Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

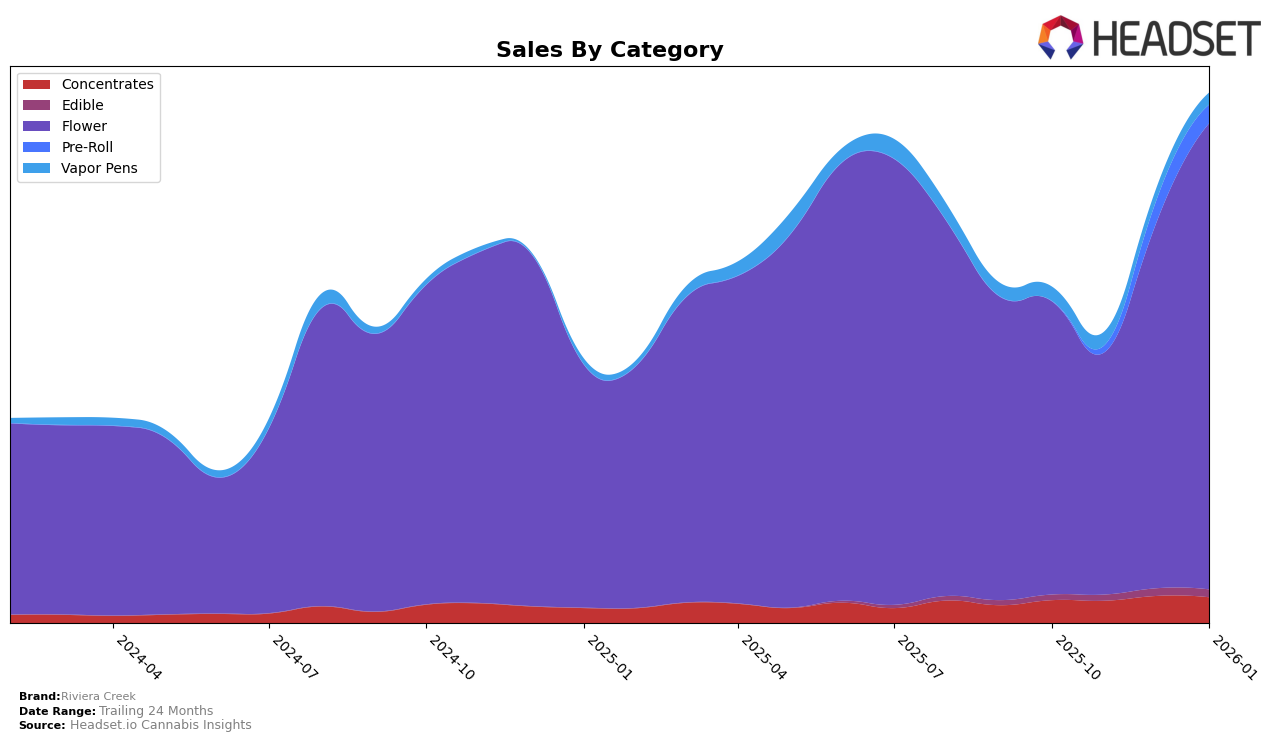

Riviera Creek has shown a dynamic performance across various categories in Ohio, with notable fluctuations in rankings. In the Concentrates category, the brand maintained a strong position, moving from a rank of 5 in October 2025 to a commendable rank of 3 in December, before slightly dropping back to 5 in January 2026. This indicates a competitive but resilient presence in this segment. In the Flower category, Riviera Creek consistently held the top spot in October, December, and January, despite a brief dip to rank 4 in November. This suggests a dominant market presence and consumer preference for their Flower products.

In contrast, Riviera Creek's performance in the Pre-Roll category was less stable, as they did not appear in the top 30 until December, ranking 8th, and then dropping to 12th by January. This indicates potential challenges in maintaining a strong foothold in this category. Meanwhile, in the Vapor Pens category, Riviera Creek struggled to break into the top 30, with rankings hovering around the mid-30s across the months. This suggests that while the brand excels in certain categories, there are opportunities for growth and improvement in others. Overall, Riviera Creek's performance highlights both strengths and areas for strategic focus within the Ohio market.

Competitive Landscape

In the competitive landscape of the Ohio flower market, Riviera Creek has demonstrated a strong performance, consistently maintaining a top position despite fluctuating competition. In October 2025, Riviera Creek held the number one rank, but experienced a dip to fourth place in November 2025, likely due to increased competition from brands like Seed & Strain Cannabis Co. and Klutch Cannabis, which surged to second and first place respectively. However, Riviera Creek rebounded in December 2025 and January 2026, reclaiming the top spot, indicating a strong recovery and resilience in sales performance. This fluctuation highlights the dynamic nature of the market, with Riviera Creek's ability to regain its leading position suggesting a robust brand loyalty and effective market strategies. The competition remains fierce, with Seed & Strain Cannabis Co. consistently ranking in the top three, which underscores the importance for Riviera Creek to continue innovating and engaging with its customer base to maintain its leadership in the Ohio flower category.

Notable Products

In January 2026, the top-performing product from Riviera Creek was Stambaugh GC (2.83g) in the Flower category, which climbed from its consistent second-place position in previous months to take the top spot, achieving sales of 12,987. Yo Rocks (2.83g), also in the Flower category, slipped to second place after leading the sales charts in the three months prior. GMO Cookies (2.83g) improved its rank to third, up from fourth in December 2025, indicating a positive trend in its sales performance. Riviera Creek Moon Rocks (1g) dropped one position to fourth place, while the new entry, Phantom Ice Hash Infused Pre-Roll (1g), debuted in the rankings at fifth place. Overall, the Flower category dominated the top positions, with notable shifts in rankings reflecting changing consumer preferences within Riviera Creek's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.