Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

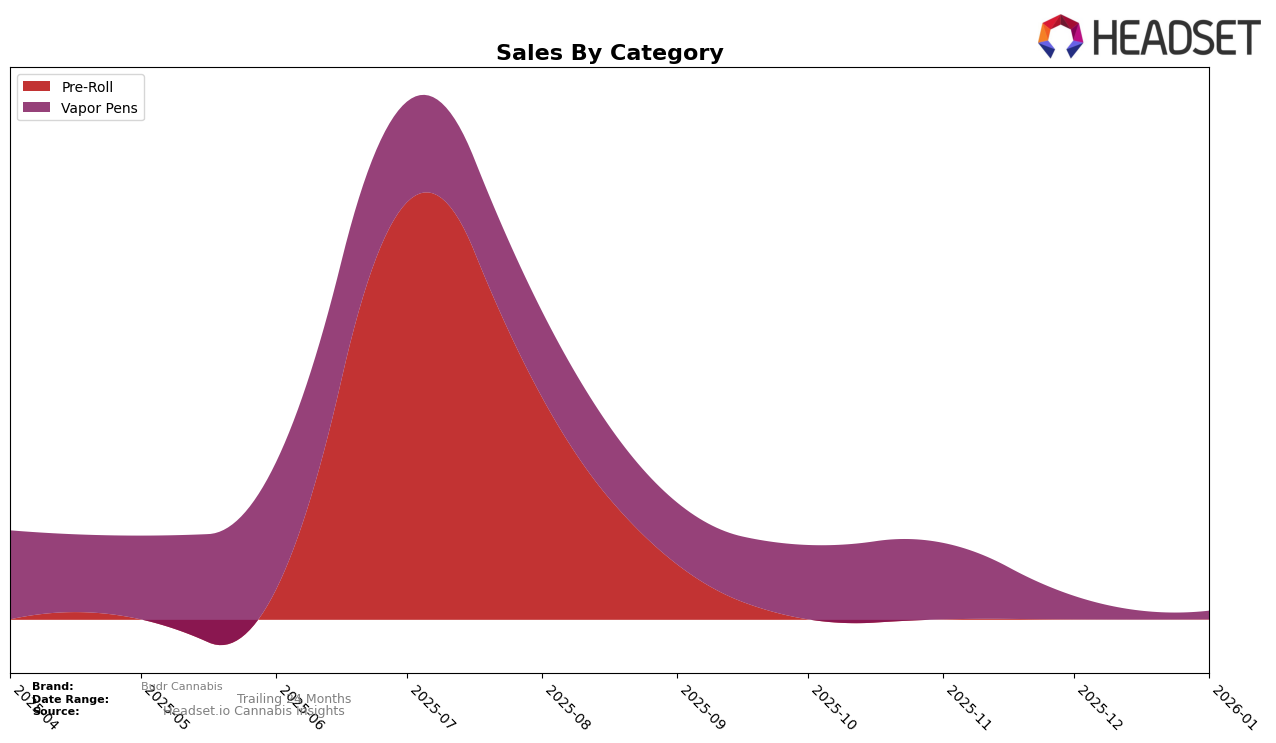

Budr Cannabis has shown consistent performance in the vapor pen category in Connecticut over the observed months. The brand maintained its position at rank 20 in October and November 2025. However, it is notable that Budr Cannabis did not appear in the top 30 rankings for December 2025 and January 2026, indicating a potential decline or increased competition in the market. The sales figures for October and November suggest a stable demand, but the absence from the rankings in subsequent months could signal shifting consumer preferences or strategic challenges that the brand might need to address.

While the performance in Connecticut's vapor pen category provides some insights, it is important to consider how Budr Cannabis is faring across other states and categories. Unfortunately, the data does not provide a comprehensive view of their performance in other regions or product categories, which could offer a broader perspective on their market strategy and growth potential. The absence of Budr Cannabis from the top 30 rankings in December and January might prompt further investigation into market dynamics or internal factors influencing their position. Understanding these nuances can provide a more detailed picture of Budr Cannabis's overall performance and future opportunities.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Budr Cannabis has faced challenges in maintaining a strong market position. As of October 2025, Budr Cannabis was ranked 20th, a position it held through November before dropping out of the top 20 by December. This indicates a struggle to compete with brands like On The Rocks, which, despite a downward trend from 15th to 19th place over the same period, consistently outperformed Budr Cannabis in sales. Similarly, Lucky Break maintained a presence in the rankings, albeit at lower positions, from 18th to 20th place, suggesting that while it also faced challenges, it managed to stay within the top 20. The data suggests that Budr Cannabis needs to strategize effectively to regain and improve its market position in the Connecticut vapor pen category.

Notable Products

In January 2026, the top-performing product from Budr Cannabis was the (I-Side) Cherry Alien Papi x Plasma Wedding Dual Chamber Disposable (0.5g) in the Vapor Pens category, maintaining its first-place ranking from December 2025. This product recorded sales of 22 units, showcasing a consistent presence at the top despite a decline in sales figures over the months. The D Inferno x SBC Distillate Dual Chamber Disposable (0.5g), also in the Vapor Pens category, was absent from the January rankings after leading in November 2025. Notably, this product had experienced a significant drop in sales from 203 units in November to 30 units in December. This shift indicates a potential change in consumer preference or stock availability affecting Budr Cannabis's product lineup in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.