Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

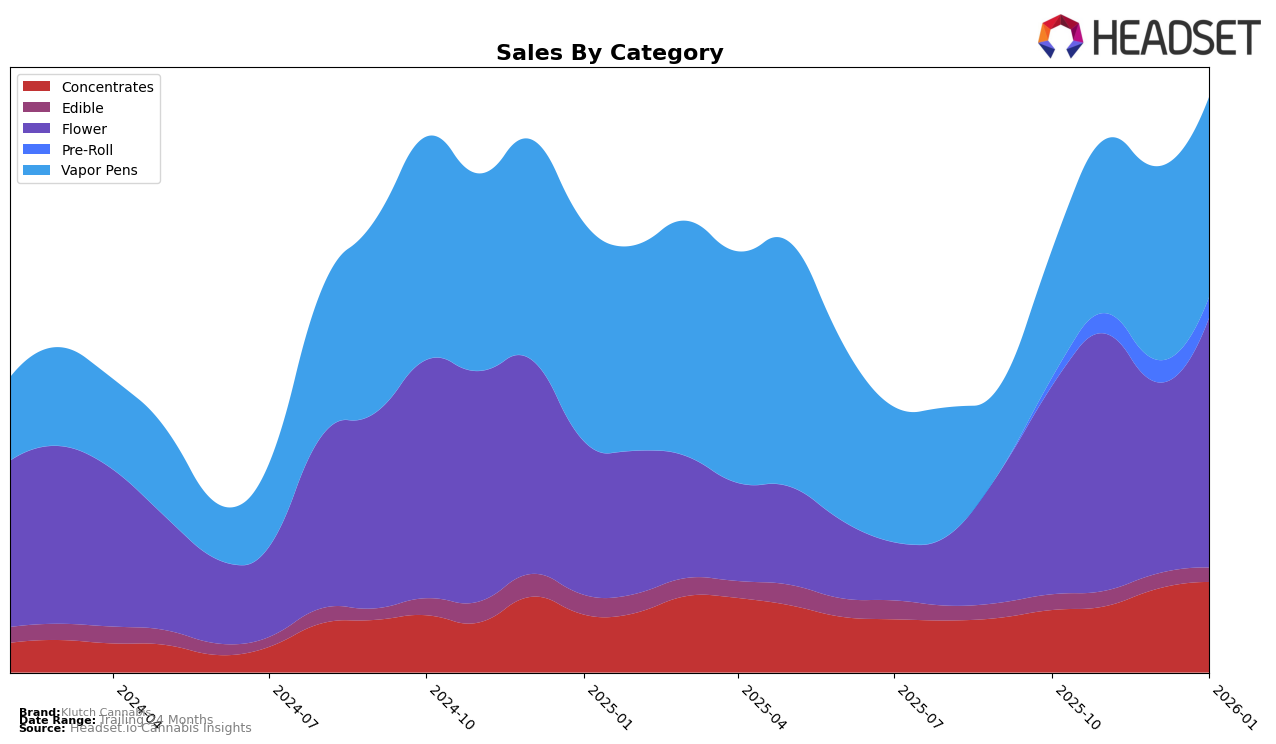

Klutch Cannabis has demonstrated a strong performance in the Ohio market, particularly in the Concentrates category where it consistently held the top position from October 2025 through January 2026. This dominance is underscored by a steady increase in sales, culminating in over $1 million in January. In the Vapor Pens category, Klutch Cannabis maintained a solid second place throughout the same period, with sales figures reflecting a positive growth trend. These consistent rankings in two major product categories highlight the brand's strong foothold and consumer loyalty in the Ohio cannabis market.

In contrast, Klutch Cannabis experienced more variability in the Flower and Pre-Roll categories. The brand achieved the top rank in Flower in November 2025, a notable improvement from sixth place in October, though it later dropped to eighth in December before rebounding to third in January 2026. This fluctuation suggests a competitive landscape and changing consumer preferences. Meanwhile, in the Pre-Roll category, Klutch Cannabis did not make it into the top 30 in October, but climbed to fourth in November and maintained a top-five position through January. This upward trajectory in Pre-Rolls indicates potential growth opportunities for Klutch Cannabis in diversifying its product appeal.

