Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

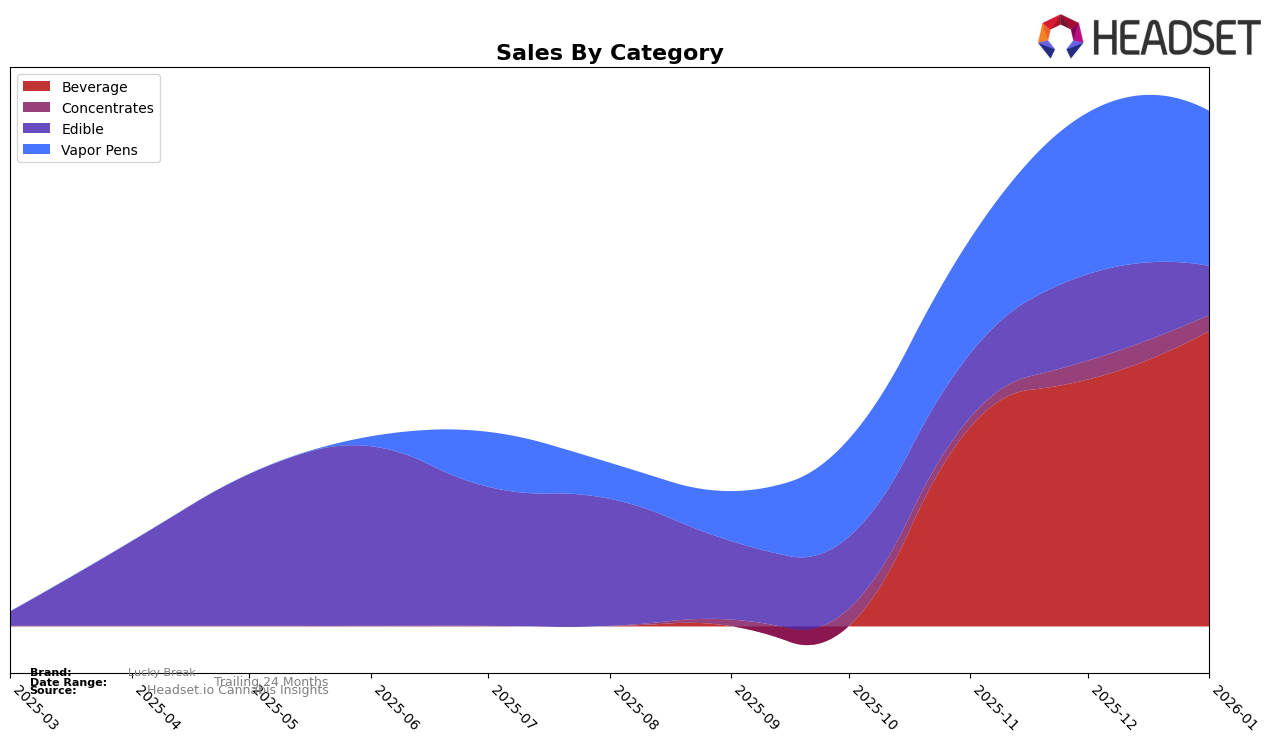

Lucky Break has shown impressive performance in the Connecticut market, particularly within the Beverage category. The brand achieved the number one ranking in this category from November 2025 through January 2026, suggesting a strong and consistent presence. This top ranking is a significant achievement, especially considering they were not in the top 30 in October 2025. The steady increase in sales from $54,635 in October to $81,033 in January further underscores their growing dominance. However, it's noteworthy that in the Edible and Vapor Pens categories, Lucky Break displayed more modest movements, maintaining positions within the top 20 but not breaking into the top 10.

In the Edible category, Lucky Break's rankings in Connecticut showed a slight decline from 16th in October to 18th in January, with sales peaking in December at $23,646 before dropping to $13,376 in January. This suggests some volatility in consumer preferences or competition within this category. Meanwhile, in the Vapor Pens category, the brand maintained a steady presence, with a slight dip in sales from December to January. Despite not breaking into the top 15, their consistent ranking in the top 20 indicates a stable foothold in this category, which might be an area of focus for future growth.

