Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

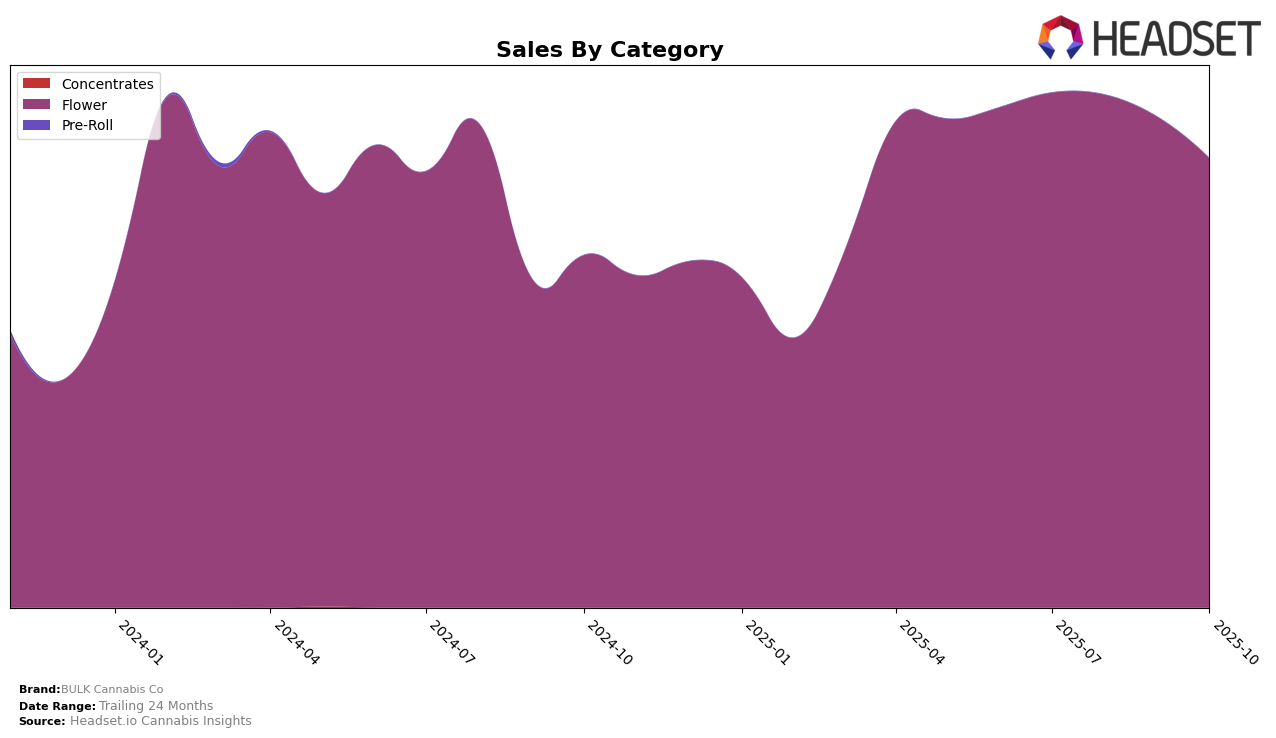

In the dynamic cannabis market of Colorado, BULK Cannabis Co has exhibited notable fluctuations in its performance within the Flower category. The brand's ranking saw a dip from 25th in July 2025 to 29th in August, before rebounding slightly to 25th in September, and then dropping again to 28th in October. This oscillation in positioning suggests a competitive landscape where BULK Cannabis Co is maintaining a presence, albeit with challenges in sustaining a higher rank. The sales figures reflect this trend as well, showing a decrease from $342,545 in July to $252,980 by October, indicating a possible need for strategic adjustments to regain momentum.

Despite not consistently maintaining a top-tier ranking, the fact that BULK Cannabis Co remains within the top 30 brands in the Flower category in Colorado is a testament to its resilience in a crowded market. The absence of a ranking in any month would have been a significant concern, highlighting the importance of staying competitive. The brand's slight recovery in September suggests potential for improvement, but the subsequent decline in October underscores the volatility of consumer preferences and market dynamics. Observers of the cannabis market should keep an eye on how BULK Cannabis Co navigates these challenges moving forward.

Competitive Landscape

In the competitive landscape of the Colorado flower category, BULK Cannabis Co has experienced notable fluctuations in its market position over recent months. As of October 2025, BULK Cannabis Co ranked 28th, a slight decline from its 25th position in July and September, indicating a downward trend in its rank. This shift is particularly significant when compared to competitors such as Fresh Cannabis, which maintained a stable rank around the mid-20s, and Billo, which saw a dramatic drop from 8th in August to 29th in October. Meanwhile, Lost in Translation (LIT) also experienced volatility, dropping from 17th in July to 30th in October. Despite these changes, BULK Cannabis Co's sales have shown a consistent decline, which may be attributed to the competitive pressures and market dynamics in Colorado. Understanding these trends is crucial for BULK Cannabis Co to strategize effectively and regain its competitive edge in the flower category.

Notable Products

In October 2025, the top-performing product for BULK Cannabis Co was Dante's Inferno (14g) from the Flower category, maintaining its position at rank 1 with a notable sales figure of 13,530. Blue Sherb (Bulk) made its debut in the rankings at position 2, indicating strong market entry. Sunset Runtz (Bulk) improved its performance, moving up from rank 4 in September to rank 3 in October, although its sales decreased from 9,161 to 6,437. Buttercream (Bulk) entered the list at rank 4, while Peanut Butter Cake (Bulk) secured the 5th spot. These shifts suggest a dynamic market with new entries and changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.