Competitive Landscape

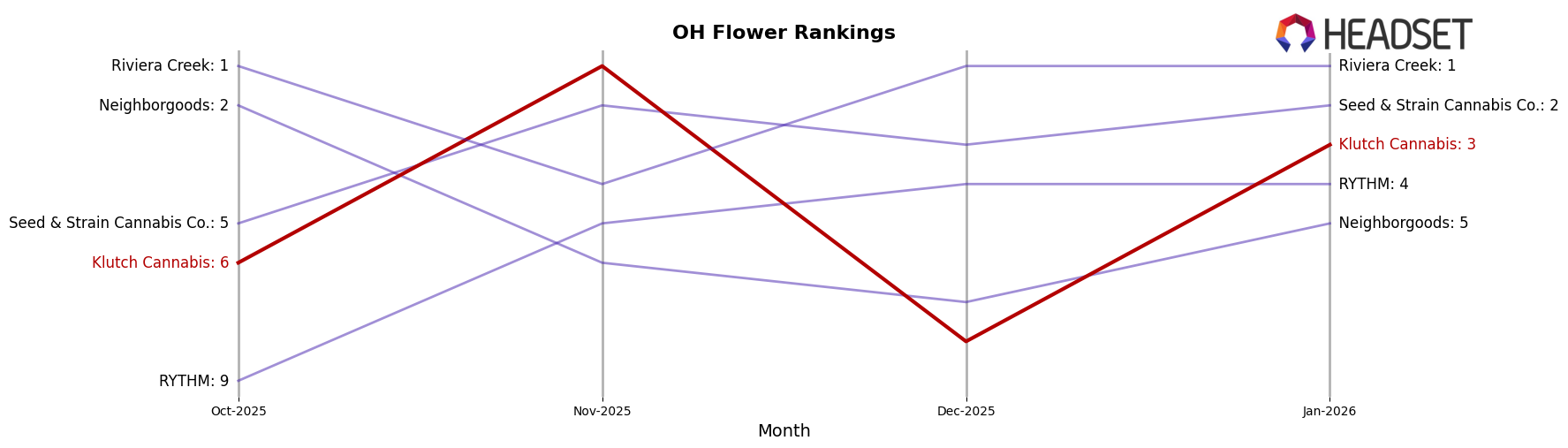

In the competitive landscape of the Ohio flower category, Klutch Cannabis has experienced notable fluctuations in its market rank and sales performance from October 2025 to January 2026. Initially ranked 6th in October, Klutch Cannabis surged to the top position in November, showcasing a significant increase in consumer demand. However, the brand faced a setback in December, dropping to 8th place, before recovering to 3rd place in January. This volatility highlights the competitive pressure from brands like Riviera Creek, which consistently maintained a strong presence, reclaiming the top spot in January. Additionally, Seed & Strain Cannabis Co. demonstrated robust performance, securing the 2nd position in both November and January, potentially drawing market share from Klutch Cannabis. The competitive dynamics underscore the importance for Klutch Cannabis to strategize effectively to maintain and enhance its market position amidst strong contenders in the Ohio flower market.

Notable Products

In January 2026, the top-performing product for Klutch Cannabis was The Citizen - Ice Cream Cake Full Spectrum Ikrusher Disposable (1g) in the Vapor Pens category, which rose to the first rank with an impressive sales figure of 11,121 units. Following closely was The Citizen - Orange 43 Full Spectrum Disposable (1g), also in Vapor Pens, which climbed to the second rank. The Orange 43 (2.83g) from the Flower category dropped to third place, despite consistently strong sales over the previous months. The Churro Milk Chocolate Bar 20-Pack (100mg) maintained a steady presence, ranking fourth, showing a slight dip from its peak in December. A new entry, Ice Cream Cake Live Resin Luster Pod (1g), made its debut at fifth place, indicating a growing interest in this product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.