Competitive Landscape

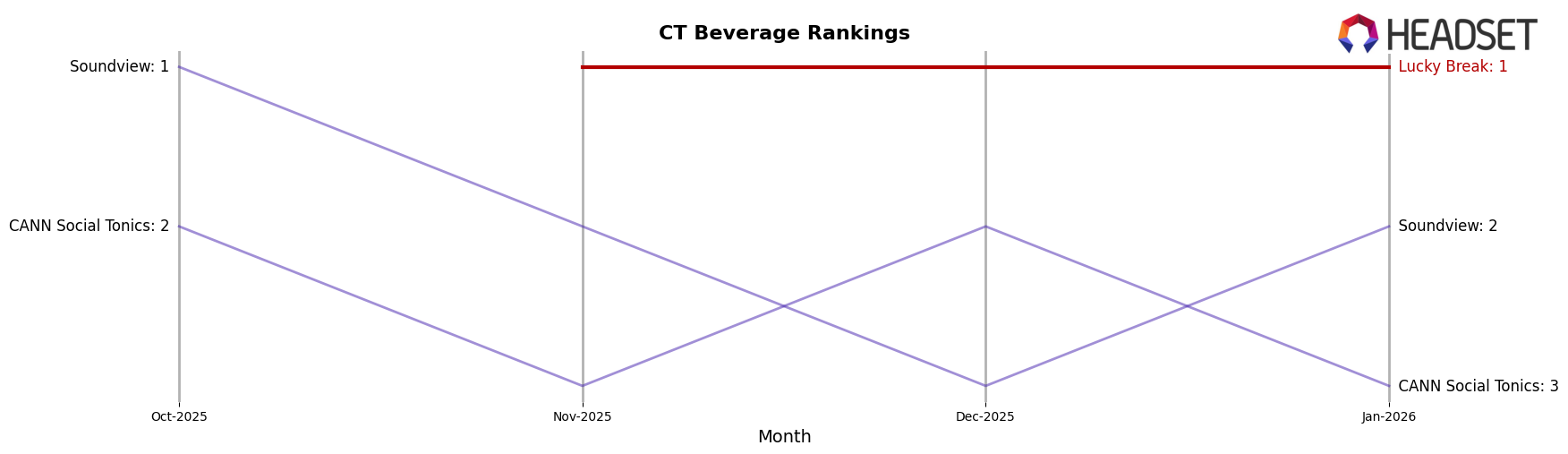

In the competitive landscape of the Connecticut beverage category, Lucky Break has demonstrated a strong upward trajectory, consistently holding the top rank from November 2025 through January 2026. This rise in rank, from being absent in the top 20 in October 2025, underscores a significant growth in market presence and consumer preference. In contrast, Soundview experienced a slight fluctuation, dropping from first to third place in December 2025 before recovering to second in January 2026. Meanwhile, CANN Social Tonics maintained a steady position, alternating between second and third place. The consistent top ranking of Lucky Break suggests a robust sales performance, outpacing its competitors and indicating a strong brand resonance with consumers in the Connecticut market.

Notable Products

In January 2026, Lucky Break's top-performing product was Fruit Punch Elixir (95mg) in the Beverage category, maintaining its first-place ranking from November and December 2025 with impressive sales of 1041 units. The Watermelon Lime Fast Acting Elixir (95mg) held steady in the second position, showing consistent popularity since November. Blueberry Lemonade Fast Acting Elixir (95mg) remained in third place, mirroring its December ranking, while the Blueberry Lemonade Elixir (95mg) debuted in fourth place. The Acapulco Gold Live Resin Disposable (0.5g) entered the rankings for the first time in January, securing the fifth position. These shifts indicate a strong preference for beverages, with Fruit Punch Elixir leading the charge in sales growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.