Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

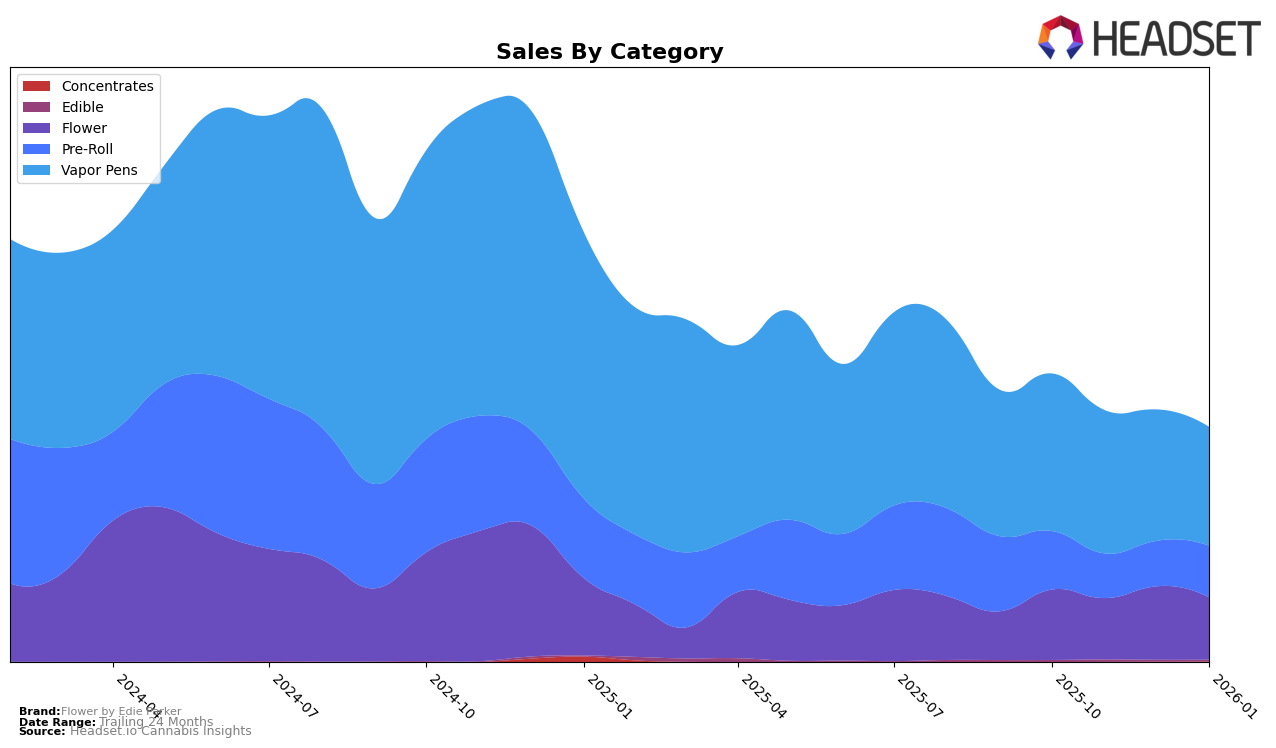

Flower by Edie Parker has shown varying performance across different states and product categories. In Connecticut, the brand has consistently maintained a presence in the top 20 for Vapor Pens, improving its rank from 19th in October 2025 to 17th by January 2026. This upward trend is noteworthy, indicating a growing consumer preference for their Vapor Pens in this state. Conversely, in Illinois, the brand has struggled to break into the top 50 for both Pre-Rolls and Vapor Pens, with rankings lingering beyond the 50th position. Notably, they did not make the top 30 for Vapor Pens in January 2026, highlighting a potential area for improvement or increased competition in the Illinois market.

In Maryland, Flower by Edie Parker holds a more stable position within the top 40 across all categories, although there has been a slight decline in their Flower category ranking from 33rd in October 2025 to 43rd by January 2026. In New Jersey, the brand's performance in Vapor Pens has seen a significant drop, moving from 24th to 52nd over the same period, suggesting a potential shift in consumer preferences or increased competition. Meanwhile, in New York, the Vapor Pens category shows a positive trajectory, with an improvement from 75th in October 2025 to 60th by January 2026, marking an encouraging development in a highly competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in Connecticut, Flower by Edie Parker has demonstrated a notable upward trend in its rankings, moving from 19th in October 2025 to 17th by January 2026. This improvement suggests a positive reception and growing market presence, although it still trails behind competitors like Earl Baker, which fluctuated between 14th and 18th place, and On The Rocks, which saw a decline to 19th in January 2026. Despite this, All:Hours and Comffy maintain stronger positions, consistently ranking higher, with All:Hours peaking at 11th place and Comffy holding steady at 14th. The sales figures reflect these rankings, with Flower by Edie Parker experiencing a significant increase in sales from November to January, indicating a strengthening foothold in the market. However, to climb further in the rankings, Flower by Edie Parker will need to continue this momentum and possibly innovate or expand its offerings to compete more effectively with the higher-ranked brands.

Notable Products

In January 2026, the top-performing product from Flower by Edie Parker was Best Buds - Dusky Rose Pre-Roll 2-Pack (1g), climbing to the number one spot with sales of 2910 units. Space Cowgirl (3.5g) maintained a consistent performance, holding the second rank, similar to its position in December 2025, with sales slightly increasing to 2847 units. Happiest Hour Blend Pre-Roll 2-Pack (1g) remained in the third position, showing steady sales figures over the months. Notably, Early Bird Pre-Roll 2-Pack (1g) held its ground at fourth place, while Best Buds - Pink Mirage Pre-Roll 2-Pack (1g) entered the rankings at fifth place. This month saw a rise in the popularity of pre-roll products, with Best Buds - Dusky Rose Pre-Roll achieving the top rank, highlighting a shift in consumer preference towards these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.