but dropping back to 10th by January. Meanwhile, Butterfly Effect - Grow Ohio saw a decline in rank from 7th in October to 11th in January, although their sales rebounded in the new year. Meigs County Grown and Certified (Certified Cultivators) also showed fluctuations in rank, with Meigs County Grown improving slightly by January. These dynamics suggest that while Buckeye Relief faces strong competition, its steady sales growth positions it well against its peers, particularly as some competitors experience greater rank volatility.

Notable Products

In January 2026, the top-performing product from Buckeye Relief was Sour Larry Cross Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales reaching 5,158 units. Loud (2.83g) emerged as the second-best seller in the Flower category, a new entry that wasn't ranked in previous months. Garlic Breath 2.0 (2.83g) dropped from second place in October 2025 to third place in January 2026, indicating a slight decline in its performance. King's Mustache (2.83g) and Ultra Bouffant (2.83g) secured the fourth and fifth positions, respectively, both appearing for the first time in the rankings. This shift indicates a dynamic change in consumer preferences towards different Flower products in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.